Yatra Online Limited IPO Details:

Estimated Market Cap: ~Rs. 2200 Cr

IPO Date: 15th September to 20th September

Total shares: 15.43~ Cr

Price band: Rs. 135- Rs. 142 per share

IPO Issue Size: ~ Rs. 775 Cr

Lot Size: 105 shares and multiples thereof

Purpose of Issue: Fresh Issue and Offer for Sale

About Yatra Online Limited:

Yatra Online Ltd, is India's largest corporate travel services provider in terms of the number of corporate clients and the third largest online travel company in India among key OTA players in terms of gross booking revenue and operating revenue for Fiscal Year 2023 (Source: CRISIL). The company has the largest number of hotel and accommodation tie-ups amongst key domestic OTA players, with over 2,105,600 tie-ups as of March 31, 2023.

Given the size and growth dynamics of the India travel market, the company has strategically focused both on the corporate and consumer markets. The company is the leading corporate travel service provider in India with 813 large corporate customers and over 49,800 registered SME customers, and it ranks as the third-largest consumer online travel company (OTC) in the country in terms of gross booking revenue for Fiscal 2023.

Strategy

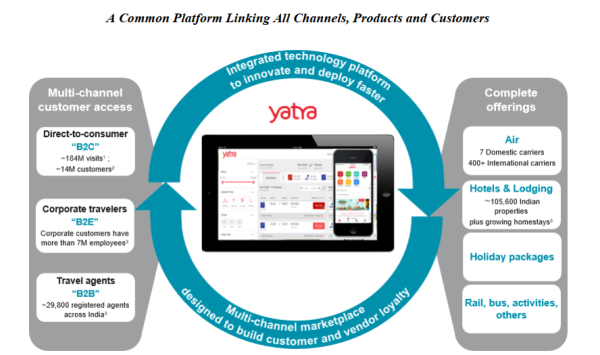

The company's go-to-market strategy spans the entire value chain of travel and hospitality, covering B2C (business to consumer) and B2B (business to business, which includes business to enterprise and business to agents). The company believes that the combination of its B2C and B2B channels enables it to target India's most frequent and high-spending travelers, namely, educated urban consumers, in a cost-effective manner.

Over 800 large corporate customers of the company employ over 7.00 million people who, along with their families, form a large part of the consuming upper middle class of India. In addition, the company's travel agent network provides additional scale to its business by leveraging its integrated technology platform in order to aggregate consumer demand from over 29,800 travel agents in above 1,000 cities across India as of March 31, 2023.

About the Industry:

In fiscal 2023, the Indian online ticketing market was estimated to be worth Rs 1,900-1,920 billion, registering 12.5-13.5% CAGR from Rs 900-920 billion in fiscal 2017. Growth can be attributed to the increasing penetration of internet and smart phones. Other enabling factors include a growing share of low-cost airlines, the increasing popularity of online railway ticket booking systems, and the convenience that online bookings offer. However, the online ticketing industry is not without its share of challenges. Travellers’ concerns about security of their personal information and online financial frauds are the key challenges that require to be addressed effectively in order to ensure a seamless transition from offline to online channels. The industry from its size in fiscal 2023 (Rs 1,900 billion - 1,920 billion) is expected to grow to 1.75 times (Rs 3,335 billion – 3,355 billion) by fiscal 2028, at a CAGR of 11.5-12.5%.

Competitors: The company faces competition for dominant players like Makemytrip & Easemytrip.

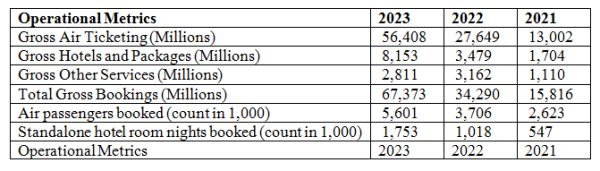

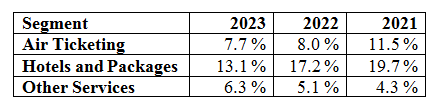

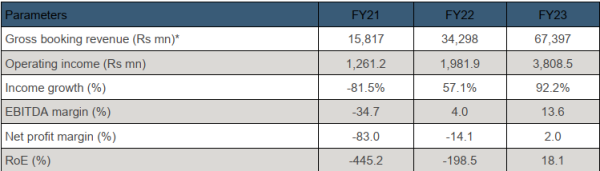

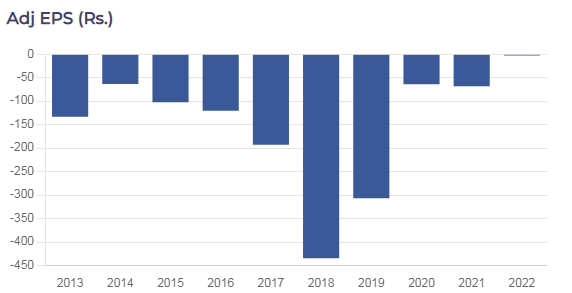

Performance: The company has significantly improved its top line with revenues tripling to Rs. 380 Cr in 2023 as against 125 Cr in 2021. This has been aided by resurgence of leisure as well as business travel post-Covid. The company has been loss making from the last several years but has jumped to profitability last year. With the growth in revenue, Adjusted Margins have seen a dip as seen below:

Revenue Breakup:

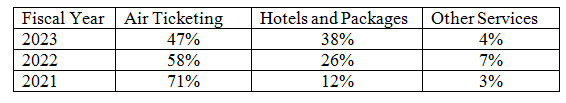

Revenue Mix:

Segment wise Margins:

Key Financial Parameters for Yatra:

Click here to check the 10-year financial X-ray.

Key Acquisitions:

In February 2019, the Company completed the acquisition of the corporate travel business of Travel.co.in Private Limited, or “TCIL”, a Chennai-based corporate travel services provider, to strengthen its corporate travel business and its presence in South India.

In August 2017, Yatra acquired a majority stake in Yatra for Business Private Limited or “YFB”, and in July 2020, it acquired the remaining shares making it a wholly owned subsidiary. Yatra for Business (YFB) is an independent corporate travel services provider and this acquisition helped Yatra to widen its customer base in the corporate travel business.

Concerns:

- Accident related claims: The company is exposed to the claims arising from travel-related accidents or customer misconduct during their travels. Any such accidents that may be a leading cause of mortality and morbidity among tourists shall deteriorate company financials.

- Vendor concentration risk: In the Air Ticketing segment, a substantial portion of its revenue depends on just four domestic airlines: Indigo, Vistara, Air India, and another airline that recently initiated insolvency proceedings. Since most of India's air travel business is concentrated among these carriers, any adverse developments in the Indian aviation industry, particularly among these dominant airlines, could significantly impact Yatra's business.

Management Team:

Dhruv Shringi is the Whole-time Director and CEO of the Company. He is a Chartered Accountant & also holds a master’s degree in business administration from INSEAD. He was previously associated with Fords Motor Company, Arthur Anderson & Co., Ebookers.Com Plc as well as with the Internet and Mobile Association of India as its vice-chairman. He is also currently serving as the co-chairman of the FICCI tourism committee. He was also listed amongst the top 40 CEO’s in the country by Fortune.

Murlidhara Kadaba is the Non-Executive Director of the Company. He holds a bachelor’s degree in engineering from the University of Mysore as well as a postgraduate diploma in management from XLRI, Jamshedpur. Prior to joining our Company, he was associated with American Express Bank, Citibank, and Reliance Industries.

Neelam Dhawan is the Non-Executive Director of the Company. She holds a bachelor’s degree in economics as well as a master’s degree in business administration from the University of Delhi. She was previously associated with Hewlett-Packard Enterprise India Private Limited as VP, Solutions Sales, and with HP India Sales Private Limited, Hewlett-Packard India Private Limited, Microsoft Corporation (India) Private Limited as their Managing Director.

Opinion :

The travel & tourism, sector in India as well as worldwide has seen a significant revival in the last 2 years. We maintain optimism about the sector due to the growing share of digital booking as against traditional methods, rising per capita income & changing lifestyle of consumers. Yatra has an asset-light business model with a strong hold in the corporate travel segment. However, this industry is highly competitive & involves significant marketing & advertisement spends to maintain market shares. Yatra has just barely turned profitable even though these are one of the best times for the travel industry. The risk-reward preposition does not look favourable; it would be prudent to avoid this company to invest in the initial offer.

Recommendation: Avoid

Note: We do not recommend buying just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on a business model and valuation.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: