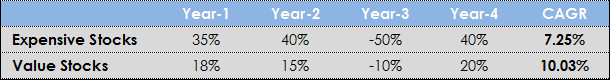

Value Investing delivers consistent returns!

Let's understand the magic of Value Investing. In the short term, valuation probably may not hold true because markets are driven more by sentiments. Cheap stocks may get cheaper, and expensive stocks may get more expensive. But, it has been observed that over a long period of time, there is a higher chance of making good and consistent returns, if you hold a portfolio of cheaper stocks i.e. stocks which in the lowest quartile of their valuations.

Why?

- Expensive stocks tend to have good news and growth expectations attached to it. Analysts and investors tend to extrapolate good news longer into the future. Similarly, bad news is extrapolated for cheaper stocks. This behavior leads to an overreaction at both the extremes. In reality, expensive stocks disappoint, as good news can’t go on forever; while cheaper stocks throw positive surprises, as reverse to the mean eventually happens. This leads to higher returns from holding a basket of cheaper stocks.

- A portfolio of cheaper stocks restricts the downside, as the bad news is already factored in. While the portfolio may go down along with the market in short-term, but over long-term, the chances of losing a lot of money are less. This leads to lower loss of capital.

- Since stocks are cheaper relative to cash flows, a pool of cheaper stocks generally has higher dividend yield, which improves the returns even in a flat market. Since, expensive stocks are likely to be growing fast, they retain all the cash flows for growing the business and also, since they are trading at high multiples to cash flows, dividend yield happens to be lower.

- The portfolio of expensive stocks experiences more volatility due to change in investor sentiment and PE multiples. Investments in the expensive stocks are done based on ‘hope’ and investors often overpay for the growth. The portfolio is likely to correct from time to time, if the forecast don’t pan out. Moreover, an average investor is likely to sell out such a portfolio as s/he is unable to handle the volatility. Absolute cheapness and high dividend yield leads to lower downside for a portfolio of cheaper stocks. Corrections are unlikely to be very steep as the stocks that qualify to be cheap have already fallen from their peaks. So, volatility could be low, and it doesn’t scare away investors.

There’s no denying the fact that following the tenets of value investing could (a) Boring, (b) Miss multi-baggers and (c) Often lag behind in bull market. However, value investing delivers consistent returns as opposed to low probability event of overnight richness.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: