Awfis Space Solutions Limited IPO Details:

Opening Date: May 22, 2024

Closing Date: May 27, 2024

Listing: BSE and NSE

Number of Shares: 1.56 Cr shares

Face Value: Rs 10 per share

Price Band: Rs 364-383 per equity share

Issue Size: Rs 598.93 Cr

About the Awfis Space Solutions Limited Company:

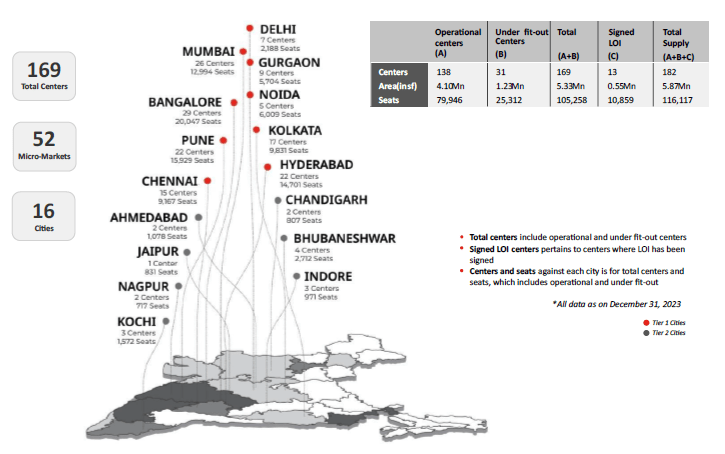

Awfis is a flexible workspace solutions company in India, having 169 centers across 52 micro markets spread across 16 cities (which includes all tier I cities and 7 major tier II cities), with 105,258 seats and 5.33 million sq. ft. of chargeable area which helps in catering to over 2,295 clients.

Awfis provides workspace solutions ranging from individual flexible desk needs to custom office spaces for startups, small and medium enterprises and also for large corporates. These solutions cater to single seat to multiple seats, which can be contracted by the clients for periods ranging from one hour to several years.

While the core business is the flexible working solutions, Awfis has also built capabilities to design, build, maintain and manage a wide range of flexible workspace requirement such as construction and fit out services segment, along with facility management services. They also provide allied services like food and beverages, I.T. support services, event hosting and meeting arrangements.

Industry Overview:

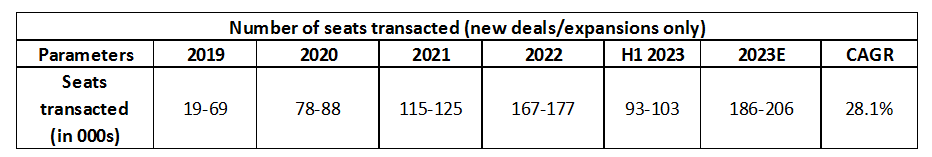

The total addressable market size of flexible workspace segment is estimated 282 million sq. ft.

In India, the total market size of flexible workspace segment more than tripled in the last 5 years, from 20mn sq.ft. before 2019 to ~62 mn sq.ft. in FY24 in Tier 1 cities and approximately 1.7mn sq.ft. in 2019 to approx. 5.7 mn sq.ft. in FY24 in tier 2 cities, taking it to a combined 67.7mn sq.ft. Cities like Ahmedabad, Kochi, Bhubaneswar, Indore, Jaipur primarily drove the growth in Tier 2 cities.

Why Flexible workspaces are booming?

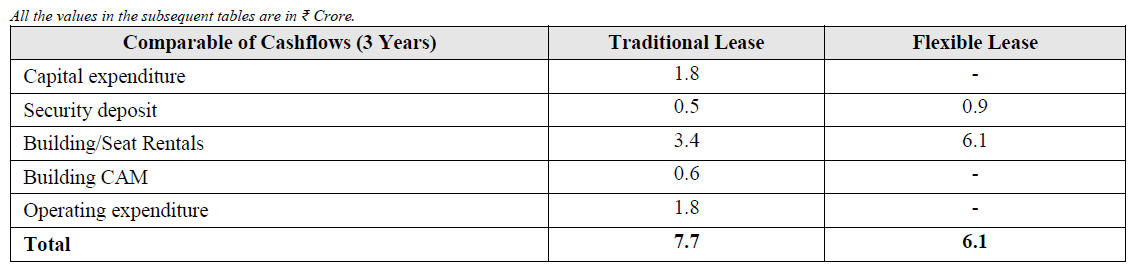

CAM-Common area maintenance

According to Awfis, total expected outflow for a tenant in a normal, traditional lease is approximately Rs. 7.7 crores, as compared to Rs 6.1 crores for a 3 year lease at a flexible workspace center.

Advantages of flexible workspaces:

- Cost Savings: Lower fixed cost, such as rent ,utilities, etc.

- Flexibility of duration: Under a traditional lease, tenants with shorter lease duration face problems as the lessee has to commit on a lock in period, which is typically around 3 years. Flexible workspaces allow the Tenants to take up spaces as per their requirement.

- Flexibility in area/seat requirements: Companies can easily scale up/down based on their workforce requirements.

Business model

Awfis derives a majority of its revenue from its business of leasing spaces (73% in 9MFY24), with Construction and fit out projects contributing 24% in 9MFY24, up from 6% in FY21. In 9MFY24, the company reported a net loss of Rs. 18.9 crores.

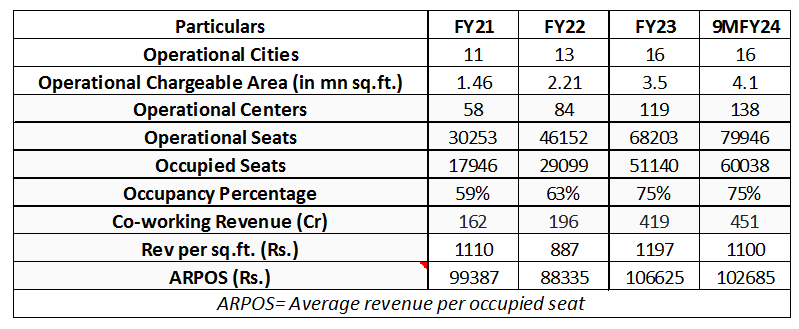

Key Operational Metrics:

The company sources workspaces on two different models:

Straight lease (SL) model: Under this model, the space owner leases the space to flexible workspace operators on traditional leases, which include a fixed monthly rental, maintenance charges, security deposit, locking period, lease tenure and rent escalations. Under this model, the risks of capital, occupancy build up and operational burn is borne by the company. The company plans to set up 4 new centers under the straight lease model (existing 62 centers with ~35300 seats).

Managed Aggregation (MA) model: Under this model, the space owner becomes a stakeholder in the centers by co-investing in the fit-out infrastructure. The space owner incurs capital expenditure and forgoes fixed monthly rental for a component of Minimum guarantee (MG) & takes a share of revenue/ profit on pre-negotiated terms. Awfis provide a MG to the space owner starting from the 5th to 13th month of operations, until the end of the contract. As of December 31, 2023, The minimum guarantee component at the MA centers was an average 45.88% of the rental prevailing in the respective localities. Around 59% of the arrangements under the MA model had a MG obligation, while 41% did not.

The company is focussing more on the Managed Aggregation model and plans to set up 8 new centers under this model (existing 107 centers, ~70,000 seats).

Margins will be limited in case of managed aggregation model as AWFIS will have to share profits with the space owners.

Competitors: major competitors to Awfis are WeWork India, Cowrks, Smartworks and Tablespace. SmartWorks and WeWork are the 1st and 2nd largest flexible workspace solutions provider in India respectively, measured in terms of sq.ft.

Object of the issue:

- Out of the total fresh issue size of Rs. 128 crores, the company plans to utilize Rs. 42 crores towards funding the capital expenditure of establishing new centers

- Awfis plans to establish 45 new centers, aiming to add between 33,000 to 34,000 seats. The average number of seats at existing centers, based on those launched in the past 24 months, is 608. The average cost for these existing centers is Rs.1,092 per square foot, with the estimated size of new centers being 26000 sq.ft, compared to the current average of 21,388ft.

- Out of the 45 new centers being planned, the company plans to fund 33 of these via internal accruals, with 12 being funded via the proceeds from the fresh issue.

- Furthermore, the company plans to deploy ~Rs. 54 crores towards working capital, which has increased on account of its changing segmental mix, towards the construction and fit-out segment, which forms around 24% of the revenue as of 9M’FY24, up from 6% in FY21.

- One major factor contributing to this working capital requirement is the asset-liability mismatch in the security deposits. The company projects that by FY25, the working capital requirements will total to Rs. 90 crores.

The main selling shareholders are Peak XV partners (Indian unit of Sequoia Capital), Bisque Limited and Link Investment Trust.

Positives:

- Increase in tenure and occupancy- The weighted average lock-in tenure for clients has increased from 14.78 months as of FY21 to 22.21 months as of FY23, and 23.33 months as of 9FY24. The weighted average total tenure of clients has increased from 19.84 months as of FY21 to 32.06 months as of FY23 and 31.76 months as of 9MFY24. Also, properties mature after 12 months with an average occupancy of ~75%+.

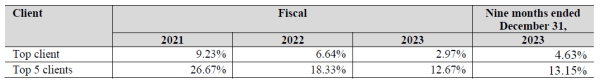

- Diversified client base - The company has a diversified client base, with 68.57% being large corporations or multinational corporations, 19.79% being SMEs, 10.84% being start-ups, based on the number of occupied seats as of December 31, 2023. Also, the top 5 clients now contribute only about 13.15% of the revenue, when compared to nearly 27% in FY21.

Concerns:

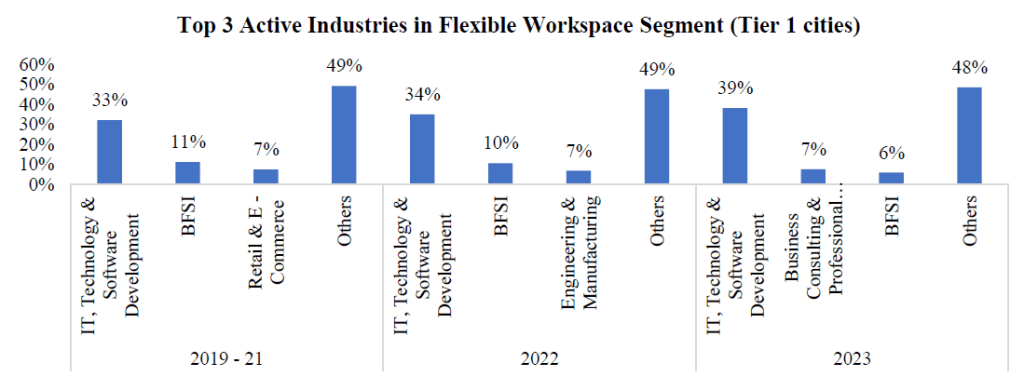

- Sector concentration risk: The company is dependent on the Information technology industry with 46% of the occupancy coming from this sector. Any slowdown in this sector will significantly affect the performance of Awfis.

- Long term fixed costs: The company has entered into straight lease contracts for 1.94 million sq.ft. across 62 centers. These agreements are longer than their agreements with their clients. Any termination with their clients and the company’s inability to find a replacement can put pressure on their liquidity position.

- City Diversification risk: As of December 2023, 67.82% of rental income in the co-working space was derived from centers located in Bangalore, Mumbai, Pune and Hyderabad. Given the company’s focus on expansion in tier II cities, the future realizations might go down and disruptions in any of the 4 cities mentioned above can negatively affect the business.

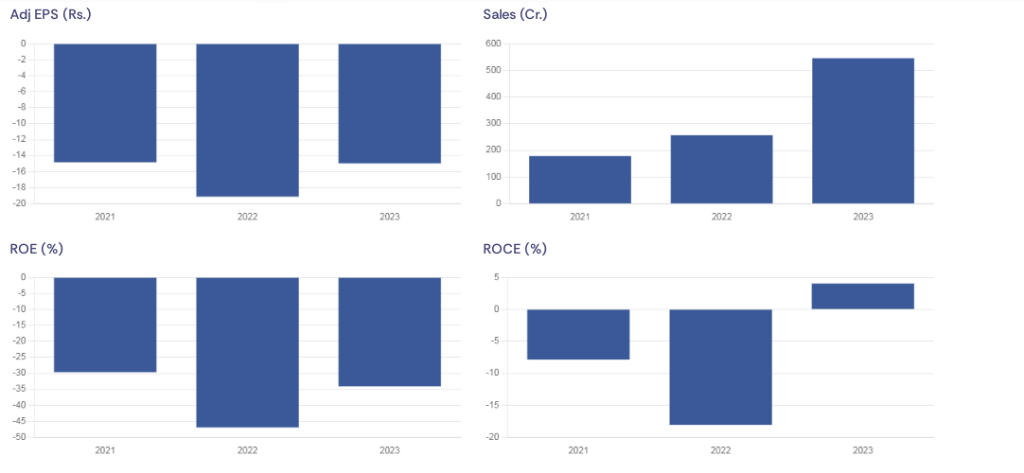

Financials

The company was loss-making at the EBIT level till 2023. In 9MFY24, the company reported an EBIT of roughly Rs. 33 crores, with a net loss of ~Rs.19 crores.

Key Management personnel

Amit Ramani: He is the Chairman and Managing Director on the Board of the Company. He has a degree in Architecture from the School of Planning and Architecture, New Delhi, a master of Architecture from Kansas State University and a master of Science from Cornell University and has around 20 years of experience in real estate and workplace solutions, he was previously the promoter and managing director of Nelson Planning and Designs Private Limited. In addition, he has worked as senior vice president with Nelson Worldwide, LLC, and as a consultant with HOK, New York.

MoneyWorks4Me Opinion

Awfis generates 2/3rd of its revenues from corporates and multinationals, resulting in stable occupancy and revenue visibility. The company is nearing breakeven (9MFY24 loss of Rs 19 Cr) but the inherent capital intensity of the industry (both fixed and working capital) combined with low PBT margins as well as limited free cashflow leads us to recommend to avoid this issue.

Recommendation: Avoid

Awfis Space Solutions Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | May 22, 2024 |

| IPO Close Date | May 27, 2024 |

| Basis of Allotment Date | May 28, 2024 |

| Refunds Initiation | May 29, 2024 |

| A credit of Shares to Demat Account | May 29, 2024 |

| IPO Listing Date | May 30, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 39 | Rs. 14,937 |

| Maximum | 13 | 507 | Rs. 194,181 |

Awfis Space Solutions Limited IPO FAQs:

When will the Awfis Space Solutions Ltd IPO open?

Awfis Space Solutions Ltd IPO will open for subscription on Wednesday, 22nd May 2024, and closes on Monday, 27th May 2024.

What is the price band of Awfis Space Solutions Ltd IPO?

The price band for Awfis Space Solutions Ltd IPO is Rs. 364-383/share.

What is the lot size for the Awfis Space Solutions Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 39 shares, up to a maximum of 13 lots i.e. Rs. 1,94,181/-.

What is the issue size of Awfis Space Solutions Ltd IPO?

The total issue size is ~ Rs. 598.93 Cr.

When will the basis of allotment be out?

Allotment will be finalized on May 28th and refunds will be initiated by May 29th. Shares allotment will be credited in Demat accounts by May 29th.

What is the listing date of Awfis Space Solutions Ltd’s IPO?

The tentative listing date of the Awfis Space Solutions Ltd IPO is May 30th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: