As investors, we are always on the lookout for opportunities in high-growth businesses that deliver superior return on equity (ROE), require lower capital expenditure (capex), and provide high dividends. In a previous blog, we explored such a business in the Asset Management Company (AMC) sector. Today, we will delve into another promising sector: wealth management. The wealth management industry encompasses a wide range of financial services tailored to affluent individuals and families. These services include investment management, financial planning, tax planning, estate planning, and more. The primary goal of wealth management is to help clients achieve their financial objectives, preserve their wealth, and ensure its smooth transfer to future generations.

Wealth Management Services Overview:

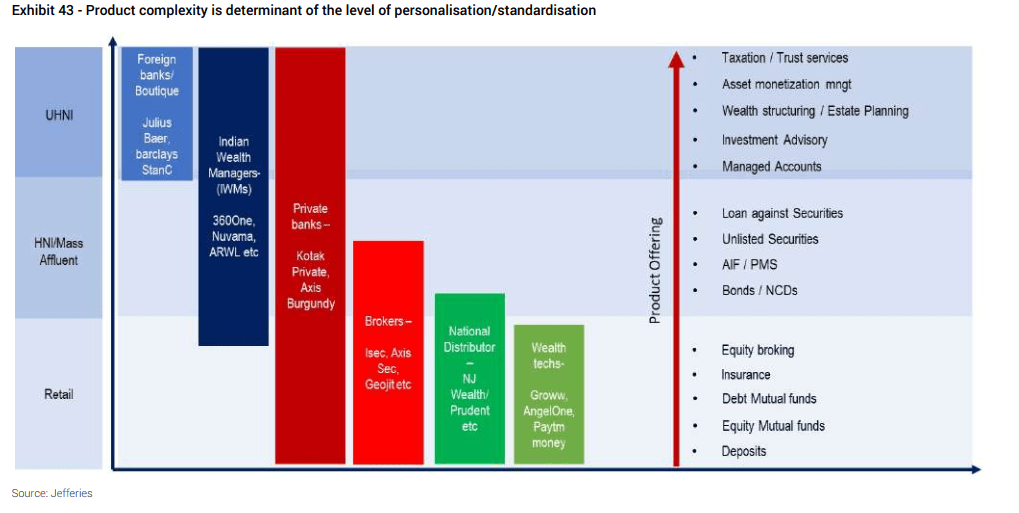

Wealth management is a fragmented industry with various categories of players catering to different customer segments. As one ascends the wealth ladder, the demand for personalized services (as opposed to standard products) increases significantly. Consequently, the complexity of products is highest for the Ultra High Net Worth Individual (UHNI) segment, which also has the greatest need for professional wealth management. At this level, the wealth management model shifts from a platform-based approach to a relationship-driven one.

Different Players in Wealth Management:

- Private Banks: Offer wealth management services exclusively to high-net-worth individuals with personalized services. E.g Kotak is the market leader, dominating in the UHNI segment with 'Kotak Private' and Axis Bank with its 'Burgundy' vertical.

- Independent Wealth Management Firms: Provide unbiased financial advice and services, often partnering with various institutions.

- Brokerage Firms: Focus on investment advisory and transaction services as part of their broader brokerage services. E.g. Motilal Ostwal, Angel One, ICICI Securities

- Family Offices: Manage the financial affairs of ultra-high-net-worth families, offering highly personalized services.

- Robo-Advisors: Digital platforms providing automated financial planning services, catering to a broader audience. E.g ET Money

Revenue Model of Wealth Management Firm

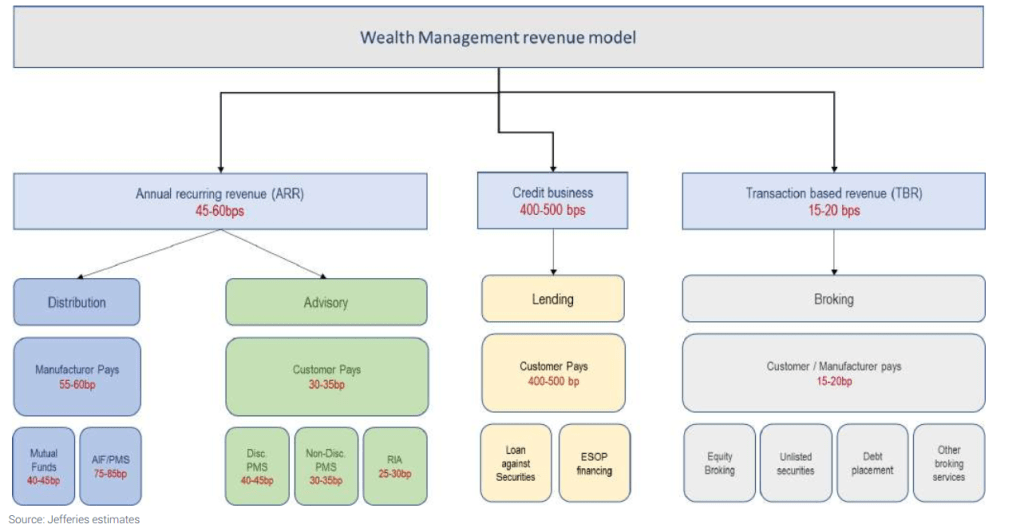

- Trail fees / ARR model (45-60 bps of AUM)

- Advisory: In the Advisory model, wealth managers provide clients with portfolio management and advisory services, assisting them in designing and managing investment portfolios (with or without the client’s discretion). In the Registered Investment Advisor (RIA) model, wealth managers solely act as advisors without managing the investments directly.

- Distribution: Some clients prefer a relationship based on distribution, where the wealth manager's role is limited to execution and sales. In this model, the manufacturer pays trial fees to the wealth managers. Due to regulatory requirements mandating a clear definition of the relationship between the client and the advisor/distributor, wealth managers assign separate client codes to those opting for either advisory or distribution services.

- Credit business (400-500 bps of AUM) Loan against securities business helps deepen customer relationships and for well-rated WMs, it also yields strong net interest margins.

- TBR model (15-20 bps of AUM) Transaction-based revenues are driven by broking revenues, spreads on illiquid debt, spreads on unlisted equities, etc. WMs also purchase/warehouse securities and distribute them amongst clients. WMs also do NCD syndication wherein manufacturers pay advisory charges to WMs and these also come under TBR.

Growth Opportunities in Wealth Management

In 2024, India emerged as one of the world's fastest-growing economies, presenting a compelling narrative of increasing financialization on a global scale. According to industry data, the wealth management industry in India is set for significant expansion, with the addressable market projected to grow at an annual rate of 13-14% over the next five years. Key drivers of this growth include urbanization, rising incomes, the "premiumization" of consumption, increasing female labor force participation, the adoption of transformative digital technologies, and enhanced mobility of wealth. Moreover, the accelerated creation of wealth beyond traditional hubs in recent decades, combined with overall low market penetration, is expected to further boost the demand for wealth management services in the country.

Major Listed Players in Wealth Management Space:

360 One WAM (IIFL Wealth)

360 One WAM is one of India's leading private wealth management firms, with consolidated AUM reaching Rs. 465,000 Cr as of FY24, up from Rs. 3,40,835 Cr as of FY23, and Rs. 3,27,237 crore as of FY22. The company operates in 15 states within India and has an international presence in five countries, supported by a workforce of 1,074 employees as of FY23. 360 One WAM caters to the specialized and sophisticated needs of over 6,800 high net-worth individuals (HNIs), ultra-high-net-worth individuals (UHNIs), family offices, and institutional clients, offering a comprehensive range of tailored wealth and asset management solutions.

Nuvama Wealth Management:

NWML operates in three business segments: Wealth Management (UHNI and Affluent/HNI), Asset Management, and Capital Markets (Institutional Equities, Investment Banking, and Asset Services). It is the second-largest independent wealth management player, with client assets totaling Rs. 3,45,957 crore as of March 31, 2024. The wealth segment saw net new money of Rs. 13,453 crore, while the Asset Management segment attracted Rs. 1,233 crore. Despite being relatively nascent, the Asset Management business had an AUM of Rs. 6,967 crore as of March 31, 2024. NWML has a subsidiary, Nuvama Wealth Finance Limited (NWFL) (formerly Edelweiss Finance & Investments Limited), a registered non-banking finance company (NBFC) that provides loans against securities and ESOP funding to the clients of the wealth management business. As of March 31, 2024, NWFL's loan book stood at Rs. 3,061 crore. NWML employs approximately 1,200 relationship managers and team leaders as of March 31, 2024. Additionally, Nuvama Wealth and Investment Limited (NWIL) (formerly Edelweiss Broking Limited), a wholly-owned subsidiary of NWML, primarily offers wealth management solutions along with margin trade funding and ESOP funding, with a loan book of Rs. 1,802 crore as of March 2024.

Anand Rathi Wealth:

Anand Rathi Wealth Ltd was incorporated on March 22, 1995. It is an AMFI-registered mutual fund distributor and is one of the leading non-bank wealth solutions firms in India, being ranked amongst the top three non-bank mutual fund distributors in the country. The company offers a wide product portfolio of wealth solutions, financial product distribution, and technology solutions to its clients.

Potential Risks in Wealth Management

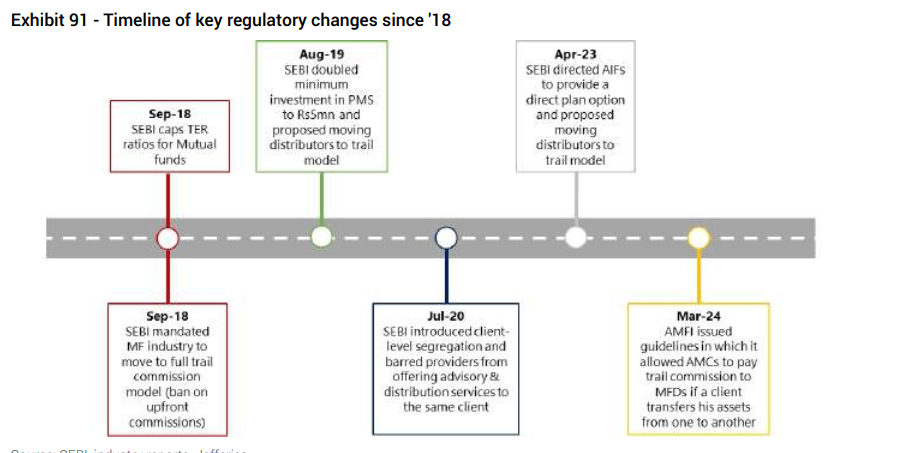

- Adverse regulations: Any additional regulatory actions aimed at reducing costs in the Mutual Fund (MF), Alternative Investment Fund (AIF), and Portfolio Management Services (PMS) segments will impact wealth managers. If SEBI introduces telescopic pricing in AIF/PMS, it could affect commissions for all players. Below are some regulations from the past decade that have impacted the sector.

- Market cyclicality: Steep market corrections impact Assets Under Management (AUM) and, consequently, fee growth. Tighter capital markets also hinder monetization events and the inflow of wealth. Therefore, the dual impact of low inflows and mark-to-market (MTM) losses leaves the business vulnerable to sharp corrections.

- Competition: Growing competition can lead to irrational pricing and reduce take rates, impacting overall sector profitability. While there is limited scope for such issues in the UHNI segment, the fast-growing HNI segment is experiencing multiple players competing for a limited share of wealth, which can result in irrational competition.

Conclusion

The wealth management sector in India presents significant growth opportunities. Indian wealth managers are well-positioned to capitalize on the country's economic expansion and the increasing financialization of savings, particularly into capital markets. India has a longstanding tradition of savings, investments, and wealth preservation, with families historically depending on trusted advisors. However, economic growth, globalization, and greater access to global financial markets have transformed the wealth management landscape.

Wealth management is an attractive business model as it requires minimal capital investment, relying instead on intellectual capital, and boasts 100% cash conversion. However, like many industries, it is cyclical. Steep market corrections can negatively impact Assets Under Management (AUM) and, consequently, fee growth.

Staying informed about industry trends and adapting to the evolving landscape are crucial for wealth management firms aiming to thrive. By doing so, they can effectively meet the diverse and changing needs of their clients, ensuring sustained success and client satisfaction.

Check out the latest update about 360 One WAM, Nuvama Wealth Management, and Anand Rathi Wealth.

...

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: