Let's imagine you have the ability to predict the future, and you're confident that your current investment portfolio will yield an 18% return over the next decade—something that makes you quite content. However, the allure of higher returns tempts you, leading your banker to offer a loan at 10%, promising an additional 'free' 8% on your leveraged portfolio. At first glance, this may seem like a tempting opportunity, but using leverage to boost returns is akin to playing a risky game, much like Russian roulette.

In Russian roulette, participants place a single round of ammunition into a revolver, spin the cylinder, and take turns pointing the gun at their own head, hoping to avoid the loaded chamber when pulling the trigger. There’s a 5 out of 6 chance that the cylinder is empty, and you get a reward of $1 million dollars. However, there is a 1 out of 6 chance that the cylinder is loaded, and you face certain death.

Despite the potential high payoff for winners, the game's inherent risk lies in the uncertainty of the live round's location within the spun cylinder. The analogy emphasizes that using leverage to enhance returns carries substantial risks, and it's best to avoid it altogether. While 5 out of 6 people may recommend playing Russian roulette, one can only know their luck in hindsight.

The key takeaway is clear: just as the best way to win at Russian roulette is not to play, the safest approach to investing is to avoid leveraging altogether. Despite the stories of successful investors who used leverage to build wealth, it's essential to remember the overlooked tales of those who faced significant losses.

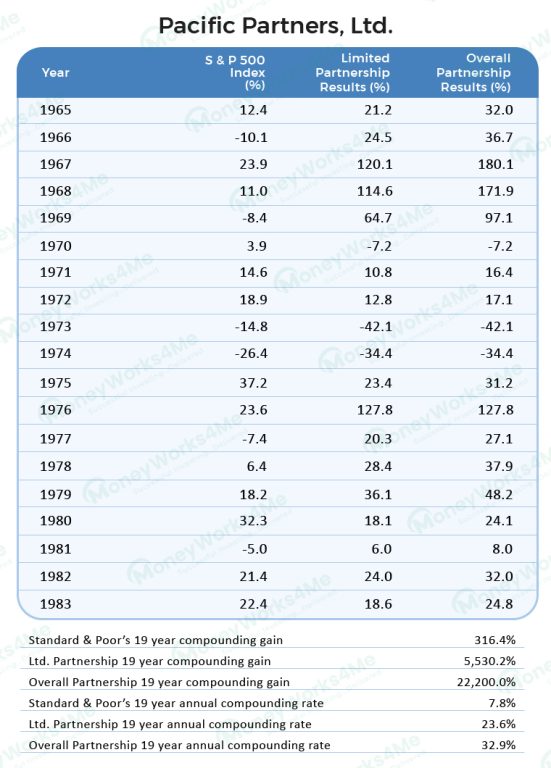

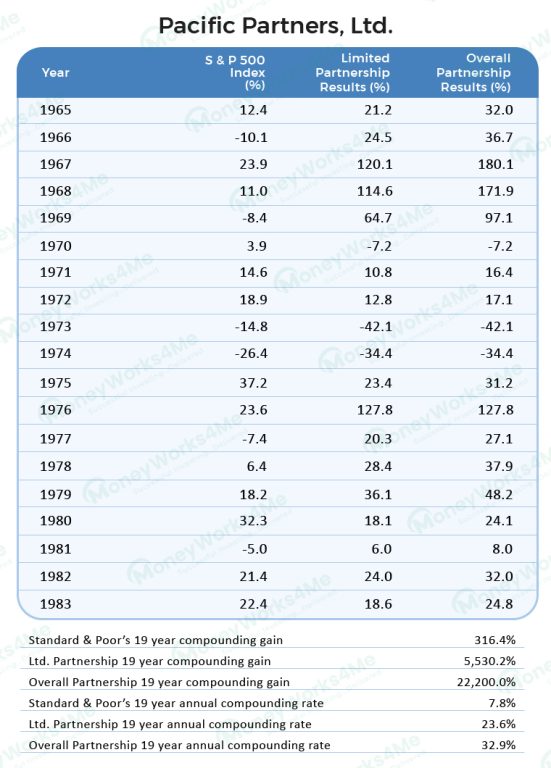

Consider the story of Rick Guerin, a prominent investor associated with Warren Buffett and Charlie Munger. While his Pacific Fund boasted impressive annualized returns of 32.9% and 23.6% for partners and limited partners over a 19-year period, respectively, a major mistake marred his personal success. Guerin's overreliance on leverage in the 1970s led to margin calls when the stock market plummeted nearly 70% in 1973-74. He was forced to sell his Berkshire stock to Warren Buffett at less than $40 a share, while its value has skyrocketed to over $600,000 per share today.

Source: The Superinvestors of Graham-and-Doddsville, 1984

Despite Rick Guerin's fund maintaining solid performance over the subsequent decade, his personal wealth faced significant erosion due to his leverage. Forced to sell his Berkshire shares in an unfavourable market, the deleveraging process occurred at exceptionally low prices. It can be reasonably inferred that his personal net worth would have been higher had he refrained from using leverage.

Markets exhibit non-linear behaviour, with corrections happening at regular intervals. Enduring these corrections is contingent on possessing a robust personal balance sheet, ideally characterized by low or zero leverage. This resilience ensures a better ability to weather market downturns and navigate the inherent volatility.

Even someone of above-average intelligence, highly regarded by one of the world's greatest investors, made significant mistakes. This serves as a cautionary tale for average investors: success in the stock market doesn't demand exceptional intelligence or risky behaviour but rather extraordinary patience.

To drive home this point, consider these three quotes to keep in mind:

- "The stock market is a device for transferring money from the impatient to the patient." – Warren Buffett

- "Markets can stay irrational for longer than you can stay solvent." – John Maynard Keynes

- "You can't produce a baby in 1 month by getting nine women pregnant." – Warren Buffett

To win in the markets, one must ensure that they are not forced to leave the markets. Avoiding situations that can result in catastrophes is more important than managing such situations.

...

Comment Your Thoughts: