There was a time when the best things in life were free-love and fresh air. No longer; everything in this world comes at a cost. Mutual Funds also come at a cost. But since we don’t pay for them separately we don’t realize just how much they cost. In fact many people don’t know that they pay for it every year as long as they hold it. The main point is not that it costs, but how much and how is it charged.

As consumers we compare the price of anything we buy with the value we enjoy and when that is in favour of value we purchase it. Prices are therefore made very visible by sellers to aid this comparison and the purchase. In the case of regular plan mutual funds, suppose you write a cheque for Rs 1 lac, about Rs 3000 (@ 2.5% plus 18% GST) is first deducted as the cost and Rs 97,000 worth of units are given to you. Then in the following year if you held the fund you a similar amount is withdrawn from your net-worth. So a lesser amount than what you put is earning returns for you.

However, the return the industry publishes is on the total amount in this case Rs 1 lac. In effect you get a lower return than what your money actually earned. Like we said the issue is not that you are required to pay a price for the service, it only that it is done in a manner that short circuits the buyer’s normal process of evaluating the price and the value equation. And even if you know the price you paid, you may not realize the cost you have incurred. So, let’s look at this more closely

What do you pay for the services and how much does it cost you?

Fund house charges various fees for managing money. It is very important for the investors to know the costs associated to investing in Mutual Funds prior to investing. And whether it is worth it?:

Expense Ratio :

Asset Management Companies, AMCs charge investors for professional fund management and operational costs which include investment management and advisory fees, sales/agent commissions, service fees, etc.. All expenses charged to investor are called the 'total expense ratio' (TER); it is an annual charge as a % of AUM. The net asset value (NAV) of a mutual fund is net of all expenses highlighted under TER. Hence, lower the TER, better the returns and vice versa.

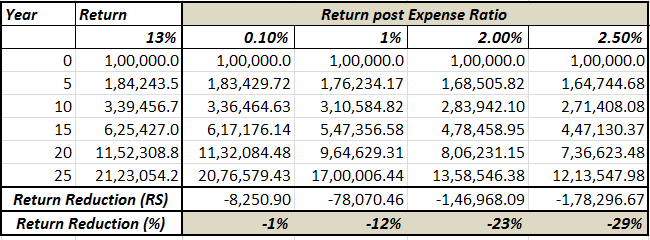

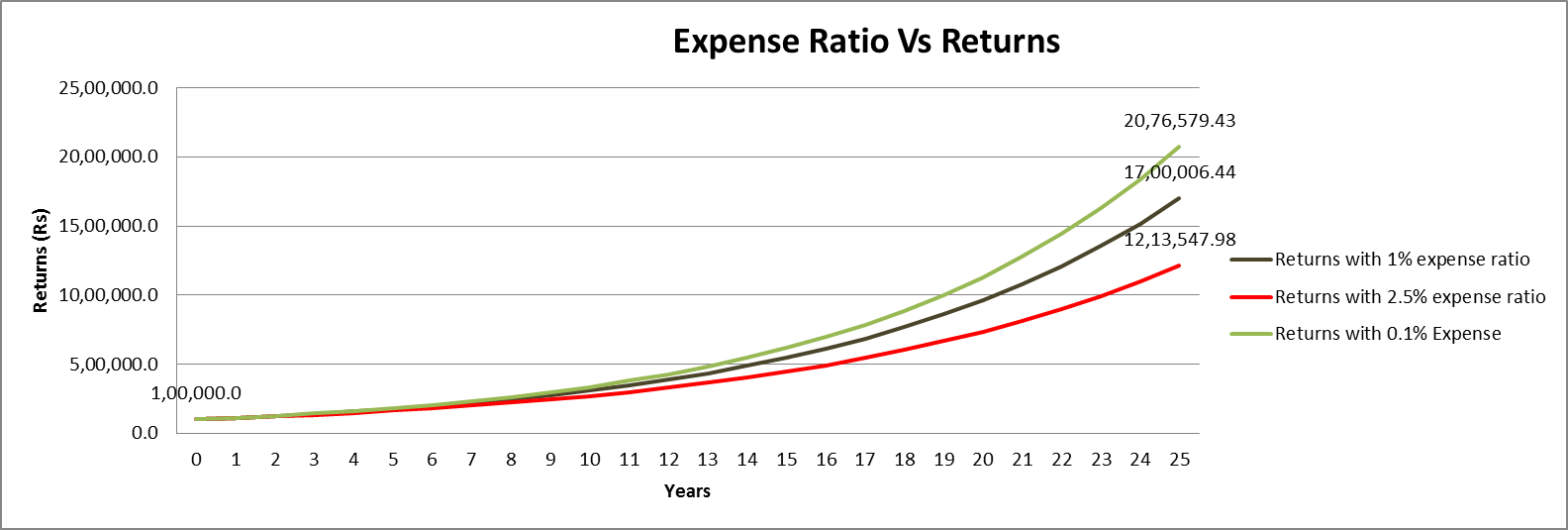

- Let’s look at an example. If an investor invests RS 1,00,000 in the first year and the fund manager compounds the money for 25 years at 13% CAGR with 0.1% fees, the corpus grows to Rs 20.76 lacs . This is a little less than 50,000 less compared to corpus with no costs which would be Rs 21.23 lacs

- Over 25 years, assuming a 2.5% expense ratio, the investment value falls to Rs.12,13,550/- .Total expense ratio (at various %), eats up additionally Rs 8.6 lacs compared to a 0.1% expense ratio. This is what a regular plan typically cost.

- As compared to that a Direct Plan charges about 1.25% as it does not need to pay any Distribution commissions. The investment grows to Rs 16.07 lacs, an additional cost of RS 5.5 over a 0.1% cost but a saving of Rs 3+ lacs over a regular plan. And considering than you don’t get a real fiduciary investment advice it is obvious that you must buy only direct plans.

Exit Load:

Exit Load is the % charges levied on the investor when on selling/redeeming a particular Mutual Fund within a certain period of investment. This charge is usually levied so as to discourage investors from exiting a Mutual Fund. Usually the funds charge in between 0.5% - 3% depending on the holding period. If the investors hold on to the investment beyond the prescribed period, EXIT load is not levied.

E.g. A fund charges 1% exit load for redemption within one year. If one redeems an investment valued at Rs. 10,00,000/- in less than one year, he would be charged with an exit load of Rs 10,000. Hence, frequent shuffling of portfolio must be avoided in mutual funds to reduce exit load expenses.

In addition to above there are some hidden costs which are not visible in the expense ratio that impact the returns that we earn in Mutual Funds. You need to Avoid Mutual Funds with Hidden Costs

What does the high cost of a Mutual Fund tell us?

First that we must prefer Direct Plans over Regular Plans. However since its launch in 2012 Direct plans are still only 12.5% of the total MF sold. So while it’s catching on, why do Regular Plans still thrive. One reason is lack of awareness of direct plans. It is also the lack of appreciation of the cost over the entire investing life even though it looks a mere 1% more.

But it is probably also because people need help in taking investment decisions even in Mutual Funds. That’s understandable because it not very simple. MF ads mention ‘you should consult your Financial Adviser if in doubt; they actually mean a fiduciary, zero-conflict of interest adviser not their distributors. But the numbers of independent investment adviser in India is very low and hence the popularity of Regular plans. But even an Independent adviser will cost money over and above the cost of a Direct Plan.

What are your options given that investing comes at a cost?

Yes, MFs are an expensive way to invest your money. The alternative is low cost Index funds. Currently the MF industry justifies its fees by showing that it earns higher returns than their benchmark index. That is to say that despite higher costs, these MFs are deliver better returns and hence you are better off investing in MFs. This seems like a sound argument; except that when the fund manager has to deliver higher returns, does he take higher risk than the index fund portfolio.

So now if all this is confusing and seems to be going around in circles, its fine because investing in Mutual Fund is not as simple as it is made out to be. And they don’t substitute your need to know enough about investing and that you need an independent investment adviser. Mutual Fund costs are substantial and you need to confirm whether you are getting your money’s worth. And just looking at past returns is grossly inadequate. It neither guarantees future returns nor inform you about the risks the fund manager is taking. And most of all it does not tell you whether a particular fund is adding value to your portfolio. However the expense ratio should remind you the high cost is dead certain.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: