This article covers the following:

1. India's Wood Panel Industry

- Plywood Market in India

- MDF Market in India

- Particle Board Market in India

2. Raw Material

- Plywood

- MDF

- Laminate

3. Industry Players

- Century Plyboards

- Greenpanel Industries

- Greenlam Industries

- Greenply Industries

- Stylam Industries

4. MoneyWorks4Me Opinion

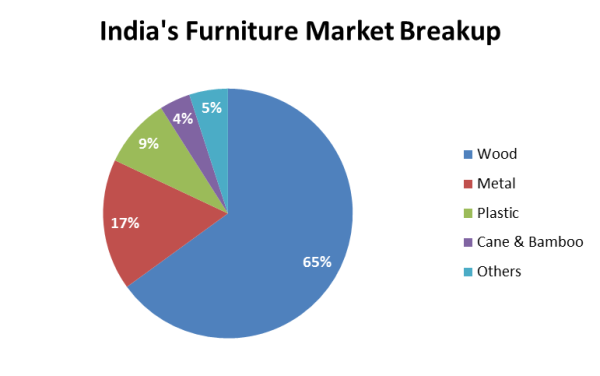

The Indian furniture market experienced a modest compound annual growth rate (CAGR) of only 3% from FY14 to FY19, primarily attributed to a sluggish real estate cycle. However, there is an anticipated acceleration in growth ahead. The wood panel industry's current size in India stands at ~Rs. 46,000 crore and is projected to exhibit a CAGR of about 9% from 2021 to 2026. Wood occupies the largest share of ~65% in the Indian furniture market.

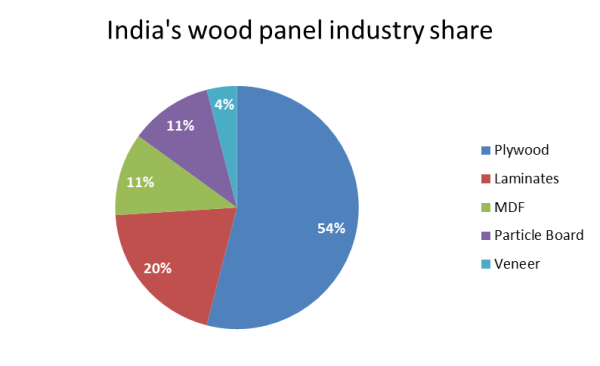

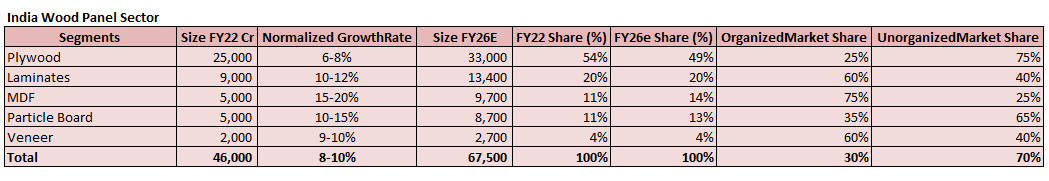

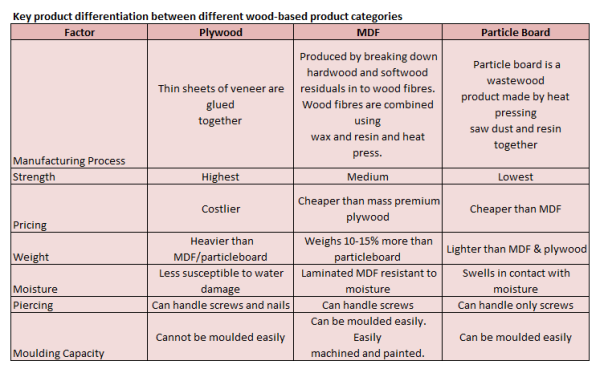

The wood-based panel market is segmented majorly by product type: Plywood, Medium-Density Fiberboard (MDF), Particleboard and decorative surface products such as Laminates & Veneers. Plywood dominates the product landscape, contributing to the largest share at around 54%, amounting to Rs. 25,000 crores, followed by laminates (~20%, Rs. 9,000 crores), MDF (~11%, Rs. 5,000 crores), Particle board (~11%, Rs. 5,000 crores), and Veneer (~4%, Rs. 2,000 crores). India's wood panel industry remains highly fragmented and unorganized (70% market share), with low entry barriers.

Plywood Market in India

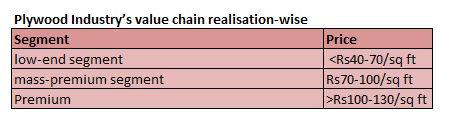

The plywood industry is categorized into premium, mid-premium, and economy segments based on the type of timber and the quality of chemicals employed. The organized segment has exhibited significantly superior growth compared to the overall industry, driven by the heightened expansion in the premium segment when compared with the medium and low-end segments.

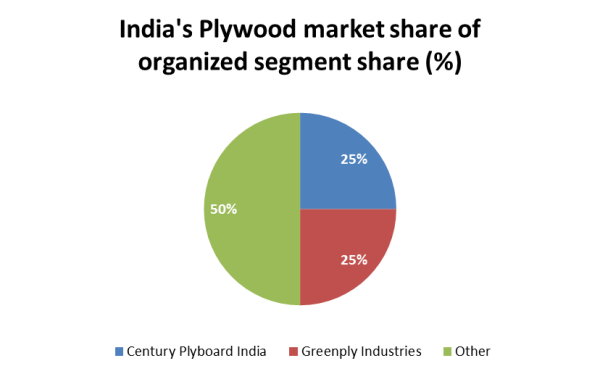

As of FY22, the Indian plywood market was valued at Rs. 25,000 crore and is projected to witness a compound annual growth rate (CAGR) of ~6-8% from 2021 to 2026, reaching Rs. 33,000 crore. The plywood industry in India is predominantly controlled by the unorganized sector, making up around 75% of the market. Among the limited organized players, Century Plyboards India Ltd and Greenply Industries Ltd stand out with a pan-India presence, collectively commanding a significant market share of ~50%.

Medium Density Fibreboard (MDF) Market in India

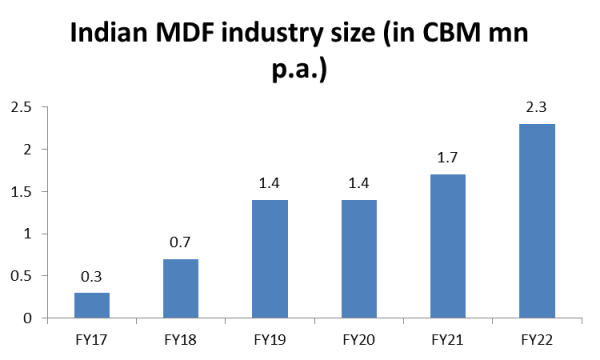

The gradual shift of India's population towards ready-made and effortlessly installable furniture, propelled by increasing disposable incomes, rapid urbanization, and the surge in online furniture purchases, has positioned Medium Density Fiberboard (MDF) as a premium alternative to low-end plywood. The adoption of MDF has expanded beyond furniture to include various non-furniture products such as shoe heel boards, toys, cabinets, gift boxes, electronic circuit boards, and blackboards/painting easels. This lead to the expansion of the industry size.

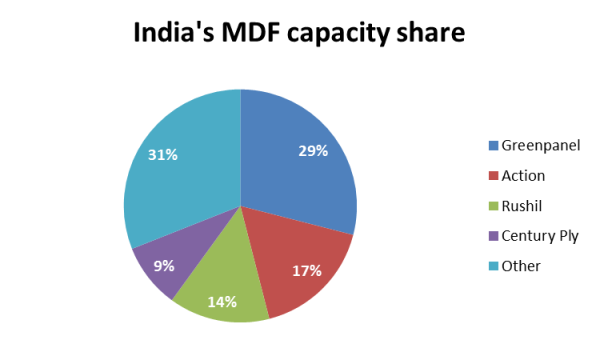

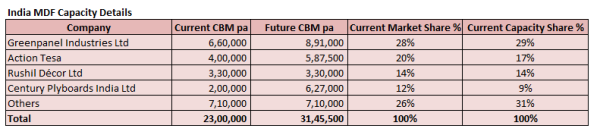

The leading four players collectively hold around 75% of the overall MDF market share and contribute to ~70% of the total capacity in India.

An increase in demand and higher margins have also attracted announcements of capacity addition from existing players like Greenpanel & Century Ply and also the entry of new players like Greenply Industries. This might create an oversupply situation which may lead to margin contraction.

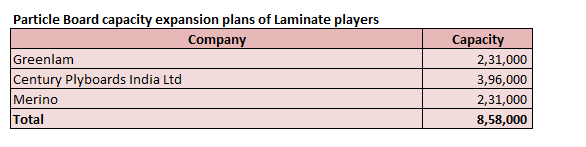

Particle Board Market in India

Particleboard, a manufactured wood product created by blending sawmill shavings, wood chips, sawdust, and synthetic resin, all sprayed with wax and adhesive, and then shaped into a mat and pressed under heat. This engineered wood variant is approximately 50%-60% more economical than traditional plywood and about 20%-30% more budget-friendly compared to MDF. The current market size for particle board in India stands at around Rs. 5,000 crore and is projected to witness a robust CAGR of ~15% from 2021 to 2026, reaching ~Rs. 8,700 crore by FY26.

Key product differentiation between different wood-based product categories

Raw Material

Plywood:

Key raw materials required for manufacturing plywood include timber and chemicals. Plywood is manufactured by assembling thin layers of wood veneers which are bonded together using powerful adhesives.

MDF:

MDF is an engineered wood product made by breaking down hardwood or softwood residuals into wood fibres, often in a defibrator, combining it with wax and a resin binder, and forming it into panels by applying high temperature and pressure. In terms of sourcing wood, players deal with farmers growing short rotation, fast-growing plantation wood species like Eucalyptus, Populus, Acacia, etc. with an average life cycle of trees being 3?5 years.

Laminate:

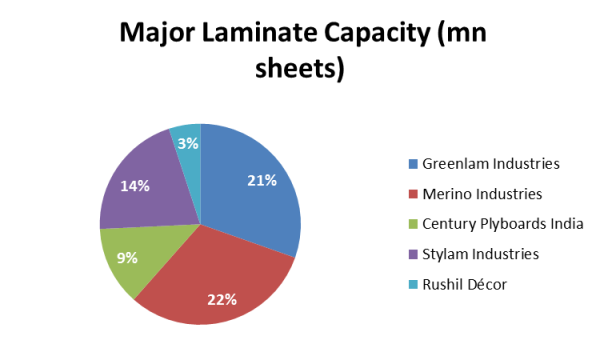

Laminates play a crucial role in elevating the aesthetic charm of decor while providing a protective layer to materials such as plywood, MDF, particle board, wooden furniture, wall panels, and flooring. They are widely employed in both residential and commercial spaces. Laminates, valued for their durability, cost-effectiveness, extended shelf life, enhanced aesthetic appeal, diverse varieties, and heightened resistance to wear and tear, moisture, and heat, are the preferred choice over paints and coatings.

Industry Players

Century Plyboards:

It stands as the sole wood panel player with a diversified presence spanning Plywood, Decorative Veneers, Laminate, MDF, Pre-laminated boards, and Particle Board segments. Within India's plywood sector, the company has secured a robust position, holding a significant market share of ~25% in the organized plywood sector as of FY22. Further expanding its influence, the company commands noteworthy market shares in organized spaces across other segments - ~17% in Laminates, 15% in MDF, and 9% in Particle Board.

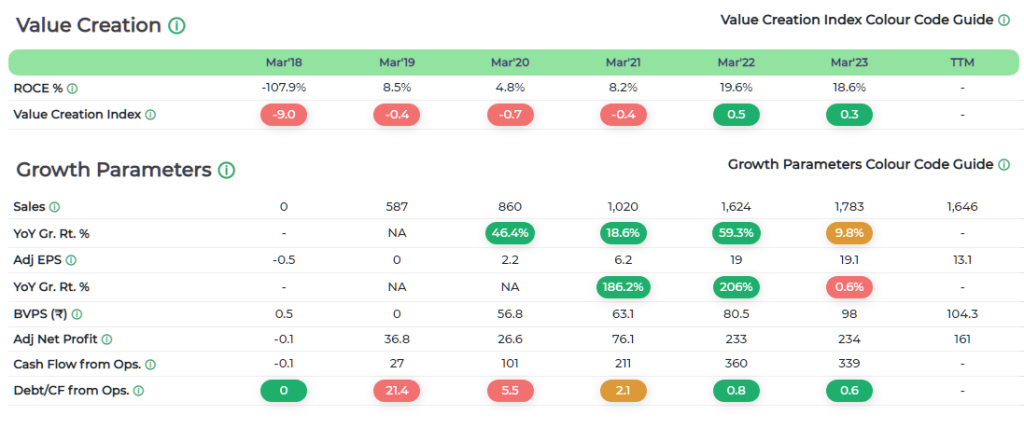

Greenpanel Industries Ltd

The company based in Kolkata (West Bengal), stands out as a prominent player in the wood panel sector, attaining national leadership in Medium Density Fiberboard (MDF). Holding the position as the largest manufacturer of MDF in India, Greenpanel commands a substantial market share, accounting for ~28% as of FY22.

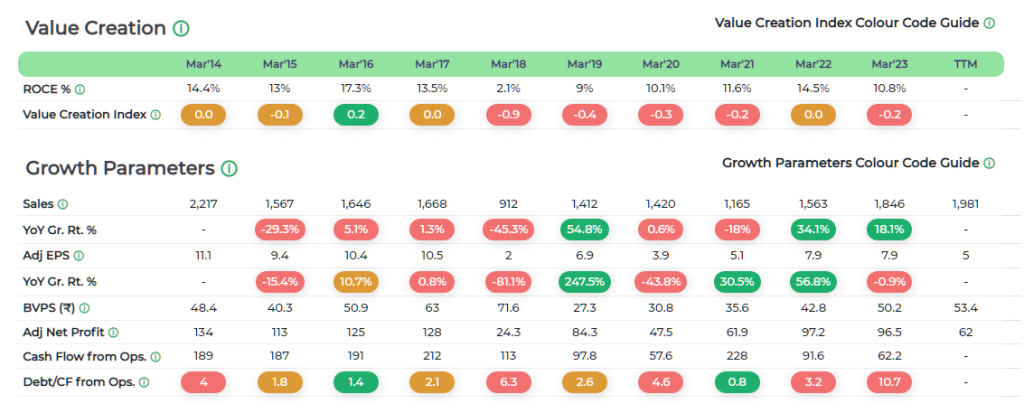

Greenlam Industries

Greenlam Industries Ltd (Greenlam) emerges as a comprehensive solution provider for surface solutions, asserting dominance in the domestic laminates market with an impressive market share of ~18%. Positioned among the top three globally, it holds the title of Asia's largest and India's foremost brand in surfacing solutions. Established in 2013, Greenlam originated following the demerger of the decorative laminate business division from Greenply Industries Ltd.

Greenply Industries

Greenply Industries Ltd (Greenply) stands as one of India's prominent plywood companies, boasting a robust presence in the organized plywood market nationwide. Established in 1990, the company is actively involved in the manufacturing and marketing of an extensive product range, encompassing plywood, block boards, decorative veneers, flush doors, and PVC products.

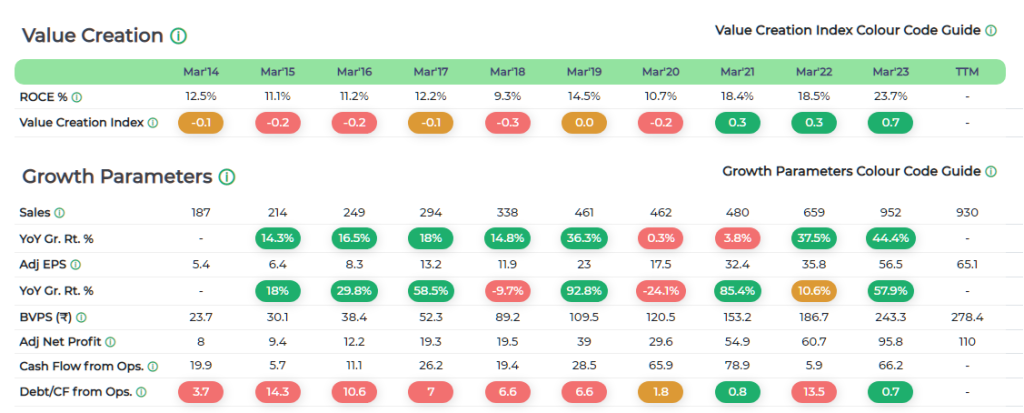

Stylam Industries Ltd

The company specializes in the production of decorative laminates, marketed under the brand name 'STYLAM,' with a significant focus on exports, primarily targeting European and South East Asian countries. Approximately two-thirds of the company's revenue is derived from exporting its products to over 65 countries.

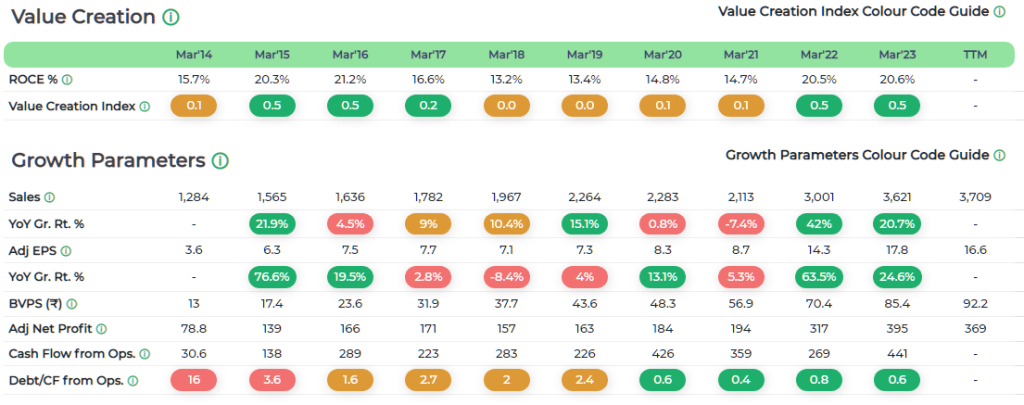

MoneyWorks4Me Opinion

The demand growth for wood panel products in India is anticipated to gain momentum in the next five years (FY21-FY26), driven by a potential revival in the real estate cycle. The demand for Medium Density Fiberboard (MDF) is particularly well-positioned for sustained growth, aligning with the shift in consumer preferences towards ready-made and easily installable furniture. However, the planned capacity expansions in the next 2-3 years may intensify competition, leading to potential pricing pressures. Additionally, rising input prices, especially for timber, are impacting margins, a factor not currently reflected in the valuation.

We recommend waiting for a more favorable entry point for a risk-reward play. Our preferences lie with Century Ply (due to its diversified presence across Plywood, Decorative, Veneers, Laminate, MDF, Pre-laminated boards, and Particle Board) and Greenpanel (holding a 28% market share in MDF).

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: