Dear Readers,

Why are we writing this note to you?

The past few days you must have got bombarded by news of geopolitical events like wars, rate hikes, quantitative easing and tapering, cryptocurrencies going bust at the wink of an eye, and a host of other things. This combined with daily portfolio tracking and seeing your portfolio slip a few % on some days may be causing anxiety.

We all understand the concepts of asset allocation, volatility, handling emotional biases intellectually but that does not diminish the challenges in real-life investing. This note is to help you respond sensibly to the current situation and certainly avoid any hasty actions.

How should you view the current situation?

Currently, markets globally are in the grip of 4 forces that are causing markets to correct- Geopolitical tensions between Russia and Ukraine, Fed interest rate hikes, higher inflation, and rising crude oil prices.

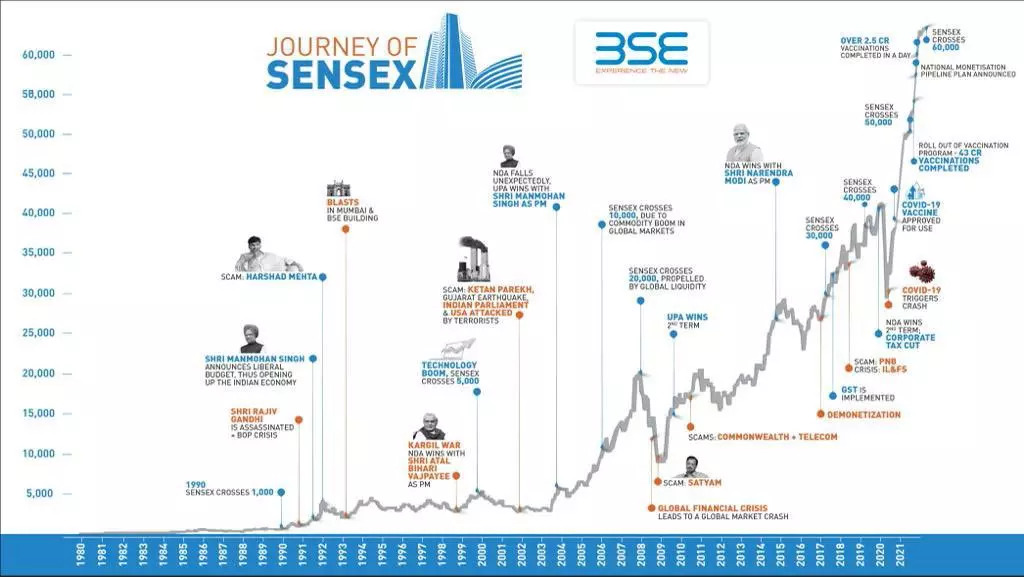

Just to give you a perspective, in the last 30 years multiple such events, wars, incidents, crashes, and boom, bubble bursts, assassinations have caused panic among investors leading them to trim/exit in the worst times instead of staying invested at the right level of allocation to equity.

Image Source: BSE, ET Markets

In spite of these events and market corrections, markets have maintained their long-term upward trajectory.

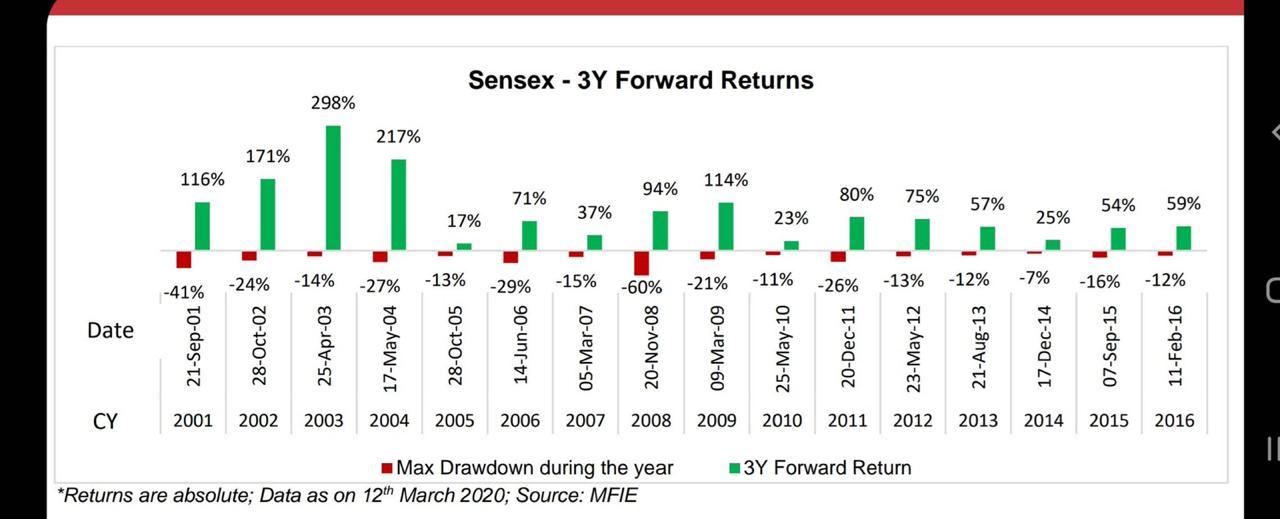

Let’s have a look at some data on how markets responded to corrections in the past.

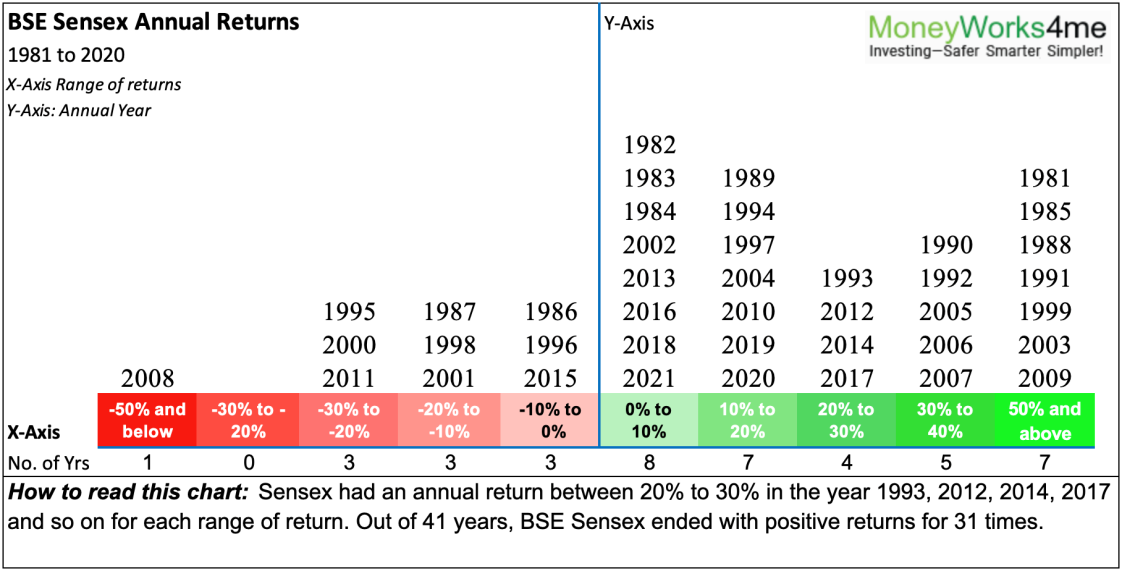

Historically, markets have recovered sharply and given multi-fold returns in the next three years following a market correction. So it makes make more sense to stay invested, keep an eye on asset allocation rather than buying or exiting in a panic since markets have stayed positive 3 out of 4 times in the last 41 years as shown below.

The above data is the reason we recommend not to disturb the equity portion in your asset allocation. Changing your asset allocation frequently will only reduce long-term returns or missing out on the target corpus.

What can help us sail through a myriad of emotions that we experience in volatile markets?

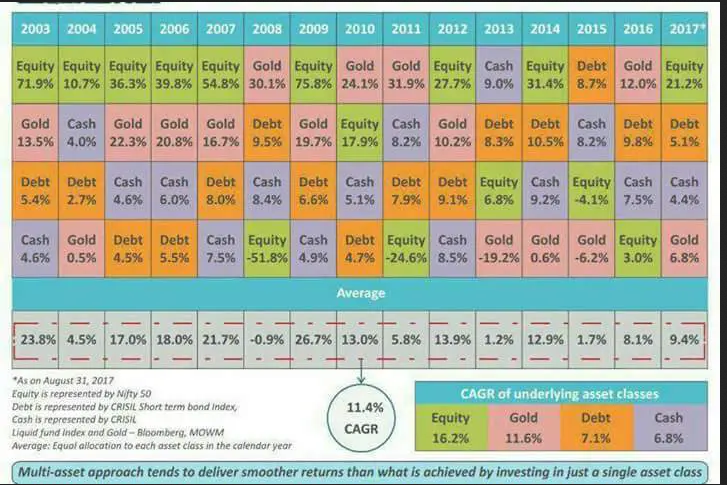

Maintaining your Asset Allocation can go a long way in rendering you a peaceful investing experience and not letting your emotional reflexes take the driver’s seat. Take a look at the table below:

Image Source: Livemint

Diversifying your investment portfolio in less correlated assets protects your portfolio from extreme movements in one asset class, most often equities. Largely, debt funds and gold have proven to be good assets for diversification due to their low to negative correlation with equity most of the time.

Blog on Gold Investing.

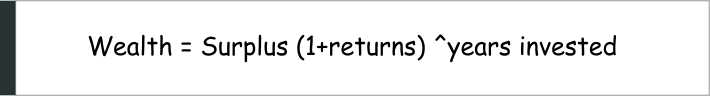

Our Omega Multi-Asset Portfolio Advisory solution was built exactly to achieve the purpose of this blog. Lastly, abide by the wealth-building formula.

- Ensure you stay invested with the surplus that you have earmarked for long-term investing. Do not sell our recommended stocks in panic unless advised. These times are best spent staying invested.

- Avoid expecting extreme outcomes from your investments. Most disappointments happen when extreme expectations are set. Check this blog by our Founder, Raymond Moses on expectations. Don’t chase very high returns and be tempted to achieve it by buying more when the market is falling and you are seeing lower prices. Remember, when seen from the recent highs, some prices will seem attractive, but they may not be when seen from their intrinsic value. When that happens we will guide you to invest in the best stocks.

- The exponential figure is the number of years that you stay invested, and that’s what the game-changer is. Stay invested as long as it is required to meet your pre-set goals.

Key Takeaways :

- Crisis, wars, tensions have been common in history and will keep on occurring in the world and that’s how things are. The world has emerged even stronger after such crises every single time and will continue to do so even in the future. That’s just the law of nature.

- As investors, we should be responding to these events in a rational manner by focusing on our long-term wealth creation journey and cut yourself away from the short-term noise.

- Use the MoneyWorks4me Financial Planning tool to prepare a simple yet comprehensive financial plan for your goals.

- Deploy the right surplus; expect the right returns and stay invested for as long it requires to achieve your goals. This is the Wealth Building Formula.

- Build a diversified multi-cap portfolio of high-quality companies acquired at reasonable prices. Check our Superstars Multi-cap solution for making informed investment decisions.

- Asset Allocation is your key to a peaceful investing experience. Collaborate with our Omega Portfolio Advisory for a one-stop solution to address all your investing needs.

Check our next blog on "what are the right actions that you should take now".

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: