The team at MoneyWorks4Me is extremely proud of the returns we have generated for our clients over the last 10 years. Over a decade, we have significantly outperformed the benchmark index, Nifty 50, by 7.6% on an annual basis and by more than 300% on a cumulative basis. An investment of Rs. 10 lakhs invested with us for 10 years would be valued at Rs. 63.6 lakhs versus Rs. 32.8 lakhs at the end of 2023. While we have beaten the index over the decade, our record is consistent as we have beaten the index over shorter and more recent time frames as well. This has been achieved by adhering to strong processes that limit our exposure to extreme risk. While high returns on capital are commendable, our fiduciary duty to ensure return of capital has played a stronger role in motivating us.

Disclaimer: Past performance may or may not be repeated in future

It is easy to pat ourselves on the back and commend ourselves for a job well done. But the job is never done, and we need to maintain our track record if not improve it further. Our clients have, and will continue to depend on us to provide adequate returns to help them achieve their desired goals which include providing security for the family, ensuring their ability to meet expenditures, and overall, providing mental peace and reaching ‘Financial Nirvana’.

We believe that our results should never be a source of complacency, and we must always ask ourselves if we could have made more returns or reduced the risk for our investors. A thorough review of our internal records shows that we definitely could have done better for our investors on two occasions. The goal here is not to generate criticism but to generate knowledge. The more we learn, the more we can earn. The team at MoneyWorks4Me believes in transparency with clients as we believe that they are our partners in wealth creation.

These errors are errors of omission. It's when investors miss out on golden opportunities because they hesitated, got cold feet, or just didn't see the potential at the time. Maybe they let fear or uncertainty get the best of them, or they were too cautious. Whatever the reason, these missed chances can mean leaving money on the table or not diversifying their portfolio smartly. It's a reminder that staying sharp, keeping emotions in check and making savvy moves are all part of the game in investing.

Our two errors of omission include: (a) Jubilant Foodworks in 2016 and 2017, and (b) Eicher Motors in 2019.

Our return calculations include dividends.

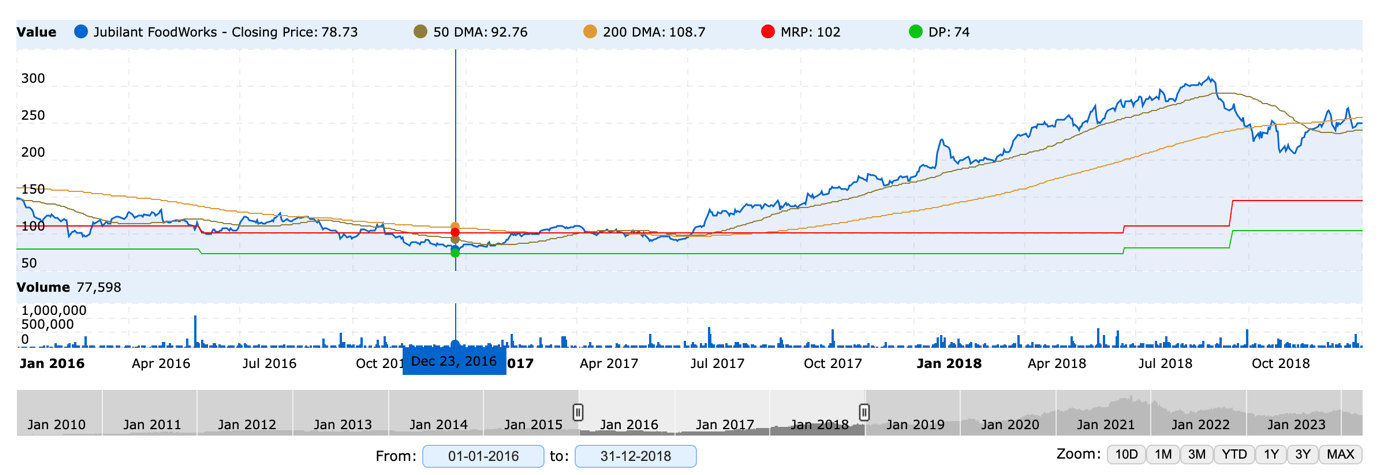

Jubilant Foodworks: Annualized Returns – 27.38%

This is undoubtedly a significant error of omission. Not only did the company’s shares trade below our Maximum Recommended Price (MRP), but they also traded extremely close to our discounted price (DP). We were afraid to recommend this company to our clients. As the share price kept falling, we forgot to ask ourselves an important question: Should the price trend have any bearing on our conviction? It shouldn’t, but it’s easier said than done. Many investors, including us, fall victim to such situations.

Luckily, due to our ceaseless need for documentation, we know where we went wrong in our analysis. This is an excerpt from our report released on 18th April 2016, titled ‘Jubilant Foodworks: Priced to perfection?’

At that time, fears were reasonable, and Jubilant Foodworks was an expensive company to own. At high valuations, it is important to be concerned about growth prospects. Our analysts were correct in their opinion. The stock fell 45% from our sell signal given in the aforementioned report.

We released another report on 22nd September 2016, titled ‘Jubilant Foodworks: -50% from its High’.

While we did revise our MRP downwards due to the bad results, the prices were significantly below our MRP. With an adequate margin of safety provided by the markets, Jubilant Foodworks should have been recommended to our clients. After all, it is the largest and most profitable QSR in the country with a strong brand recall. Such businesses are difficult to destroy, and the right management would be able to turn such a business around. Since FY17, when the company reported an all-time low PAT margin of 2.2%, the PAT margin has grown to 6.8% in FY23, representing a growth of more than three times in margins. Furthermore, the company’s peak PAT margin in FY22 was 9.5%, representing more than four times the growth in PAT margins from trough to peak.

Businesses will make mistakes that will lead to a loss of conviction, but the ability to understand whether the current situation represents any permanent damage to the moat of the business is crucial in maintaining conviction in such uncertain periods. With all the noise generated by delivery aggregators, Domino’s has maintained its competitive advantage through its own application and delivery fleet.

Eicher Motors: Annualized Returns – 23.56%

For this study, we are ignoring the low prices available in 2020 due to the impact of COVID-19, where a large number of assets were available at a discount. Additionally, we have not considered the impact of its CV business as Royal Enfield is the largest revenue driver for the company. The results referred to are standalone.

The story of Eicher Motors is a story of investing in cyclical businesses. Eicher Motors owns Royal Enfield, which is one of the most well-known motorbike brands in India. It is safe to say that Royal Enfield has achieved a ‘cult-like’ status due to its strong brand positioning in addition to the quality of its bikes. Between CY10 and FY19, Royal Enfield’s volumes grew by 40% annually, while profits grew 27 times over that period. Owning such a wonderful company would make any investor proud.

We had the chance to be an investor in Eicher Motors in 2019, when the markets started worrying about growth. Beginning in FY20, the company witnessed an event that it had not seen in the last 15 years, a drop in sales. Sales in H1FY20 were 345,819 compared to 435,463 in H1FY19, a drop of 20%. This was followed by a fall in operating margins as well as a small fall in market share. An investor’s thesis based on high growth did not hold true anymore. However, in cyclical businesses, one must remember that current growth rates, good or bad, must not be extrapolated too far into the future.

As a result, the share price corrected from a peak of about Rs. 3200 to a low of Rs. 1539, well below our MRP of Rs. 2006. We bought into the market’s thesis of a lower growth rate and lacked conviction at the prevailing market prices. However, we forgot that the market’s change in thesis also meant a price discount of more than 50%. While Eicher Motors never returned to its past growth rates, it is still growing at a considerably good rate while maintaining its stellar brand value. Its sales and EPS are at an all-time high, and ROE and ROCE are still more than 20%. With an annualized return of 23.56%, it would have been a wonderful return-generating investment.

Key Takeaways:

- Great companies rarely trade at attractive prices, and when they do, it's usually due to certain problems in the business. The market rarely offers free opportunities.

- These opportunities arise when investors who entered at higher prices or those with lower conviction exit the stock hastily, bringing prices down.

- Lower prices allow investors to lower expectations and this should provide comfort rather than adding to investors' worries.

- It is natural for great businesses to miss expectations or go through bad phases. However, it's essential to remember that great businesses can navigate through tough times successfully as long as there is no permanent damage to their competitive advantages.

- We will always make errors of omission, as we prefer them compared to errors of commission, since return of capital is more important than return on capital. Although our errors of omission may seem simple and easily avoidable, they certainly were not. Our goal is simply to use such errors to enhance our decision-making processes.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: