You must haven’t forgotten the rupee appreciation against US dollar of year 2006-07, from Rs. 45.02 in Oct’06 to Rs. 39.07 in Jan‘08; the period when the Indian stock market was on bull run and the IT industry was on bear run.

Logic says rupee appreciation shows the Indian economy is strengthening against US economy. Then, why were IT and few other industries losing their strength? As an investor, you must know the answer of how exchange rate movement affects the economy, a particular industry, and foreign investors to get benefit out of it.

As with any macro- economic indicator it is important to understand some of the important concepts in a simple manner so it is easier to apply the analysis on a particular industry or company.

What is exchange rate?

In simple words, exchange rate means how much one currency is worth in terms of another currency. If we can buy $ 1 with Rs. 46, the exchange rate of the two currencies would be $1 = Rs. 46.

There are two types of exchange rate: Fixed and Floating. Some countries have fixed exchange rate systems while some have floating. As the name suggests, the fixed exchange rate doesn’t fluctuate because of government intervention. The floating exchange rate on the other hand keeps on changing continuously just like the stock market. Thus the government intervention is almost negligible. So, which type of exchange rate system does India have? In India, we have a Managed Floating Exchange Rate System. This means that the Indian government intervenes only if the exchange rate seems to go out of hand by increasing or reducing the money supply as the situation demands.

Let’s first see two very commonly used terminologies: Rupee Appreciation & Rupee Depreciation (instead of using the word ‘currency’ we are using ‘rupee’ for the Indian context and explain the fluctuation with respect to dollar). When rupee is said to be appreciating it means that our currency is gaining strength and its value is increasing with respect to dollar. However, when rupee depreciates it means our currency is getting weaker & its value is falling with respect to dollar. You can understand it with the following example:

Suppose, currently, the exchange rate is Rs. 45 = $1,

10 months later, either of the following two cases can happen

Case1: The exchange rate is say Rs. 40 = $1. This means rupee has appreciated or gotten stronger by approx 11% and you would be paying less to for a dollar

Case2: The exchange rate is at Rs. 50 = $1. This means rupee has depreciated or gotten weaker by approx 11% and you end up paying more for a dollar.

Why does the rupee appreciate or depreciate?

Rupee’s appreciation or depreciation against the dollar depends on the change in demand and supply for both the currencies. If the demand for rupee is comparatively high, rupee appreciates; if low, it depreciates. The important question here is ‘what factors drive the demand for a currency?’ They are:

- Interest Rate: A demand for a currency is hugely dependent on the interest rate differential between two countries. A country like India where int. rate is around 7-8% experiences greater capital inflow as investors get better return than what they might get in US. (with Interest rates of 2-3%). This results into rupee appreciation.

- Inflation Rate: The demand for a country’s goods & services by the foreign buyers would be more if the inflation rate is lower in that country compared to other countries. Higher demand for goods & services would mean higher demand for that currency resulting in the appreciation of that currency. For instance if India’s inflation rate is lower than that of Zimbabwe then the demand for our goods, services and currency would be higher than that for Zimbabwe’s.

- Export-Import: If a country is exporting more than its imports from other countries, then this would mean higher demand for that currency, causing appreciation of that currency against others.

- Trading in currencies in the Forex market: The exchange rate fluctuates minute by minute because of speculative trading in the Forex market.

Though trading in Forex market causes fluctuations in the exchange rate, over a period the change is backed by the fundamental factors like the growth potential in the economy, interest rate differential and the inflation rate existing in different countries.

In a manage floating exchange rate system like India the government purchases rupee in exchange for the foreign currency to increase money supply in the economy which leads to depreciation of the home currency. Conversely, it purchases foreign currency in exchange for rupee to reduce the money supply in the economy leading to appreciation of the home currency.

Impact of Rupee appreciation/depreciation

Impact on economy: Exchange rate fluctuation has a significant impact on the overall economy of a country. Rupee appreciation against US dollar is an indication of the strengthening of Indian economy with respect to US economy.

Impact on foreign investors: If a foreign investor invests in Indian stock market and even if its value doesn’t change in 1 year, he’ll earn profit if rupee appreciates and make a loss if it depreciates. You can understand this with an example:

Suppose an FII Invests Re. 1 Cr. in the Indian stock market and at an exchange rate of $1 = Rs. 50. So, the amount invested is $200,000.

Suppose, after 1 year, even if the value of investment doesn’t appreciate the foreign investor can earn a profit if the exchange rate has changed to $1 = Rs. 40 (Rupee appreciation)

If the investor sells his investment and converts the currency, he would get $ 250,000. So, he would earn $ 50,000 as a profit thanks to a change in the exchange rate i.e. rupee appreciation

So, a continuously appreciating rupee would lead to greater investment by the FIIs.

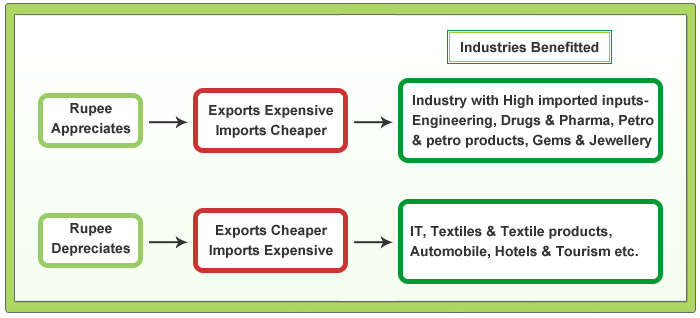

Impact on industry/companies: Appreciation of the rupee makes imports cheaper and exports expensive. So, it can spell good news for companies who rely on import of goods like heavy machinery, technology, micro chips etc. According to reports by Associated Chambers of Commerce and Industry of India (ASSOCHAM) sectors like Petro & Petro Products, Drugs & Pharma and Engineering Goods which have import inputs of as much as 77%, 19% and 21% respectively would stand to gain the most if rupee appreciates. They would have to pay less for the imported raw materials which would increase their profit margins.

Similarly, a depreciating rupee makes exports cheaper and imports expensive. So, it is welcome news for sectors like IT, Textiles, Hotel & Tourism etc. which generates revenue mainly from exporting their products or services. Rupee depreciation makes Indian goods & services cheaper for the foreign buyers thus leading to increase in demand and higher revenue generation. The foreign tourist would find it cheaper to come to India thus increasing the business of hotel, tours & travel companies.

A Small Case Study – Exchange Rate Appreciation & its impact on IT Sector

Indian IT sector is dependent on foreign clients, especially US, for more than 70% of its revenue. When an IT company gets a project from a client it pre-decides on the length of the contract and the cost of the project. The contracts with US clients are usually quoted in dollars term. So, the fluctuation in the exchange rate can bring a considerable difference in the performance of a company.

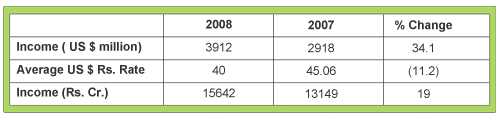

Take the example of Infosys results between 2007 and 2008 to understand the impact that the fluctuation in exchange rate can have on the performance of a company. The income of Infosys, in 2008, increased by 34.1% to $ 3912 million but because of rupee appreciation of 11.2%, from Rs. 45.06 to Rs. 40, in rupee terms, its income increased only by 19%.

“Every 1% movement in the Rupee against the US Dollar has an impact of approximately 50 basis points on operating margins” – Infosys Annual Report

However the IT sector does not just sit idle and let exchange rate play the spoil sport. It undertakes various measures like hedging exchange risks using forward and future contracts. This helps them in mitigating some of the loss due to exchange rate fluctuation but none the less the impact is substantial.

Exchange rate is thus an important tool that can be used to analyze many key industries like IT, Textiles etc. Fluctuating exchange rate has a significant impact on the economy, industries, companies, foreign investors etc. Rupee appreciation is beneficial for industries which rely heavily on imported inputs while depreciation of rupee is good news for industries which are exporting majority of their production.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: