Sankaran Naren is a highly respected figure in the Indian investment community, known for his expertise in value investing and his contrarian approach to the markets. He is the Executive Director and Chief Investment Officer (CIO) of ICICI Prudential Asset Management Company, one of India's leading asset management firms which manages more than Rs 7 lakh Crores as of March 2024. Naren has over three decades of experience in the financial markets and is recognized for his deep understanding of macroeconomic trends, equity research, and portfolio management.

Sankaran Naren is renowned for his contrarian approach to investing and his focus on deep-value stocks, steering clear of stocks in vogue. Throughout his career, he has built a reputation for identifying overlooked sectors and stocks well before they gain popularity. He emphasizes the importance of combining both top-down and bottom-up analysis to uncover undervalued opportunities that others might miss.

Naren is unwavering in his investment beliefs, often drawing inspiration from the principles of James Montier, a respected figure in value investing. He strongly advocates that being a successful investor requires a contrarian mindset — one that involves seeking value where others do not.

Naren also believes that value opportunities exist in every market environment, but finding these opportunities demands a different perspective from the consensus. He acknowledges that the rewards of this style of investing can take time to materialize, which can be challenging and even isolating. However, he remains committed to his approach, often taking positions in stocks or sectors that others have largely abandoned.

This article is divided into two parts: Part One is focused on core principles and approaches to investing and while Part two is focused on frameworks, cycles, and behavioural insights. Let’s dive into Part Two.

Creating Wealth across Asset Classes – The VCTS Framework

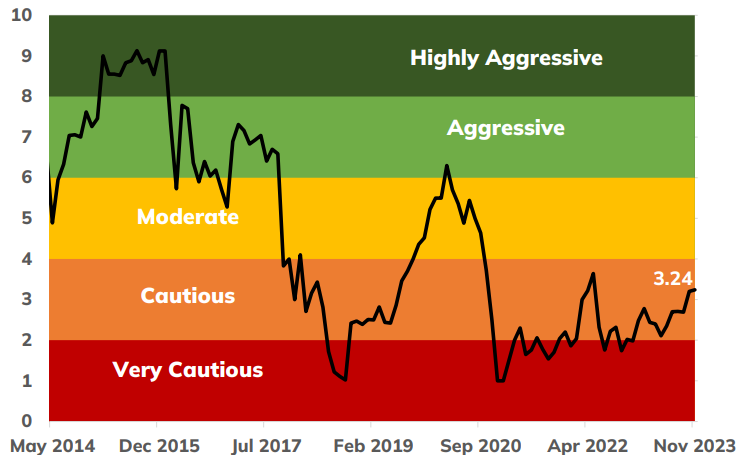

Valuations are the easiest as there is a number that one can prescribe to a business. However, understanding cycles is more important. A cycle refers to how other people are handling the asset class. In 2017, when the small and mid-cap markets were largely overvalued compared to large caps, most new funds were being created to cater to the small and mid-cap markets. The cycle tells you about how your neighbor behaves. Sentiment aids one in understanding the flow of funds to an asset class. However, finding the trigger is the most difficult. Triggers are important for a cycle to change, but they are most often found in hindsight, and one may even confuse correlation with causation. It was extremely improbable to know, with foresight, that the ILFS crisis of 2018 would lead to a slowdown in NBFCs, why mid-caps and small caps underperformed from February 1, 2018, why the real estate market peaked in 2013, or why the markets made a bottom on March 8, 2009. All that is known about these events is that the markets had moved strongly in one direction, and a change in direction was due. The trigger is largely out of one’s control, and therefore investors should focus on the other three aspects of the framework.

If valuations are cheap, people are scared of an asset class, and flows are low, an investor should buy without worrying too much about when the trigger would play out.

On Valuations

Equity

An investor should not use a single valuation method to make judgments but should use a combination of methods. A single metric can get distorted, but it is difficult to distort a larger number of metrics, thereby ensuring higher accuracy.

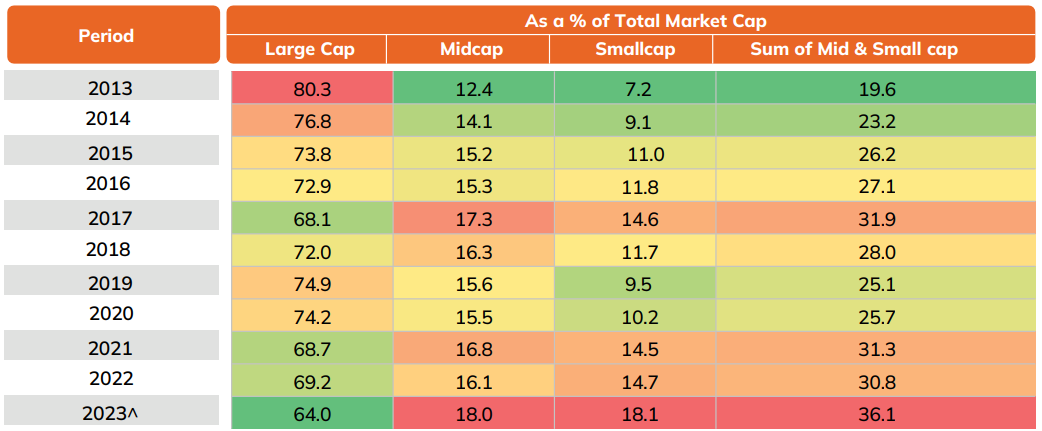

Across market capitalizations, as often seen, capital flows to and from mid-caps and small caps to large caps. To understand overvaluation and undervaluation across these pockets, S. Naren suggests segmenting companies by market capitalization and comparing the aggregate market capitalization of these categories can help one identify overvaluation and undervaluation across different capitalizations. For example, if the share of small caps is extremely small compared to historical averages, one should invest aggressively in companies in this category, and vice versa. The data is simple to collect and analyse and is extremely useful.

Credit

For credit, undervaluation and overvaluation can be gauged by the difference between the current credit spread and the historical average. The higher the current spread compared to the historical average spread, the stronger the investment opportunity, and vice versa.

Gold & Cash

Gold and cash are residual asset classes and must be treated as such. When other markets, such as equity and credit, are costly, capital should flow to gold and cash. Conversely, when all markets are cheap, one should keep no money in gold and cash.

On Cycles

Market cycles can be segmented into five stages: burst, best, boring, boom, and bubble. Bubbles are the easiest to understand. Bubbles are characterized by new non-earnings-based valuation models (the tech boom was notoriously famous for its EV to ‘Eyeballs’ model). A bubble in equity can be extremely painful for a rational investor as the markets can remain irrational for long periods of time. In the meantime, the investor would suffer from underperformance that could translate to a loss of confidence.

In booms, valuations are expensive and are characterized by large inflows of capital into the markets. In such periods, it is difficult to make money, but the risk of losing money is also lower than the risk in a bubble. A boring market is one where there is no net capital flow in any direction and valuations are not cheap. In such markets, one may not lose money or make big money, but could make some money. In the ‘Best Time to Invest,’ the markets are cheap due to a lack of buyers, and the chance to make big money is tremendous. Burst periods are the best, where the opportunity to make money is phenomenal. However, these periods are marked by extremely negative news cycles, and investing in such times requires tremendous courage.

Key Traits of an Investing Person

The ability to manage time is the most important trait of a successful investor. An investor must make time to read to be successful. Additionally, an investor needs time to think in order to make the right decision and apply his or her knowledge effectively. Most importantly, an investor must have the right temperament to make the right decisions, as the best buying and selling decisions correspond with market bottoms and peaks, respectively.

Hubris

Successful investors can suffer from hubris. Strong performance in the markets can make an investor believe in their greatness. This is not an exception to the rule but is a general character trait found in many successful investors. Such names include Anthony Bolton, Bill Miller, and Bill Gross as the most famous examples. Hubris often makes one believe in their infallibility, which leads to errors in decision-making. This exists due to the inherent structure of the investment industry, where an investor is given money until he or she fails, and it is this excess capital that sets one up for failure. To avoid hubris, one must focus on consistency in the process. While it may have mixed results in the short run, a good and consistent process will generate strong returns over the long term.

Solutions to Hubris

Hybrid Funds: Naren suggests that hybrid funds are structured in a manner that helps an investor avoid hubris. Hybrid funds force an investor to sell as the market goes up and buy when the market goes down.

Credit Funds: The credit market in India is fairly illiquid, requiring an investor to hold securities until maturity. This promotes good decision-making as one avoids thinking about selling the security at a higher price to a greater fool.

Closed-End Funds: These structures do not attract fresh capital during bull markets or face withdrawals during bear markets. One of the key characteristics that Berkshire Hathaway has, that has led to its success, is its closed-ended structure, which has prevented hubris from setting in.

Leverage: Borrowing money is a double-edged sword that amplifies returns as well as losses. Avoiding leverage and the excess returns that accompany it helps an investor navigate tough periods successfully.

Conclusion

This article is based on S. Naren’s speech, "Learnings from My Investment Career," originally presented at the Third Value Investing Pioneers Summit hosted by CFA Society India in November 2019. Sankaran Naren's approach to investing is defined by his deep conviction in value investing, a contrarian mindset, and a commitment to understanding market cycles. His career teaches us that successful investing is not just about finding the right stocks but also about the disciplined practice of portfolio sizing and timing exits—key aspects often overlooked by the average investor. Naren’s philosophy emphasizes patience, the importance of holding cash during market peaks, and buying into undervalued opportunities that the broader market tends to ignore.

He underscores the need for a balanced approach and always being aware of the risks involved in going against the crowd. By utilizing metrics like dividend yield, price-to-earnings ratios, and market capitalization, Naren shows how an investor can uncover hidden value in overlooked sectors. His insights into managing hubris, using hybrid and closed-end funds, and avoiding leverage provide practical guidance for maintaining discipline and consistency in investing.

Ultimately, Naren's strategies remind us that successful investing is a blend of rigorous analysis, a contrarian attitude, and the wisdom to manage cycles with a long-term perspective. By staying true to these principles, investors can navigate market volatility, capitalize on value opportunities, and achieve sustained wealth creation over time.

Click here to dive into Part 1 and explore more of Sankaran Naren's investing insights!

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: