Index Investing is quite popular in the US but it is not very lucrative in India versus the west. Index Investing has its merits in developed and diversified economies. For countries, especially emerging countries, Concentrated Index construction due to few large-sized companies leave a lot of returns on the table which helps in beating the Index over the long term.

This article covers the following:

- Are index funds the right way to invest? Do Index Funds make sense in India?

- Why is Index Investing not picking up in India yet?

- What do we suggest?

Are index funds the right way to invest? Do Index Funds make sense in India?

We come across several queries around Index Funds in the Indian context. Index investing, also called passive investing, accounts for 30 percent of the equity market in a country like the US according to Moody's. However, in India, it is still at a nascent stage.

In developed markets including the US, Index funds undoubtedly offer a low-cost, diversified, tax-efficient option for investing in the long term. In Indian markets too, Index funds are cheap versus an average actively managed equity fund. NiftyBees, a popular index ETF that tracks the Nifty 50 index (ETF is a fund that trades on exchange), charges just 0.05% p.a. on total AUM.

Even if Index investing has its merits, it doesn’t have an attractive proposition for Indian investors yet. If we remove Employee Provident Fund’s (EPFO) contribution in Index funds, Index Funds form less than 5% of total Asset under Management (AUM).

Why is Index Investing not picking up in India yet?

Better odds of outperformance

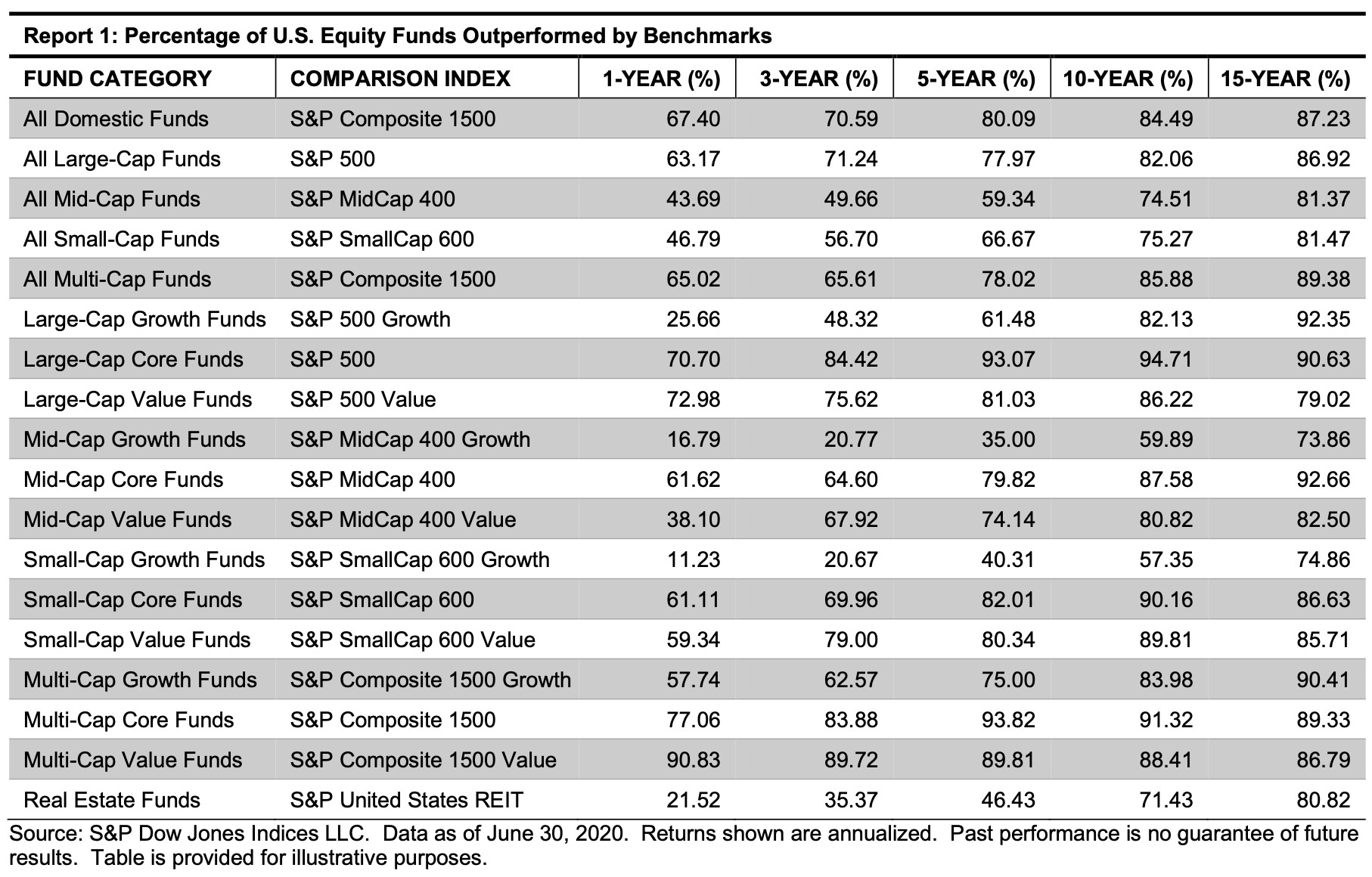

As per SPIVA Scorecard, US actively managed funds have a poor track record of beating the index funds.

In the US, less than 20% of the funds in the Multi-cap or mid-cap category are able to beat the index returns over 10-years and 15-years.

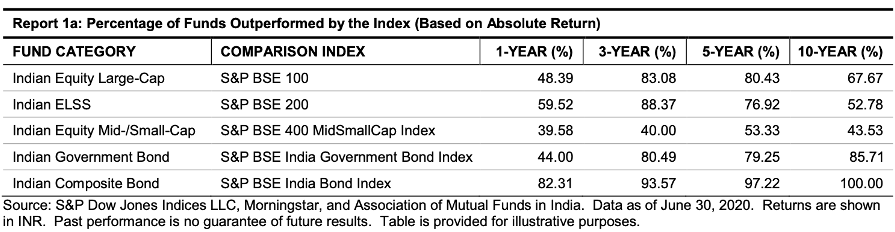

On the other hand, if we exclude Large-cap funds, Indian multi-cap (most ELSS are multi-cap) and mid-cap/small-cap funds have a good track record beating the index post fees. Almost one in two funds beats the index comfortably over a 10-year period. 50% is good odd to take a chance of beating an index versus 20-25% in the US.

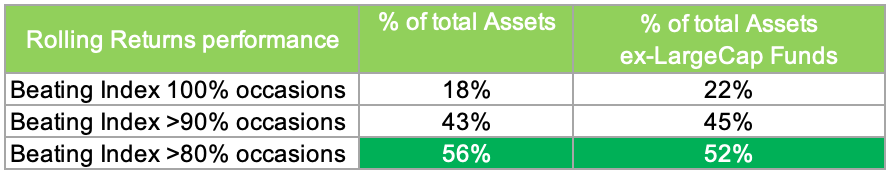

Fig: Five years rolling returns performance vs benchmark; Source: ACE MF, MoneyWorks4me research

Tax efficiency

The index is known for its Buy-and-Hold investing. Once bought, Index seldom sells stocks that satisfy the criteria of free-float market cap. This reduces the turnover ratio of Index Funds. (Turnover ratio=%change in the portfolio over 1 year)

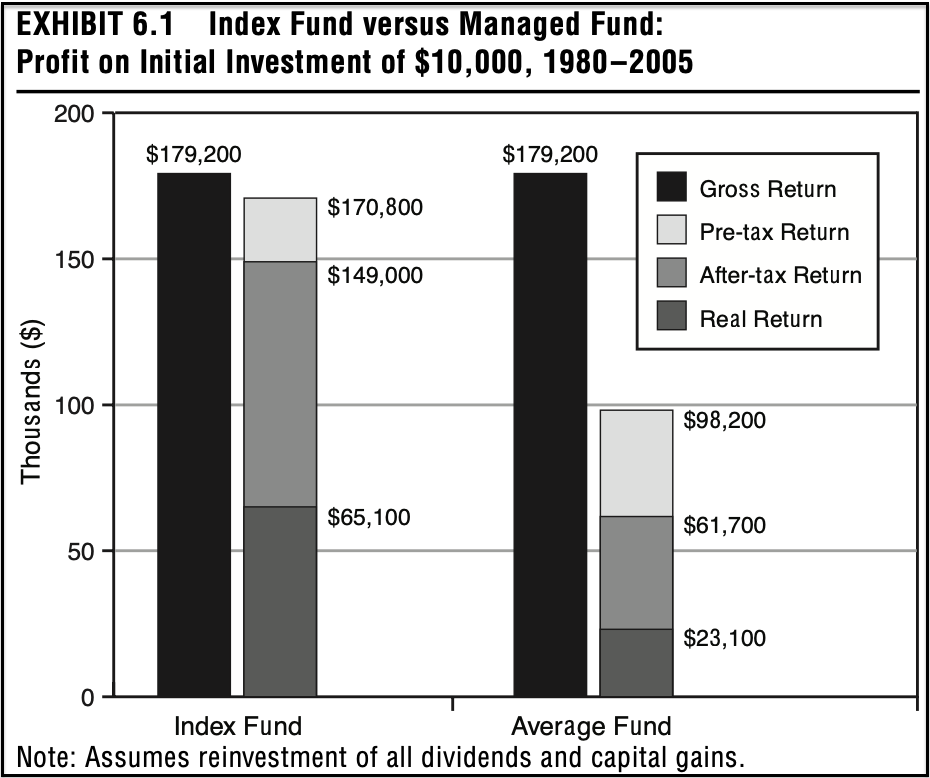

As per US income tax laws, if a fund buys/sells stocks, the investor in the fund is liable for capital gain taxes. An actively managed fund with a higher turnover ratio, typically 100%+, will incur capital gain taxes several times during the holding period. This eats into investor returns over time.

On the other hand, an Index fund with low turnover saves lots of capital gain taxes for its investor.

In his book, The Little Book Common Sense Investing, John Bogle writes, “With the high portfolio turnover of actively managed funds, their taxable investors were subject to an estimated effective annual federal tax of 1.8 percentage points per year (state and local taxes would further balloon the figure), …[on the other hand] investors in the index fund were actually subjected to lower taxes—in fact, at 0.6 percentage points, only about one-third of that tax burden.”

In India however, an investor in an actively managed fund is taxed only after he sells the fund. A higher turnover ratio does not mean higher tax implications for the investor versus an Index Fund. So in terms of tax efficiency, Index Funds have no edge over actively managed funds in India.

Costs, Costs, Costs

Costs play an important role in determining investor returns. In the US, an expense ratio of an average actively managed mutual fund is around 1% p.a. (range 0.5%-1.5%). Now compare this with long-term returns of the US equity market of 7-8% CAGR. The expense ratio eats into 10-20% of total returns generated by the market. (expense ratio 1%/total return 7%=14% of total returns).

Compare that with the expense ratio of the direct plan of actively managed mutual funds in India. Indian equity market average return hovers around 12-13% CAGR over the long term, so an average expense ratio of ~1% means costs are just 7-8% out of the total returns. (expense ratio 1%/total return 13%=7.5% of total returns). An expense ratio of an actively managed fund doesn’t pinch investors as much as it does in the US or any developed market.

Concentration

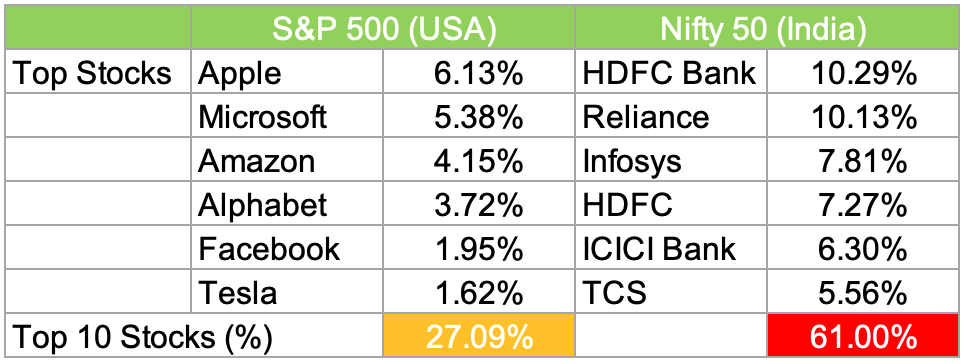

Index Fund in India is less diversified in terms of Sector/Stocks. In the US, the same is not true as the very fifth stock is just 2% of the index and many other stocks get good representation.

Index having 61% of the portfolio in top 10 stocks has two pitfalls: one, it is very risky, and future performance largely depends on what top 10 stocks do; two, there are many stocks that have little to nil representation in Index and may offer far superior returns. For an active manager, this makes it possible to beat the headline index over time.

Few other reasons why Index Funds haven’t taken off in India:

- Distributor-driven business model; Distributors earn higher commission selling Actively managed funds.

- A lower percentage of institutional investors versus retail investors could have opted for Index funds. (EPFO is actively investing in Index ETF since Aug 2015)

What do we suggest?

- Any market is a zero-sum game, one’s profit is another’s loss; Index fund returns will be nothing but average returns of all investors. When you sell HDFC Bank stock someone else buys; if HDFC Bank goes up, you lose the gains. It is natural that half the investors will perform better than the Index and another half will lag.

- But given the advantages of active investing in India above, we strongly believe Indian investors can build a portfolio of process-driven actively managed mutual funds/Advisory model portfolios with help of advisors for a reasonable fee.

- MoneyWorks4me direct stocks portfolio, which follows Quality at a reasonable price with a blend of value investing, has managed to beat Index Fund returns over several 3 & 5 year periods quite consistently.

- MoneyWorks4me also recommends actively managed mutual funds that follow a process like Value, Momentum, Quality, and Size. These processes tend to beat index fund returns over the long term and it is well documented by academic research.

- One must understand that to outperform an Index fund, a portfolio must be built differently than the index. Different portfolio than the Index often causes lead and lag versus Index return in the medium term. Every investor doesn’t have the temperament or deep understanding of processes to stick with the fund through its temporary underperformance. One needs an advisor’s help to understand the pros and cons of every process and building a diversified portfolio of different types of investing.

- Currently, we recommend 3-5 active mutual funds following complementing process and hold them for the long term. In a diversified portfolio, at any given time two funds may outperform while the other two may lag temporarily. All funds leading the index at the same time would indicate inadequate diversification, which also means these funds will lag index returns together in the future. Over the long term, the bulk of the portfolio will deliver index beating returns as the underlying funds’ process helps in outperformance.

- We believe building a diversified portfolio is highly tax-efficient. It avoids moving in and out of funds incurring unnecessary costs like Exit loads and Long Term/Short Term Capital Taxes.

- Only if you wish to handle your entire family savings, understand asset allocation principles, and have control over behavior in good times and bad, a couple of Index funds is all you need for your nirvana.

- Active investing in India has clear advantage without much to lose if one follows a diversified process approach, and holds it long enough for it to bear fruit, just like one ought to do with Index Investing.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: