JSW Infrastructure Limited IPO Details:

Estimated Market Cap: ~ Rs.25,000 Cr

IPO Date: 25th September to 27th September

Total shares: 23.5 Cr

Price band: Rs. 113- Rs. 119 per share

IPO Issue Size: ~ Rs. 2800 Cr

Lot Size: 126 shares and multiples thereof

Purpose of Issue: Fresh Issue

About JSW Infrastructure Limited:

JSW Infrastructure Limited (JSWIL) is the second largest commercial port operator in India (in terms of cargo handling capacity in FY23). It operates nine port concessions in India, which collectively have an installed cargo handling capacity of 158 million metric tons per annum (MTPA). Leading ports managed by JSWIL are Jaigarh and Dharamtar (both in Maharashtra) on the West coast and Paradip (Odisha) on the East coast. Additionally, the company manages two port terminals in the United Arab Emirates (UAE) under operations and maintenance (O&M) agreements, with a combined cargo handling capability of 41 MTPA.

It is a member of the JSW Group, a multinational conglomerate that owns a wide range of assets in different sectors. These sectors include steel, energy, infrastructure, cement, paints, venture capital, and sports. Being part of the group, the company initially received cargo from group customers (steel and energy). This helped in the smooth ramp-up of their assets and better utilization of their capacities. JSWIL’s cargo handling systems are mostly mechanized, leading to fast turnaround times and efficient resource utilization.

The company's goal is to boost its market share in India's port and logistics infrastructure sector. JSWIL aims to achieve operational capacities of up to 300 million metric tons per annum (MTPA) across their ports and terminals by 2030.

Industry

The Sagarmala program has the goal of increasing India's port capacity to over 3,300 MTPA by 2025. This includes 2,219 MTPA at Major Ports and 1,132 MTPA at Non-Major Ports by 2025, as stated by the Ministry of Shipping. Major Ports are under the administrative control of the Government of India while the Non-major ports are governed by the respective Maritime State Governments.

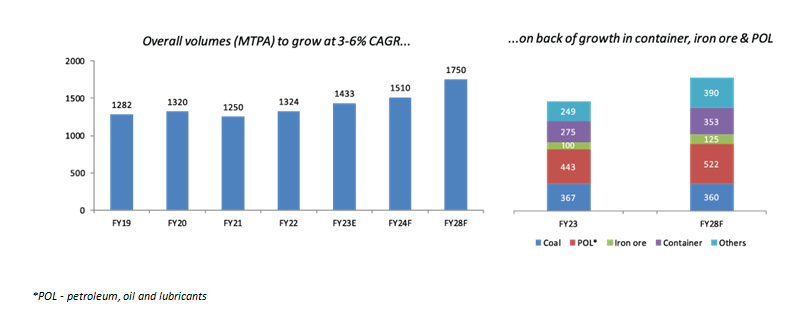

Port traffic in FY23 saw robust growth of 8.2%, driven by a substantial increase in coal cargo traffic due to higher domestic power demand. Coal traffic alone grew by 26%, while container traffic remained sluggish with a modest 3% growth. Iron ore traffic benefited from coastal movement, rising by 7%, and POL (petroleum, oil, and lubricants) traffic increased by 5% due to revived demand across various industries.

For FY24, port traffic growth is expected to moderate to 3-6%. Coal traffic is likely to grow by 2-7%, container traffic may see a slight increase of 4-7%, and iron ore traffic is projected to grow by 10-15%, but POL traffic is anticipated to have subdued growth of 2-5%.

Looking ahead to FY24-28, growth at Indian ports is expected to stay within the range of 3-6%. Additionally, non-major ports are gaining share due to their efficiency, lower turnaround times, and competitive rates compared to major ports.

Cargo volumes at Non-Major ports in India rose from 577 million metric tons (MMT) in FY21 to 604 MMT in FY22. The company's strategy involves concentrating on expanding in Non-Major Ports where they can enhance their operations by offering fully integrated logistics solutions with an optimal mix of bulk, container, liquid, and gas cargo types. They also plan to continue expanding their presence at Major Ports.

Business model

Concessions period providing long-term visibility

The company's Port Concessions are durable assets with concession periods usually lasting 30 to 50 years. For example, the Jaigarh Port in Maharashtra received a 50-year concession in 2008, while the Dharamtar Port (Maharashtra) and the other port terminals at Major Ports received concessions/licenses for 30 years. The average concession period for ports and terminals, weighted by capacity, is ~25 years. This long-term arrangement offers stable revenue prospects.

Port location

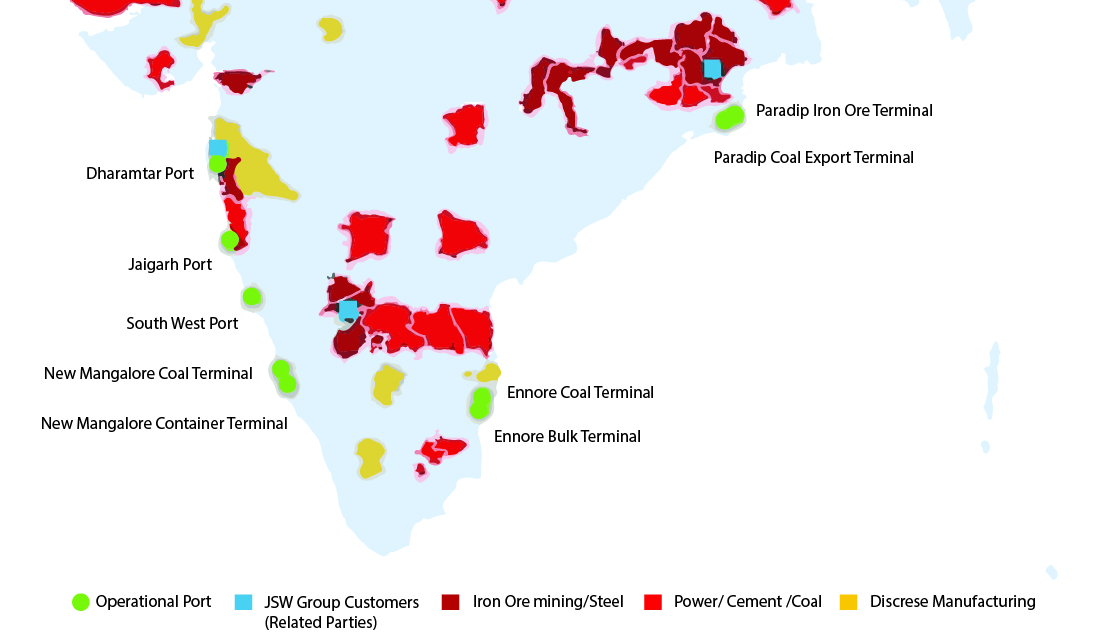

Location is crucial in the ports industry, with ports near major shipping routes having a competitive advantage due to cost savings for importers and exporters. The company's ports are strategically placed on both the west and east coasts, are well-connected to customers in industrial areas like Maharashtra, Goa, Karnataka, Tamil Nadu, Andhra Pradesh, Telangana, and mineral-rich regions such as Chhattisgarh, Jharkhand, and Odisha. These states handle large volumes from coastal and inland areas.

Besides their favourable location, the company's assets also gain an advantage from a versatile evacuation system. This system includes roads, railways, mini-bulk carriers, and conveyor systems. It allows the company to offer tailored supply chain solutions to its customers.

Customers save on transportation costs because of the company's strategic location and efficient evacuation infrastructure. This leads to greater reliance on the company's assets and helps boost business growth.

The strategic location of ports

A map is altered only for presentation purposes.

Revenue model

JSWIL offers maritime services like cargo handling, storage solutions, logistics, and value-added services. The company is transitioning to become a complete end-to-end logistics solutions provider. Pricing for services depends on several factors, including Port Concession specifications, cargo volume, cargo type, customized services, and competitive pricing from other ports. Tariffs are typically governed by the Port Concession agreements, with some tariffs escalating annually based on the Wholesale Price Index of India. In other cases, tariffs are determined by market conditions. Long-term contracts with JSW Group Customers and Long-Term Third-Party Customers also follow WPI-linked escalations.

Cargo mix

The company currently handles a variety of cargo types, including dry bulk, break bulk, liquid bulk, gases, and containers. This includes items such as coal, iron ore, sugar, urea, steel products, rock phosphate, molasses, gypsum, barites, laterites, edible oil, LNG, LPG, and containers.

They have developed expertise in handling diverse bulk cargo like liquid commodities (such as edible oil and chemicals), LNG, LPG (with India's first Floating Storage and Regasification Unit-based LNG terminal at Jaigarh Port), urea, and they're expanding their container operations. They've created specific facilities for different types of cargo, like LPG storage and neem coating facilities for urea.

Sticky cargo

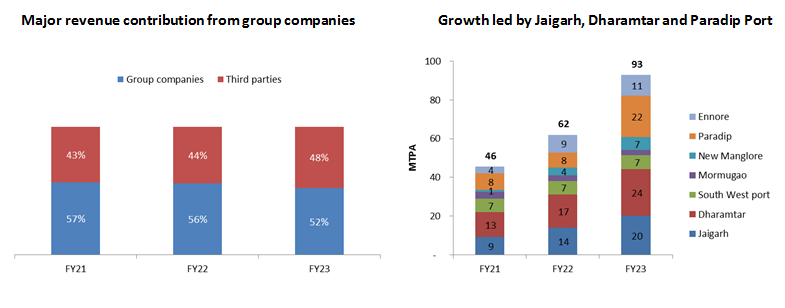

JSWIL has long-term contracts with JSW Group Customers (related parties), some of which include take-or-pay provisions. As of FY23, these contracts commit to a minimum annual cargo volume of 25.40 MMT, which represents 27% of the total cargo volume. This "sticky cargo," which includes cargo for both JSW Group Customers and Long-Term Third-Party Customers, has been steadily increasing.

Customers: Vedanta,Trans Impex, Karam Chand Thapar & Bros Coal Sales, Balaji Malts, Seil Energy India, Chettinad Logistics, Western Concessions.

Peers:

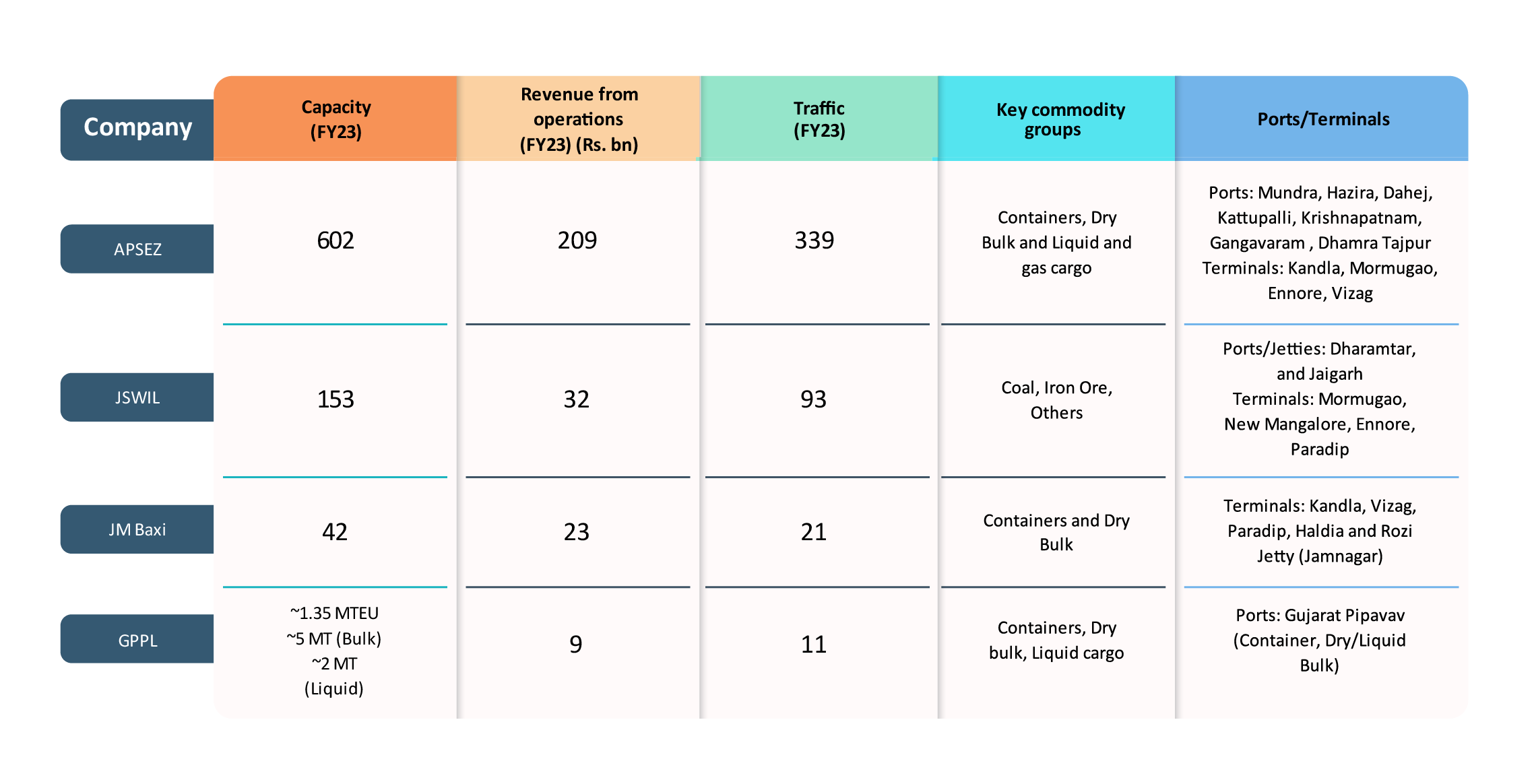

Key port/terminal operators in India are Adani Ports and Special Economic Zone (APSEZ), Gujarat Pipava Port (GPPL), JM Baxi, DP World, PSA International, and APM Terminals, among others.

Acquisition strategy

The company has a history of acquiring Port Concessions in Tamil Nadu and Karnataka to expand its capacity and presence across different regions and cargo types, in response to growing cargo volumes. They plan to continue expanding their portfolio and operations by considering acquisition opportunities, particularly focusing on container and liquid cargo handling and increasing their third-party customer base.

Their approach to evaluating potential targets includes assessing their strategic fit with existing assets, potential for expansion, and investment returns. As an example, in November 2020, they acquired two terminals (the Ennore Coal Terminal and Ennore Bulk Terminal) at Kamarajar Port in Tamil Nadu and one terminal (the New Mangalore Coal Terminal) at New Mangalore Port in Karnataka from the Chettinad Group. This acquisition added a total operational capacity of 16.73 MTPA and allowed them to serve third-party customers while expanding their presence along India's east coast.

Expansion plans

- Capacity addition - The company has ambitious expansion plans. They aim to increase the capacity of Jaigarh Port by developing a terminal that can handle LPG, propane, butane, and similar products with a proposed capacity of up to 2 MTPA. This terminal's proximity to industrial areas and LPG bottling plants in Maharashtra will help attract repeat customer orders.

- Group expansion plans - They anticipate continuing to benefit from the overall growth of various businesses within the JSW Group. For instance, JSW Steel plans to increase its installed capacity to 37 MTPA by FY25, up from 27.7 MTPA in FY23. Similarly, JSW Energy aims to achieve up to 10 gigawatts (GW) in FY25, compared to 4.8 GW in FY23. These expansions are expected to contribute to the growth of cargo volumes across their existing assets and create a foundation for future growth at new locations.

- New ports –

- JSWIL plans to create a non-major port in Jatadhar (Odisha) with a capacity of up to 52 MTPA to serve JSW Steel's upcoming facility in Odisha. These projects will be completed in phases and are expected to add a total of 54 MTPA to their cargo handling capacity in India.

- Furthermore, the company has submitted a bid for a new deepwater greenfield port in Keni district, Karnataka. They have experience in Public-Private Partnerships (PPP) at Major Ports, having been awarded concessions for two terminals in FY16 and FY17 from the Paradip Port Authority and the New Mangalore Container Terminal in FY20 from the New Mangalore Port Authority. They are actively pursuing PPP opportunities as part of their growth strategy and are expanding the capacity of their container terminals in New Mangalore, Karnataka.

- Synergistic businesses- The company plans to explore related businesses, including the development of container terminals, liquid storage terminals, container freight stations (CFS), multi-modal logistics parks (MMLP), and inland container depots (ICD). This strategic approach will enable them to offer comprehensive end-to-end logistics solutions to their customers.

Objects of the issue

The company intends to use the Net Proceeds for the following purposes:

- Repaying certain outstanding borrowings by investing in their wholly-owned subsidiaries, JSW Dharamtar Port Private Ltd and JSW Jaigarh Port Ltd.

- Financing the capital expenditure needs of their wholly-owned subsidiary, JSW Jaigarh Port Ltd, for planned expansion and upgrading activities at Jaigarh Port. This includes expanding the LPG terminal (2 MTPA), setting up an electric substation, and acquiring and installing a dredger.

- Financing the capital expenditure requirements of their wholly-owned subsidiary, JSW Mangalore Container Terminal Private Ltd, for an expansion project at Mangalore Container Terminal.

- Using the funds for general corporate purposes.

Financials

JSWIL’s revenue has recorded 26% CAGR over FY19-23 and 40% CAGR over FY21-23 accelerated by acquisitions in 2020 (New Manglore coal terminal and Ennore port). EPS has doubled on better margins (driven by higher utilization) and normalized costs. The company plans to pay off Rs 880 Cr debt and do capital expenditure of ~Rs 12 bn for expansion. We expect the company to keep on churning out 15%+ RoE/RoCE over the next few years.

Concerns

Cargo concentration risk

A significant portion of the cargo handled consists of coal and iron ore. This means that the company's business is vulnerable to downturns in the trade or transportation of these commodities.

Additionally, the company's subsidiary, SWPL (South West Port Limited), is currently involved in a public interest litigation case related to coal and coke handling operations at Mormugao Port in Goa (8/9% overall cargo /revenue contribution). If this petition doesn't rule in favor of the company, there is a risk that coal and coke handling operations at Mormugao Port could be forced to shut down. Furthermore, the Government of India is implementing legislation to limit emissions and encourage the adoption of renewable energy sources. This regulatory trend is reducing the demand for coal for industrial purposes.

West coast concentration risk

A major portion of the company's revenue comes from ports and terminals situated along the west coast of India. Two of the company's key ports, Jaigarh and Dharamtar Ports (22/26% volume contribution in FY23), make substantial contributions to its cargo volume and revenue from operations. Both of these ports are located in Maharashtra. This geographic concentration makes the company's operations at these ports vulnerable to various local and regional factors, including weather conditions, natural disasters, government policies, political developments. Furthermore, since Dharamtar Port primarily handles transshipment from Jaigarh Port, using smaller barges and mini bulk carriers, disruptions at one port could also disrupt operations at the other.

Foreign exchange risk

Although the company's reporting currency is the Indian Rupee (INR), it engages in transactions denominated in foreign currencies. These transactions include earning revenue from certain customers in foreign currency and incurring finance costs on foreign currency borrowings and Secured Notes. Consequently, the company is exposed to currency translation risk.

While the company doesn't have formal hedging arrangements in place, it benefits from a natural hedge for US-dollar borrowings (USD 400 mn) through US dollar-linked revenue. Additionally, it employs cash flow hedges to manage its foreign exchange risk. However, if the company cannot align revenues received in foreign currencies with costs incurred in the same currency or if there are significant exchange rate fluctuations between these currencies, it could adversely impact liquidity or the efficient utilization of working capital.

Management

Sajjan Jindal, aged 63, is the Chairman and Non-Executive Director, as well as the Individual Promoter of the Company. He holds a bachelor's degree in mechanical engineering from Bangalore University. With a career spanning over 36 years in the manufacturing and steel industry, he has played a pivotal role in the sector's growth.

He has been associated with JSW Steel Ltd since 1997, initially as its managing director and currently as the chairperson and managing director. He also serves as the vice chairman of the World Steel Association and sits on the board of directors of JSW Energy Ltd.

Arun Maheshwari, aged 53, serves as the Joint MD and CEO of the company. He holds a bachelor's degree in commerce and has successfully completed his MBA. He has a rich professional history, having previously held positions at prominent organizations such as Jindal Strips Ltd, Jindal Iron & Steel Company Ltd, and Jindal Vijaynagar Steel Ltd. With over three decades of experience in diverse areas such as marketing, raw material imports, corporate strategy, and infrastructure, he brings valuable expertise to the company. He has been associated with the company since April 2019.

Lalit Singhvi, aged 60, serves as the Whole Time Director and CFO of the Company. He holds a bachelor's degree in commerce (honors) from the University of Jodhpur and is a fellow member of the ICAI. He has been associated with the Company since January 2015, initially as Senior VP - Finance and Commercial. Prior to this role, he held significant positions at various organizations, including Shree Shubham Logistics as President - Commercial, Sterlite Industries (India) Ltd as CEO for Fujairah Gold FZE, and Suhail Bahwan Group (Holding) LLC as General Manager (Finance).

Opinion:

JSWIL is well placed to capture non-major ports growth and has (a) captive volumes from group companies as well as (b) expansion plans which will increase revenue visibility. However, JSWIL currently is still gearing to become a fully integrated logistics solutions provider (high margin) and to scale up third-party revenues. At listing it will trade at ~29x FY23 EPS, expensive than Adani Ports & SEZ/Gujarat Pipavav (25/18x TTM EPS).

Recommendation: Subscribe for listing gains

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: