Le Travenues Technology Ltd IPO Details:

Opening Date: June 10, 2024

Closing Date: June 12, 2024

Listing: BSE and NSE

Number of Shares: 7.95 Cr shares

Face Value: Rs 1 per share

Price Band: Rs 88-93 per equity share

Issue Size: Rs 740.10 Cr

About the Le Travenues Technology Ltd:

Le Travenues is a technology company focussing on the Indian travel Industry through its OTA (Online travel Agency) platform Ixigo. Ixigo helps Indian Travellers plan, book and manage their trips across railways, airways, buses and hotels.

These OTA solutions are developed using proprietary algorithms and crowd sourced information. Ixigo provides services such as confirmation predictions, travel status updates, pricing and availability alerts, travel itinerary planner, among others.

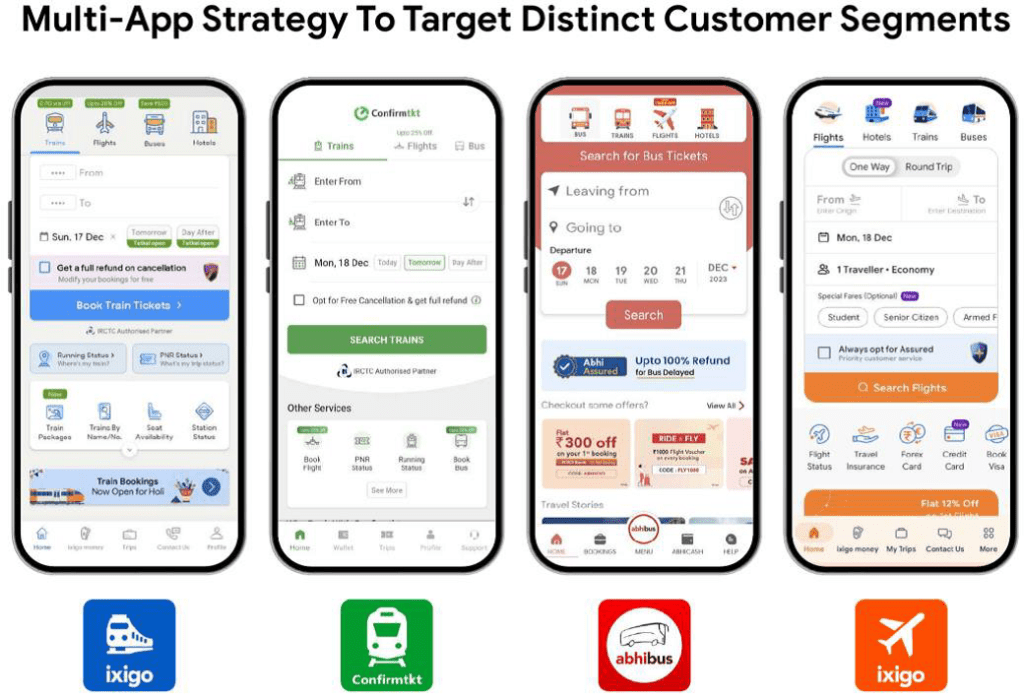

Ixigo’s Platforms

According to a Frost and Sullivan report Ixigo is the largest Indian train ticket distributor in the OTA rail market and has the largest market share of around 51%, in term of rail bookings. Ixigo’s bus focussed app, AbhiBus is the second largest bus ticketing OTA in India, with a 12.5% market share in H1 FY24. It had a market share of nearly 5.2% of the total airline OTA market by volume in H1FY24.

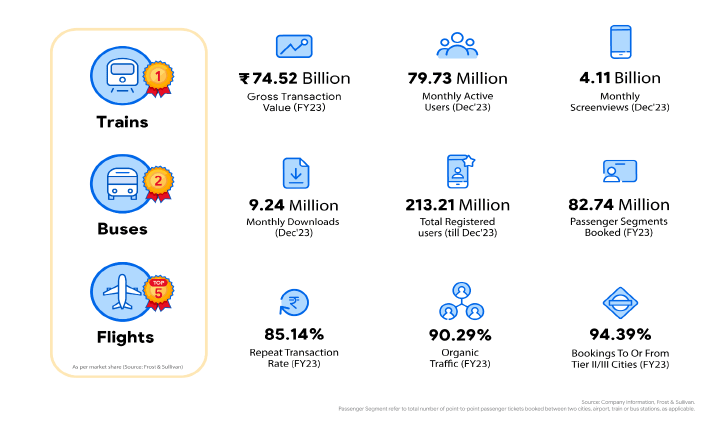

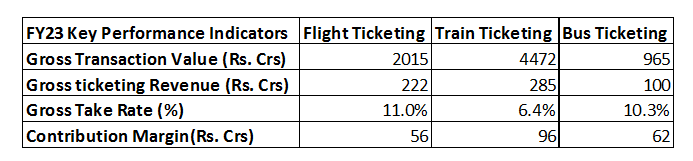

Key Performance Indicators:

Note- Gross revenue is before discounts.

The train ticketing business is the largest for Ixigo, with a Gross Transaction Value (GTV) in excess of Rs 4000 crores. This vertical has nearly 8 crore monthly active users as of December 2023. The flight ticketing vertical is the second largest, contributing ~Rs. 2600 crores as GTV, followed by the Bus Ticketing Vertical with a GTV of Rs. 887 crores.Ixigo has nearly 8 crore monthly active users as of December 2023

About the Industry:

Indian travel and tourism spending was Rs. 16.5 trillion in FY23, contributing nearly 9.7% of GDP in the same fiscal year and is expected to grow strongly in future period.

The Young and middle India is becoming increasingly mobile due to increase in disposable income and the frequency of vacation and travel has increased. Due to increased penetration of internet, Indians living in Tier II & Tier III towns are increasingly contributing to the growth of travel industry.

The higher number of OTAs and increasing competiveness among airlines, railways, and buses has increased affordability of travel. The convenience of booking with OTAs is playing a big role in reducing information asymmetry and increasing comparison of travel modes. Due to focus of OTAs on providing complete travel packages, rather than acting as merely booking intermediaries has also boosted the OTA space.

The travel industry has directly benefited from government policies which are aimed at boosting both domestic and inbound travel to India. This policy impetus is for all segments of air, road and rail to boost the movement of masses across the country. This is evident by the number of roads and airports built. Some of the major schemes include UDAN, Swadesh Darshan, Pilgrimage Rejuvenation and Spiritual Heritage Augmentation Drive (PRASAD). With a budget of Rs. 2400 crores being allocated to the Ministry of Tourism, Rs. 1740 crores has been allocated for enhancement of tourism infrastructure.

Trends in Indian travel Industry: Airlines were the early adopters of OTA channels with online bookings valued at Rs.1,162 billion. OTA penetration expected to reach 80% by FY28. The OTA for airlines is expected to grow at 18% CAGR vs the 12% projected for the Airline Industry.

81% of reserved tickets in the rail segment were booked online in FY23, and this is expected to rise to 86% by FY28, with online bookings expected to grow at a CAGR of 8% by FY28, compared to 6% for the overall rail industry.

The Hotels industry had an online penetration of 32% in FY23 and is projected to reach 44% in FY28, with the online segment expected to grow at 14% CAGR, compared to 7% for the overall hospitality industry. OTA market in this industry is expected to increase from Rs. 238 billion to Rs 517 billion by FY28, a CAGR of 17%

The online penetration in the Bus ticketing segment is a 19% and is expected to grow to 28% by FY28. OTAs hold 88% of online bus ticket booking market in FY23.

Business Segments:

Key product lines:

Flights: The Flight booking vertical commenced operations in 2007 by virtue of launch of travel search website aimed at providing travellers an aggregated comparison of deals and accurate travel information, to facilitate purchase of flight tickets on third party airline and OTA websites. In FY20, the company transitioned to an OTA model which allowed users to buy flight tickets on Ixigo’s platforms directly.

Train: The company launched Ixigo trains app for android in the year 2013, with the objective of improving the experience of Indian train travellers by allowing them to search for train related information and providing updates on status of their PNR numbers, to help make travel decisions.

In 2017, Ixigo commenced selling train tickets as a B2C ticketing principal service provider for IRCTC. In February 2021, Ixigo acquired Confirm Ticket, a train-utility and ticketing focused company.

Buses: Bus transport is the preferred mode of travel for masses in both urban and rural India, accounting for the largest share of 70% of all transportation used in India. Ixigo introduced its bus ticketing service on its platform in 2016. Ixigo acquired the business of AbhiBus with effect from 1st August 2021 and also holds a significant minority stake in FreshBus, which provides inter-city bus travel service using environment friendly busses.

Hotels: In December 2023, Ixigo launched a hotel booking section on the website and its apps to allow users the ability to search, compare and book hotels in India and internationally. The Hotel industry contributes for a significant share in the OTA industry’s profit mix due to higher margins. Currently, It is clubbed under other revenue.

Note- Gross revenue is before discounts.

Key competitors to Le Travenues include MakeMyTrip, EaseMyTrip, Yatra.com and Cleartrip.

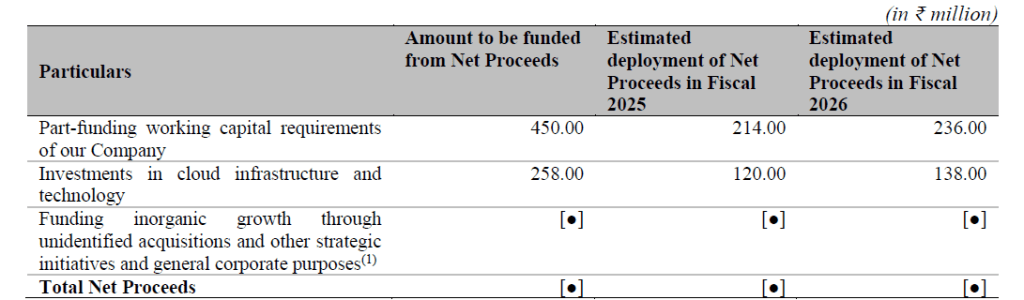

Purpose of Issue: Out of the total IPO size of Rs. 740 Cr, the fresh issue size is roughly around Rs. 120 Cr, these proceeds are planned to be utilised for working capital requirements and investments in cloud infrastructure and other related technology.

Main Selling shareholders:

Peak XV (Indian unit of Sequoia capital), SAIF Partners, Madison India and Micromax are some of the non-promoter selling shareholders, while promoters Rajnish Kumar and Aloke Bajpai are also offloading some part of their stake in the company.

Positives:

Scalability: Given the inherent nature of this business, when the customers to this company increase, it will directly impact the bottom-line as costs of such businesses are largely fixed, but the revenue of such businesses may increase disproportionately.

Network effect: As their buyer base grows, they channel additional demand and therefore conduct more transactions through their platform. This attracts more suppliers, which in turn, enables them to offer better pricing, wider range, and offer better supply of products to consumers.

Concerns:

Competitive intensity: The industry is dominated by a various competitors and pricing may be the only metric which differentiates the players from the rest. Also there is little to none barriers to entry in this business.

Customer cancellation costs: Ixigo launched its suite of Assured which is a free cancellation option for the passenger and are provided for a nominal fee, but the company has to bear all the costs incase there are cancellations. The company incurred ~Rs. 95 crores in such cancellation and refund costs in 9MFY24.

Advertising costs: Ixigo spent nearly Rs. 118 crores on advertising related expenses and is expected to grow further. The customer acquisition cost of the company increased from Rs. 44 in FY21 to Rs. 131 in FY23 and stood at Rs.198 for 9MFY24.

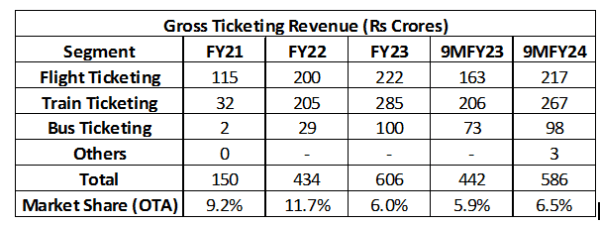

Financials:

The company showed healthy growth in Sales from FY20 to FY23 growing at a CAGR of 65% from Rs. Rs. 112 crores to Rs. 500 crores, but reported negative EPS in FY20 and FY22.

Acquisitions:

Confirm Ticket: Le Travenues acquired this company in FY21. Confirm ticket is a data analytics company giving insights on ticket waitlist and helps in train confirmation predictions

AbhiBus: Was acquired in FY22 to consolidate Ixigo’s position in the bus booking segment.

FreshBus: Le Travenues holds a significant minority stake in the company. FreshBus provides eco-friendly bus options to travellers.

Management:

Aloke Bajpai: He is the Co-Founder Chairman, Managing Director and Group Chief Executive Officer. He is an Alumnus of IIT Kanpur and did his MBA from INSEAD. Prior to starting Ixigo, he was Vice President in FinalQuadrant Solutions, managing strategic business development and in Amadeus as a senior Engineer.

Rajnish Kumar: He is the Co-Founder, Director and Group Co-Chief Executive Officer. He is an alumnus of IIT Kanpur. Prior to starting Ixigo, he worked with Amadeus as a Technical Lead.

MoneyWorks4Me Opinion

Ixigo operates in a growing but competitive industry. We like that it has (a) dominant share in train ticketing, (b) has levers to grow in Hotel booking segment (newly launched) and (c) network effect benefits. However, (a) currently deferred tax income inflates profitability and it will have to pay taxes going forward, (b) advertisement expense may increase as competition usually plays on pricing. We feel that the issue has baked in future growth and aggressive investors with a long term view can apply.

We wrote an IPO on TBO Tek, Yatra in the same industry and think TBO Tek is more better placed as it is a B2B platform which doesn’t have to aggressively advertise.

Recommendation: Aggressive investors with a long term view can APPLY.

Le Travenues Technology Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | June 10, 2024 |

| IPO Close Date | June 12, 2024 |

| Basis of Allotment Date | June 13, 2024 |

| Refunds Initiation | June 14, 2024 |

| A credit of Shares to Demat Account | June 14, 2024 |

| IPO Listing Date | June 18, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 161 | Rs. 14,973 |

| Maximum | 13 | 2093 | Rs. 194,649 |

Le Travenues Technology Limited IPO FAQs:

When will the Le Travenues Technology Ltd IPO open?

Le Travenues Technology Ltd IPO will open for subscription on Monday, 10th June 2024, and closes on Wednesday, 12th June 2024.

What is the price band of Le Travenues Technology Ltd IPO?

The price band for Le Travenues Technology Ltd IPO is Rs. 88-93/share.

What is the lot size for the Le Travenues Technology Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 161 shares, up to a maximum of 13 lots i.e. Rs. 1,94,649/-.

What is the issue size of Le Travenues Technology Ltd IPO?

The total issue size is ~ Rs. 740.10 Cr.

When will the basis of allotment be out?

Allotment will be finalized on June 13th and refunds will be initiated by June 14th. Shares allotment will be credited in Demat accounts by June 14th.

What is the listing date of Le Travenues Technology Ltd’s IPO?

The tentative listing date of the Le Travenues Technology Ltd IPO is June 18th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: