Concord Biotech Limited IPO Details:

Estimated Market Cap: 7,754 Cr

IPO Date: 4th August to 8th August

Total shares: 2 Cr

Price band: Rs. 705- Rs. 741 per share

IPO Issue Size: ~ Rs. 1551 Cr

Lot Size: 20 shares and multiples thereof

Purpose of IPO: Offer for sale by existing shareholders

About Concord Biotech Limited:

Concord Biotech is a niche biopharma company manufacturing APIs (active pharmaceutical ingredients) and formulations for select therapeutic areas. Operating in the B2B segment, it develops

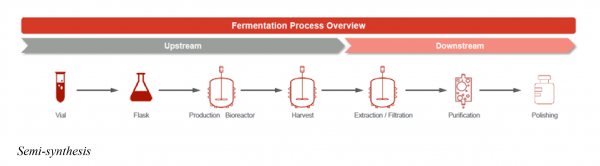

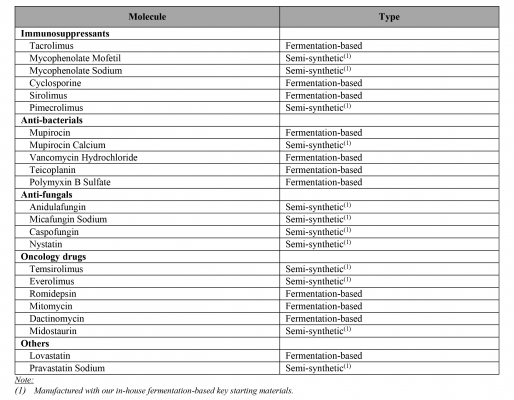

(a) APIs through fermentation as well as semi-synthetic processes, across therapeutic areas of immunosuppressants, oncology, and anti-infectives.

(b) formulations, which are used in the therapeutic areas of immunosuppressants, nephrology drugs, and anti-infective drugs for critical care.

The company had submitted 128 Drug Master Files (DMFs) for their APIs in multiple countries. These filings consisted of 20 DMFs in the United States, 65 in Europe, and 4 in Japan.

Concord Biotech has close to equal market share in domestic as well as export markets (catering to 70+ countries), with the United States being a key export market. It has a diversified customer base (200+ with Intas Pharmaceuticals and Glenmark Pharmaceuticals being 2 major customers) and long-standing relationships with various global generic pharmaceutical companies.

Concord Biotech possesses three manufacturing facilities (Dholka, Valthera, Limbasi) with a combined fermentation capacity of 1,250 m3 and two dedicated research and development (R&D) units, all situated in Gujarat, India. It adheres to regulations and quality standards set by authorities in India and other regions.

Inspections at the Valthera (formulations) and Dholka (API) facilities yielded positive results from the USFDA and other agencies.

A recent inspection by the USFDA has been concluded at the company's Limbasi facility (API). The facility is planned for serving key emerging and regulated markets, upon obtaining approvals from the relevant regulatory authorities in these markets.

Manufacturing process cycle

Key APIs molecules based on the manufacturing process

In 2022, Concord Biotech commanded a market share of over 20% by volume across select fermentation-based API products, including Mupirocin, Sirolimus, Tacrolimus, Mycophenolate sodium, and Cyclosporine.

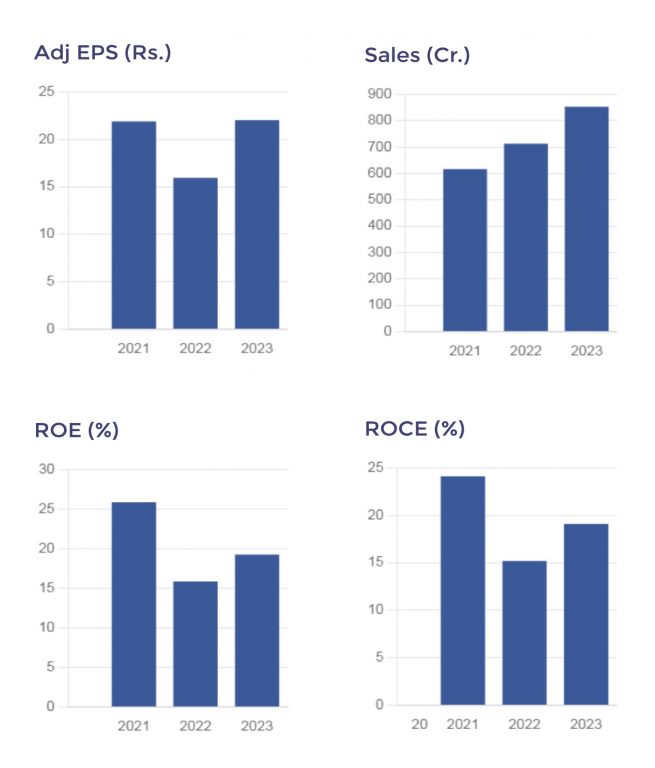

Financials:

Concord Biotech has shown consistent revenue growth recently. The company’s revenue has grown at a CAGR of 17.6% over FY21-23.

Concord Biotech has delivered healthy ROE as well as ROCE. Given the focus on high-value, low-volume products, it is able to maintain higher operating margins.

Key Financial Ratios and Trends:

[caption id="attachment_19000" align="aligncenter" width="655"] Source: DRHP[/caption]

Source: DRHP[/caption]

Management:

Sudhir Vaid serves as a Promoter, Chairman, and Managing Director of the company. He holds a Bachelor's degree in Science from Punjab University and a Master's degree in Science from Punjab Agricultural University. Prior to his current role, he was affiliated with Ranbaxy Laboratories Ltd and Lupin Chemicals Ltd. Additionally; he worked as a consultant with M/s. Sudman Consultants, providing services to companies like Plus Chemicals S.A., Lek Pharmaceuticals & Chemicals Co., and Biocon India Ltd.

Ankur Vaid is a Promoter, Joint Managing Director, and Chief Executive Officer of the company. He holds a Bachelor's degree in Chemical Engineering from Rashtrasant Tukadoji Maharaj Nagpur University and a Master's degree in Business Administration from Rochester Institute of Technology. Mr. Vaid has been with the company since 2009 and boasts over 15 years of experience in the pharmaceutical sector. He played a pivotal role in establishing the company's research and development division and has contributed significantly to the company's market strategy.

Lalit Sethi serves as the Chief Finance Officer of the company, having joined in March 2022. He possesses a Bachelor's degree in Commerce from Delhi University and is a Chartered Accountant. Prior to his role in Concord Biotech, he held positions in companies including Tilaknagar Industries Ltd, High Polymer Labs Ltd, Dabur India Ltd, British Health Products (India) Ltd, East India Hotels Ltd, and American Express Bank Ltd.

Prakash Sajnani holds the positions of Company Secretary and Compliance Officer, as well as Assistant Vice President (Finance) in the company. He joined in February 2006. Mr. Sajnani holds a Master's degree in Commerce from the University School of Commerce, Gujarat University and is a member of the ICAI and ICSI. With over 18 years of association with the company, he has fulfilled roles as a General Manager overseeing various company departments.

Positives:

- Barriers to entry- Fermentation is intricate, demanding specialized expertise due to its involvement with microbial strains, process control, and purification steps. Minor process adjustments can cause notable output differences. The complexity, scaling challenges, and substantial capital investment form significant barriers to entry in the fermentation-based API sector.

- Established presence across complex fermentation value chain- Concord has established a strong presence across the fermentation value chain, encompassing R&D, patents, key starting materials, APIs and formulation manufacturing, as well as marketing and distribution of such products. It targets high-value; low volume API’s which translates into better realisations and healthy margins.

- Leadership in immunosuppressant APIs- The company holds a prominent position as a global developer and manufacturer of specific fermentation-based APIs in immunosuppressants and oncology. In 2022, they commanded a market share of over 20% across key fermentation-based API products. Their portfolio comprises 23 fermentation-based APIs (6 key immunosuppressant APIs).

- Strong pipeline- It aims to diversify its API portfolio by using its technical expertise to develop complex fermentation-based products with high growth potential. This strategy is intended to increase profitability and strengthen its market position. They also plan to capitalize on their fermentation technology expertise to produce valuable APIs with low volumes as patents expire. Their pipeline includes multiple APIs in immunosuppressant, anti-bacterial, and oncology areas.

Risks:

- Raw material sourcing- Concord relies on imports of raw materials from China (approx. 50/42/32% of raw material consumed in FY21/22/23). There's uncertainty about the continuity and availability of these materials in the future, possibly affecting business, finances, and operations. Our observation is that these materials are not critical for most fermentation-based APIs (major segment).

- Working capital-intensive business- Company operations necessitate substantial working capital for raw material procurement and product development before customer payments are received.

- Regulatory risk- Regulatory authorities conduct periodic inspections of manufacturing facilities and products. Failure to comply may lead to regulatory actions, potentially restricting product sales or approvals. Currently, no additional actions are needed based on observations from the USFDA, CDSCO, or other external agencies.

Valuation:

At an IPO price of Rs.740 per share, the company trades at a P/E multiple of 32x in FY 2023 (comparable listed peer group PE average 30x). We remain watchful of a ramp-up in revenues and whether it maintains the current margin profile going ahead.

Recommendation: Suitably priced, prudent to wait for attractive valuations.

Note: We do not recommend buying just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on a business model and valuation.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: