Quality First – if you live by this principle, then investing in Blue-chip stocks will come naturally to you. Some of the most successful investors in the stock market have amassed huge wealth by investing in quality stocks and then holding on to those investments. However, the temptations in the market are great, and even seasoned investors keep wondering what they are missing out on.

If you really want your investments to enable you to reach your financial goals and create wealth, you need to master the art of investing in blue-chip, quality large-cap stocks and allocate a portion of your portfolio towards this.

It’s understandable if you are excited by the bull market and the rapid price rise in some of the other stocks. By all means, invest in them and see if it works for you. After all, in investing unlike life, you need not think ‘either-or’. Maybe some other style of investing will work for you, but investing in quality large-cap, blue-chip stocks will definitely work wonders for you, albeit it may take some time before you can see it.

In this piece, we will help you do just that.

Blue-chip stocks

Let’s start by broadly defining what blue-chip stocks are and how you can identify them. Although the term ‘blue-chip’ originated in 1920, even a century later, it’s still used commonly by investors while refer to high-quality stocks. Blue-chip stocks are offered by companies that are financially stable, established, and have a reputation for reliability. These companies have a solid track record of sustainable performance and a business model that has endured previous market upheavals and can continue to do so in the future. They are usually market leaders in their respective industries, and their consistent profitable growth leads to a market cap that puts them in the large-cap league. Think Nestle, TCS, HDFC, Asian Paints, Infosys, etc.

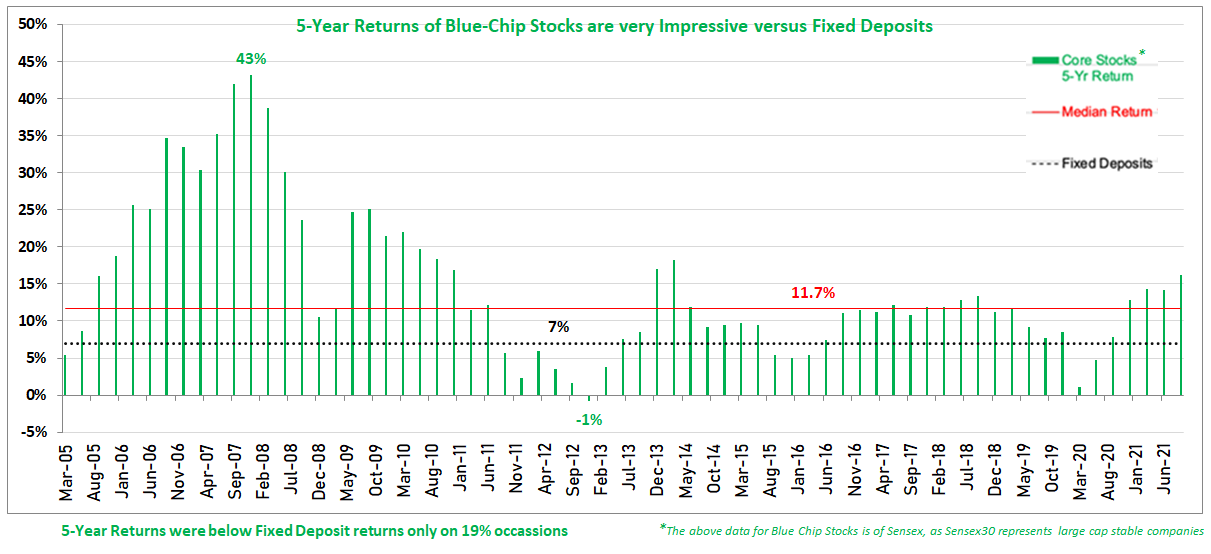

As you can see in the above chart, the returns of these companies were pretty stable and sustainable. The returns delivered by them have been more than the Fixed Deposit returns 81% of the time in the last 16 years.

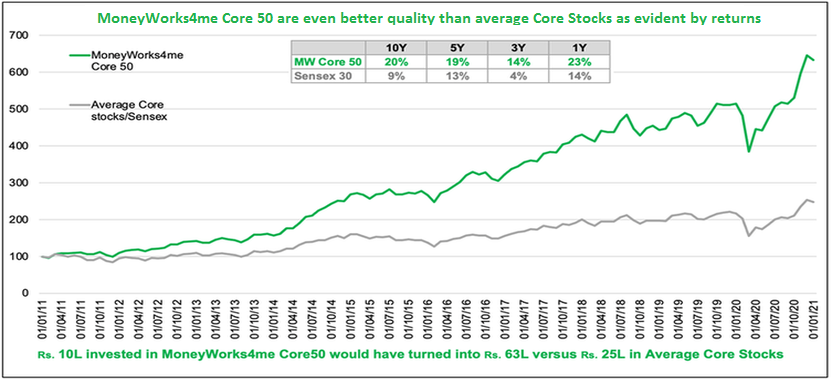

Core stocks are a selective set of stocks from the large-cap space. The below chart shows the returns of MoneyWorks4me Core stocks versus the average large-cap companies.

In terms of growth in valuation, blue-chip stocks being larger companies grow slowly compared to smaller companies but they grow consistently and profitably. They provide inflation-beating returns, even in the most dynamic and turbulent market conditions, as seen in the above charts.

How to Invest in Blue-chip Stocks

Of course, if something is of high quality, it can’t be available for cheap! By the same logic, blue-chip stocks are often expensive to buy (though not as expensive as some of the recent IPO stocks). This is one of the biggest discouraging factors for investors who don’t want to park a major portion of their surplus buying shares that are expensive. The possible ‘slow’ growth of blue-chip stocks also takes the excitement out of investing, not something that active investors prefer. In contrast, this can turn into a ‘boring’ investment activity.

Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas. -Paul Samuelson

But if you can follow a process of regularly investing a portion of your surplus, say 50% in quality large-cap, blue-chip stocks, over time, you can build a robust portfolio that has stability, excitement, and high returns. Here’s how you can go about it:

Shortlist & Research:

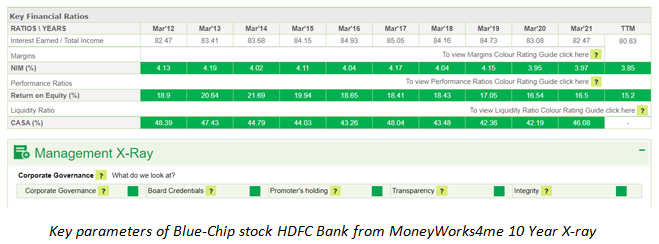

Start by creating a shortlist of companies that have been consistently strong performers in the market. You can use a stock screener tool to do the initial filtering of large companies. Key parameters that you should be focusing on while shortlisting are:

- Returns on Capital Employed (ROCE): The ROCE should be more than 15% for the past 10 years or more. This shows that the business has been performing well historically and has the ability to provide healthy returns to investors.

- Overall Financial Health: Study the net income, return on assets, operating cash flow, debt/equity ratio, and asset turnover.

- Trustworthy Management: Check if the management and promoters are trustworthy and that there are no reasons to doubt their honesty and concern for minority shareholders. Also check if the holding has decreased, if so why and whether there is any pledging of shares by the promoters. These are signs which should make you cautious and maybe even avoid investing.

Select Rightly Priced Stocks:

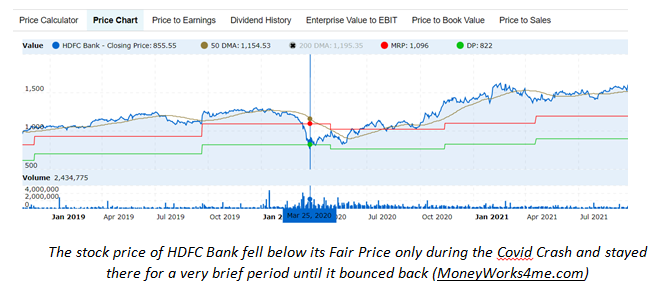

The next step is deciding at what price you can consider buying. Buying blue-chip stocks at the right price can allow you to buy more and significantly boost your returns. It doesn’t mean that you have to wait for your selected companies’ stock prices to crash before you can buy them! Essentially you need to be assured of an attractive upside or returns from the current price.

This means that the stock prices should be fair representatives of their financial performance and future growth potential. Some ratios like PE, P/BV, P/Sales, EV/EBIT, etc. are used to determine this. However, these are impacted by market prices and by current earning, sales, etc.

Equity Analysts do a valuation exercise to arrive at the fair value of the stock based on fundamentals. This involves some assumptions. However, since the performance of quality large-cap companies is fairly predictable and expected to be stable, we can get a good estimate of its fair price. Using these estimates you can assess whether the stock is rightly priced for investment.

Diversify:

Having done all the research and due diligence, you can now invest in the best blue-chip stocks that are available at the right price. Irrespective of your investment capital, you must not forget the importance of diversification. Diversified blue-chip investments will protect you from macroeconomic disturbances and reduce the risk exposure of your portfolio. One way to quickly achieve this is to invest in a Model Portfolio at least a portion of your available lumpsum and your monthly savings.

Hold-on For Long Term:

Finally, once you have invested, prepare to hold on to these stocks for the long term. Unlike mid-cap or small-cap stocks that may require some churning, blue-chip stocks are great for buy and hold. What it means is that you don’t worry about short-term price movement. An investment horizon of 7-10 years is typical for blue-chip stocks.

However, it doesn’t mean that you should just invest and forget. Keeping an eye on your investments is important, but with blue-chip stocks, the idea is to not panic during market volatility, crash or recession and ride out these movements patiently. You may also buy more when such events occur. But selling decisions should be taken with great caution.

In conclusion, to give your stock portfolio much-needed stability and a foundation for consistent returns, blue-chip stock investing is important. With thorough research and a keen eye on the stock valuation, you can invest in quality blue-chip stocks at the right time. The key is to develop a process and stick to it to effectively take control of your portfolio’s performance.

Moneyworks4me’s Core50 Superstars is an investing solution that is designed to help you do just that. Start your blue-chip investing journey on the right note with Core50 Superstars and grow your portfolio steadily.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: