Utpal Sheth is one of India’s most prominent investors. As the CEO of Rare Enterprises, the firm founded by the late Rakesh Jhunjhunwala, Utpal Sheth has played a pivotal role in continuing the legacy of one of India's most legendary investors. With a career spanning several decades, Sheth has amassed extensive experience in various facets of finance, including investment banking, portfolio management, and strategic advisory.

Under his leadership, Rare Enterprises has thrived, leveraging Sheth's keen ability to identify undervalued stocks and make astute investment decisions. His differentiated insights and deep understanding of the Indian equity market have earned him a reputation as a thought leader in the industry. Sheth's investment philosophy, termed as ‘Gorilla Investing’, often revolves around a long-term perspective, focusing on fundamental analysis and value investing.

His speech called ‘Unlock Value Chain of Long-Term Investing’ at an event hosted by Samco Securities has provided excellent insights into the nature of long-term investing, which forms the basis of this article.

This blog is divided into two parts. Part 1 explains the process of long term investing and the drivers that accompany each step, while Part 2 highlights the foundational requirement for long term investing and the structural enablers that aid the process.

Let’s dive into Part One.

Long-Term Investing

In investing, having an insight is extremely important. While having an insight is necessary, it is not sufficient to generate outsized returns in the market. There are various other characteristics that separate a successful investor from the rest of the crowd.

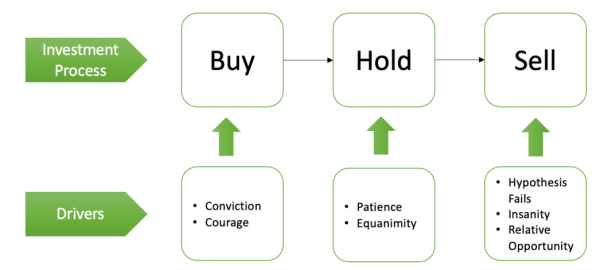

The Investment Process

Investing is a 3-step process. An investor must buy a security, hold it for a certain period of time before eventually selling it. However, each step in this journey has multiple elements.

Buying

A good time to buy a stock is when it is undervalued, which is only possible when the aggregate market disagrees with your view. As a result, it may often seem like the wrong time to buy the stock, or it may seem like there are better alternatives. In such situations, buying requires both conviction and courage. With courage and without conviction, an investor may build a position without understanding the investment. With conviction and without courage, an investor may, at best, build a smaller than desirable position in the investment. A good buying decision therefore requires both courage and conviction.

Holding

Holding shares for long periods is simple in theory, but difficult to execute. Extended holding periods subject the investor and investment to multiple periods of underperformance and losses. When investors are controlled by changes in the market and stock prices, as markets continue to remain unpredictable and uncertain, they will suffer. In such situations, only investors with equanimity will be able to hold on to their positions successfully. Additionally, an investor must be patient enough to wait for the thesis to play out. Selling before one is required to may lead to substantial profits, but not to the actual extent possible. Therefore, successfully holding onto investments for the required duration requires patience and equanimity.

Selling

Successful selling implies successful buying and holding; however, this may not always be the case. In cases where the buying decision was wrong, or when the hypothesis fails, selling immediately is the best solution, irrespective of gains or losses. When a hypothesis fails, the investor does not understand the reason for price movement, one way or another, which adds stress. In situations when the buying decision was correct, there are two reasons to sell a stock. The first case is market insanity. Sometimes, the markets may bid up the price of a stock to irrational levels which cannot be supported by the fundamentals. This is different from merely high valuations, which may still be attributed to the quality of the underlying business. When the prices reach levels that are not grounded in reality, one should sell the stock. In the second case, when the market presents better opportunities for investors relative to their portfolios, it may still be a wise decision to sell a current holding to buy a stock presenting better long-term opportunities for wealth creation.

To continue exploring this topic and dive deeper into our insights, don’t miss out on Part 2 of our blog series. Click here to access it now!

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: