Honasa Consumer Limited IPO Details:

Estimated Market Cap: ~Rs. 10,425 Cr

IPO Date: 31st October to 2nd November

Total shares: 5.25~ Cr

Price band: Rs. 308- Rs. 324 per share

IPO Issue Size: ~ Rs. 1,701 Cr

Lot Size: 46 shares and multiples thereof

Purpose of Issue: Fresh Issue and Offer for Sale

About Honasa Consumer Limited

Honasa Consumer was established in 2016 by the husband-wife duo Varun and Ghazal Alagh, renowned for their appearance on Shark Tank. Their venture began with the creation of Mamaearth, a brand specializing in natural and toxin-free baby care products.

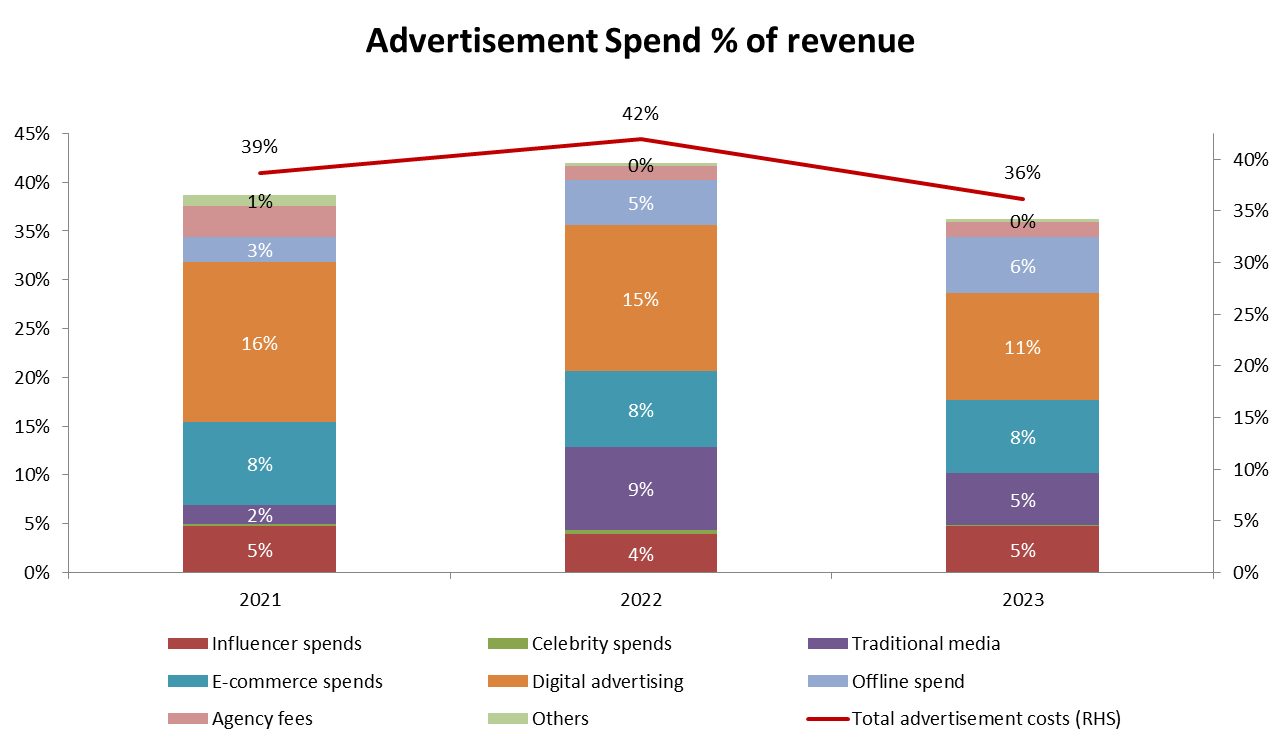

Honasa Consumer Limited, widely recognized for its flagship brand Mamaearth, stands as India's largest digital-first beauty and personal care (BPC) company, based on its revenue from operations in FY23. The company houses a portfolio of brands, including Mamaearth, Derma Co., Aqualogica, and Ayuga. Additionally, it owns the BBlunt salon chain and the Dr. Sheth’s skincare brand. Honasa Consumer operates as a digital-first hub of brands, dedicated to addressing the diverse needs of millennial customers in the beauty and personal care sector.

It is backed by prominent investors such as Sequoia Capital India, Sofina Ventures SA, Fireside Ventures, Stellaris Venture Partners, Shilpa Shetty Kundra, etc. It recently raised $52 million in its Series F funding round at a valuation of $1.07 billion (Rs 8,560 Cr), becoming the first D2C unicorn in India.

Industry

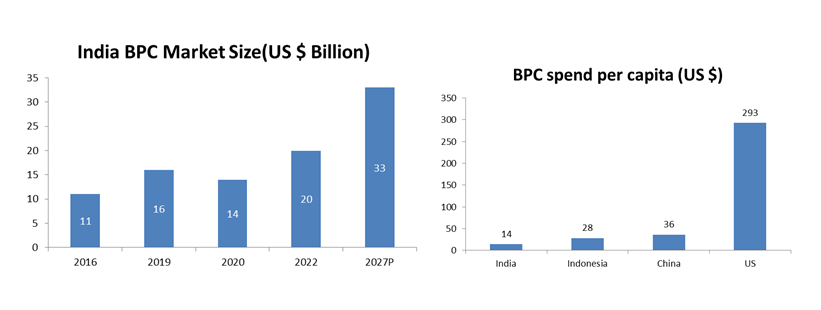

The beauty and personal care industry in India stands out as one of the fastest-growing segments within the consumer sector. Currently valued at approximately US $20 billion, the Beauty and Personal Care (BPC) market in India is expected to see an annual growth rate of 11%, reaching an estimated US $33 billion by 2027.

India's BPC market is substantial, ranking as the 6th largest globally. Yet, it's important to note that there is significant untapped potential. Historically, Indian households have allocated relatively less of their spending toward BPC compared to other nations. For example, in FY22, per capita BPC expenditure in China was nearly three times that of India. Even in comparison to a relatively smaller economy like Indonesia, India's per capita spending on BPC products remains lower, signifying substantial room for growth. India's per capita expenditure on BPC products is currently among the lowest when compared to some other developing countries. With GDP per capita surpassing US $2,000, a critical turning point observed in other developing economies, India stands at the brink of significant growth in this sector.

The BPC products market in India is currently undergoing a fundamental transformation, driven by the convergence of technology, the demographic dividend, and rising consumer aspirations.

Business Model

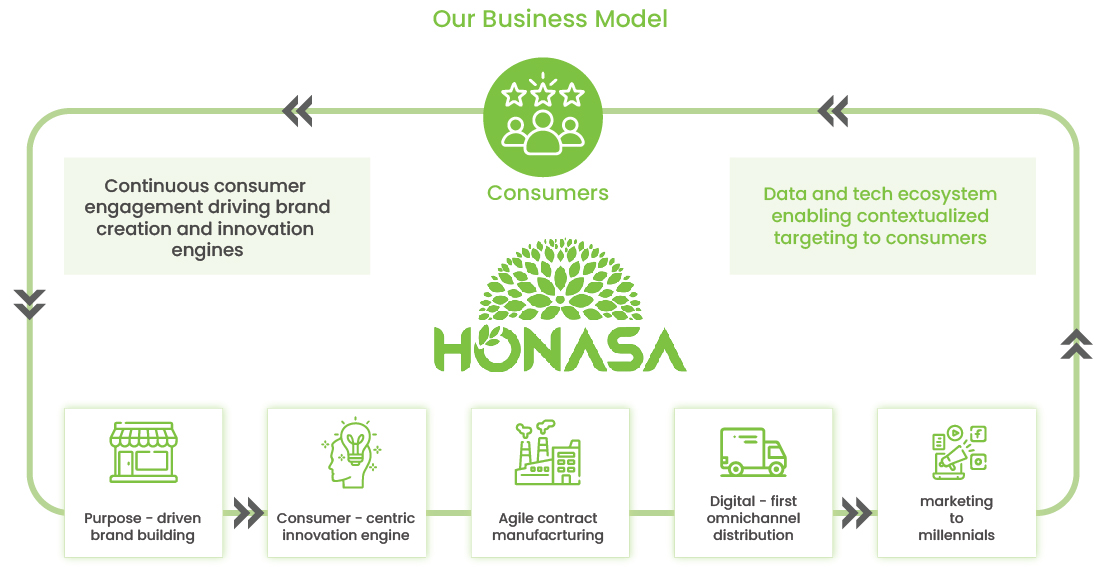

Honasa Consumer embraces a direct-to-consumer (D2C) approach, primarily marketing and selling its products through its own website and app, in addition to well-known online marketplaces like Amazon, Flipkart, Nykaa, and more.

The Direct-to-Consumer business model for beauty and personal care (BPC) brands is centered around selling products directly to consumers via online channels. Key components of this model encompass product quality, online sales strategies, customer engagement, data-driven decision-making, compelling brand narratives, sustainability, and efficient supply chain management. This approach prioritizes the establishment of a robust online presence, active engagement with customers, and alignment with values that resonate with the target audience.

We will analyze the Honasa Consumer business model across three key dimensions:

- Brand Building

- Distribution

- Marketing

Brand Building

The success of Mamaearth underscores the ability of management to recognize and respond to emerging trends, leading to the creation and growth of brands. This expertise is utilized to develop new brands, contributing to rapid expansion. The brand-building processes are driven by the consumer-centric approach that is integrated into various aspects of the business model, including innovation, digitally-oriented omnichannel distribution, and the technology and data-driven marketing and consumer engagement model.

Distribution

The company's presence on online channels, including both DTC platforms and e-commerce marketplaces, is strategically harnessed during the initial phases of a brand or product's lifecycle. This strategy aims to create trial opportunities for early adopters, establish direct consumer engagement, and evaluate product-market fit. As a product or brand matures, a selective introduction of these offerings in offline stores is employed to expand their reach to a broader consumer base. This digital-first distribution approach empowers the company to integrate customer feedback into new product launches, facilitating the efficient scaling of new products.

Marketing

Honasa has implemented a data-driven and personalized marketing strategy aimed at generating interest and driving sales for its brands and products. This strategy hinges on data-driven insights, enabling the creation of genuine and pertinent content for consumers. This content is generated not only in-house but also through partnerships with a network of digital influencers.

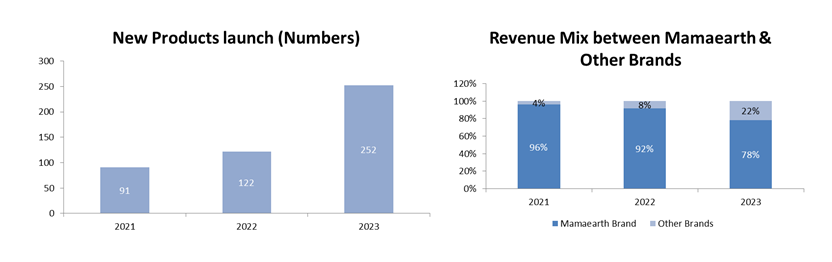

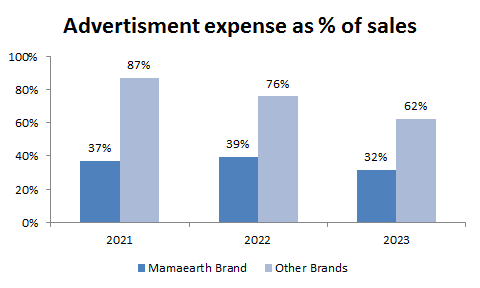

Details of the advertisement expenses across different platforms:

Moreover, the company leverages its data ecosystem to attain a deep comprehension of consumers, taking into account various factors, including demographic information, behavioural patterns, and transactional data. This information empowers Honasa to segment its user base into micro-cohorts. This segmentation, in turn, allows the company to deliver customized user experiences that closely align with the unique needs and preferences of individual consumers.

Financial

Honasa Consumer's revenue scaled up 3x to Rs 1,493 Cr over the period spanning FY21 to FY23. In FY22, Honasa Consumer achieved profitability, securing a profit of Rs. 20 Cr. The company allocates a significant portion of its resources to advertising expenses, reflecting its commitment to building brand awareness, as evident in the advertisement spend, which stands at approximately ~39% of revenue. It is anticipated that the company will continue to invest in advertising to drive sales growth, all while maintaining a vigilant eye on profitability.

Peers:

The Beauty and Personal Care (BPC) industry in India is characterized by high fragmentation and intense competition, with numerous players offering diverse categories and price ranges. Notable industry leaders include Hindustan Unilever (HUL), L’Oréal India, Emami, Dabur & Himalaya Drug Company, among others. Additionally, the industry features a significant presence of unorganized and regional players catering to the mass market.

Honasa Consumer operates within the premium segment of the industry, targeting urban millennial consumers seeking high-quality, innovative, and distinctive products aligned with their preferences. In this segment, it faces competition from both online and offline players, including WOW Skin Science India, Plum Goodness, Forest Essentials, Kama Ayurveda, Nykaa, Purplle, The Good Glam Group, Sugar Cosmetics, and more.

Key Acquisitions:

Since launching Mamaearth in 2016, the company has added five new brands to their portfolio, namely The Derma Co., Aqualogica, Ayuga, BBlunt, Dr. Sheth’s. The Company has made the following strategic acquisitions and investments toward inorganic growth:

*COA: Cost of Acquisition

Objective of the issue:

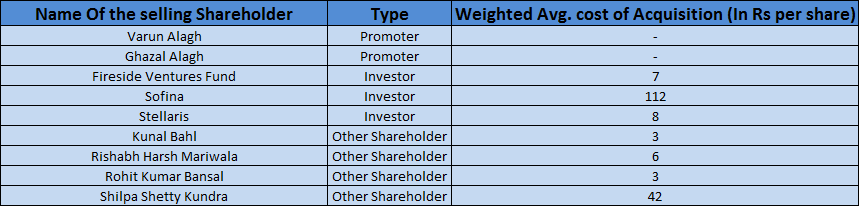

The offer comprises the fresh issue of Rs. 365 Cr and an offer for Sale ~4.12 Cr shares. Offer for sale details:

The company intends to use the net proceeds from the fresh issue for the following purposes:

- Advertisement expenses towards enhancing the awareness and visibility of our brands

- Capital expenditure to be incurred by the company for setting up new EBOs;

- Investment in Subsidiary, Bhabani Blunt Hairdressing Pvt Ltd (BBlunt) for setting up new salons

- General corporate purposes and unidentified inorganic acquisition

Risk Factors

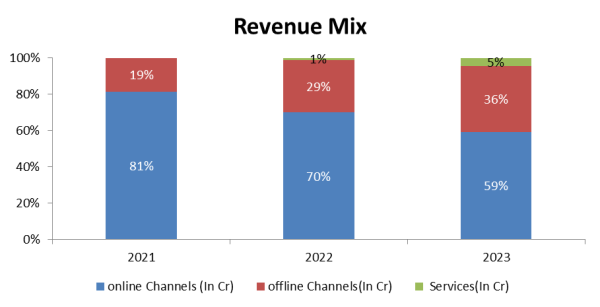

- Channel risk: The company depends on third-party e-commerce platforms for a significant portion of its online sales, which may expose it to various risks such as changes in policies, fees, commissions, and discounts. The company is shifting its revenue mix from online channels to offline channels.

- New brand-building expense: The company is allocating substantial resources to advertising new brands in order to drive sales, and any failure in this endeavor could have an adverse impact on the business. Consequently, incremental sales may come at lower margins.

- Internal controls not up to standard: The auditor's Opinion on internal financial controls issued on standalone financial statements for the FY20 contains a disclaimer of opinion relating to the Auditors’ inability to obtain appropriate audit evidence to provide a basis for an opinion on adequate internal financial controls.

Management

Varun Alagh, a Company Promoter, serves as the Chairman, full-time director, and CEO. He holds a bachelor's degree in electrical engineering from the University of Delhi and a post-graduate diploma in business management from XLRI, Jamshedpur. Previously, he worked with Hindustan Lever Ltd, Diageo India Pvt Ltd, and Coca-Cola India Pvt Ltd.

Ghazal Alagh, a Company Promoter, serves as a Whole-time Director and the Chief Innovation Officer. She holds a bachelor's degree in computer applications from Panjab University, Chandigarh, and a software engineering certification from the academic council of the NIIT Academy, New Delhi.

Ishaan Mittal, a Non-Executive Director representing Peak XV and Sequoia Capital, holds a bachelor's degree in mechanical engineering from the Indian Institute of Technology, Delhi, and a master's degree in business administration from Harvard University, Commonwealth of Massachusetts. He has served as a director of the company since January 3, 2020. Previously, he worked at the Boston Consulting Group (India) Private Limited for over a year and has been with Peak XV Partners Advisors India LLP (formerly, Sequoia Capital India LLP) for more than eight years, currently holding the position of "Managing Director."

MoneyWorks4Me Opinion

Honasa stands as a prominent player in the Direct-to-Consumer (D2C) segment of India's beauty and personal care industry. It boasts a robust brand portfolio, a loyal customer base, diversified revenue streams, a strong online presence, and promising growth prospects. The company is well-positioned to benefit from favourable industry trends, including the increasing demand for natural and premium products, the rising prevalence of e-commerce, and the expanding millennial population.

However, it's worth noting that Honasa Consumer Limited's valuation appears relatively high when compared to its peers and competitors in the industry. As of its financials for FY23, the company's price-to-sales ratio (P/S) is estimated to be around ~ 7x at the upper end of the price range. This places it in line with the P/S ratios of some of its listed peers such as HUL (9.43x), Colgate (10.41x), P & G Hygiene (13.96x), Emami (6.36x), Dabur India (7.6x), Godrej Consumer (7.24x), and others.

If revenue growth requires similar kind of advertisement spends then it becomes a value dilutive preposition. Given current expensive valuation risk reward is not favourable.

Recommendation: Avoid

Note: We do not recommend buying just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on a business model and valuation.

Honasa Consumer Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | October 31, 2023 |

| IPO Close Date | November 02, 2023 |

| Basis of Allotment Date | November 07, 2023 |

| Refunds Initiation | November 08, 2023 |

| A credit of Shares to Demat Account | November 09, 2023 |

| IPO Listing Date | November 10, 2023 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 46 | Rs. 14,904 |

| Maximum | 13 | 598 | Rs. 193,752 |

Honasa Consumer Limited IPO FAQs:

When will the Honasa Consumer Ltd IPO open?

Honasa Consumer Limited IPO will open for subscription on Tuesday, 31st October 2023, and closes on Thursday 02nd November 2023.

What is the price band of Honasa Consumer Ltd IPO?

The price band for Honasa Consumer Limited IPO is Rs. 308-324/share.

What is the lot size for the Honasa Consumer Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 46 shares, up to a maximum of 13 lots i.e. Rs. 1,93,752/-.

What is the issue size of Honasa Consumer Ltd IPO?

The total issue size is ~ Rs. 1701 Cr.

When will the basis of allotment be out?

The allotment will be finalized on November 07th and refunds will be initiated by November 08th. Shares allotment will be credited in Demat accounts by November 09th.

What is the listing date of Honasa Consumer Ltd’s IPO?

The tentative listing date of the Honasa Consumer IPO is November 10th 2023.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: