‘’The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell." And this is exactly what we told you in our article last week, that the best time to invest in the stock market is right now!!

Also reiterating further, you should invest in safe stocks i.e. the blue chips. And that the Nifty 50 stocks are a great list to look at where you can find a good handful of investment-worthy blue-chips. But world-over, there is a belief that safe stocks, like the Nifty 50, cannot give you great returns. They can probably only give you ‘’enough’’ returns. But much against this belief we at MoneyWorks4me.com think otherwise. Want to know why??

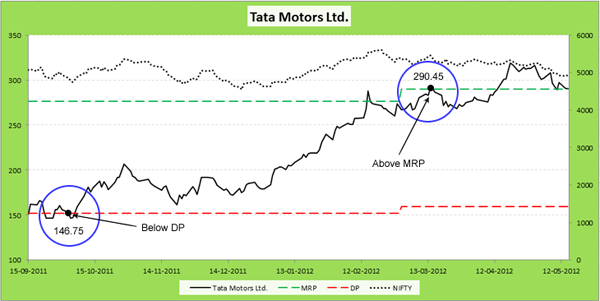

Let’s rewind a little… Cut to Oct’2011. Tata Motors (a Nifty 50 stock), India’s largest automobile company fell to Rs. 146.75. This was mainly due to the fact that Tata Motors poor performance in June and September quarters. Tata Motors being a fundamentally strong company offered a great buying opportunity at this point, more so because it was at Rs. 146.75 which was below our MoneyWorks4me’s Discount Price (ideal buying price).

From there the Tata Motors stock saw some negativity till mid Dec and was hovering around the same levels. This was because of the general negativity in the market in the months of November and December. The factors responsible for this were global fears of the European debt crisis deteriorating further, the rupee taking a beating and the domestic problems of high inflation and interest rates along with a government handicapped with corruption allegations and policy paralysis.

But surprise surprise!!!... With the New Year setting in, investors were showered with good news. The Sensex and the Nifty saw a rally that lasted from mid-December right upto mid-February taking the Sensex to 18000 levels and the Nifty to 5600 levels. This rally was on the back of positive developments around the world and the Indian economy. Also, Tata Motors posted good results in the next 2 quarters due to higher global sales. This led the stock spurt to Rs. 290.45 in March 2012. This price was above the MoneyWorks4me MRP (Right Price) which would have proved to be a good selling price for Investors.

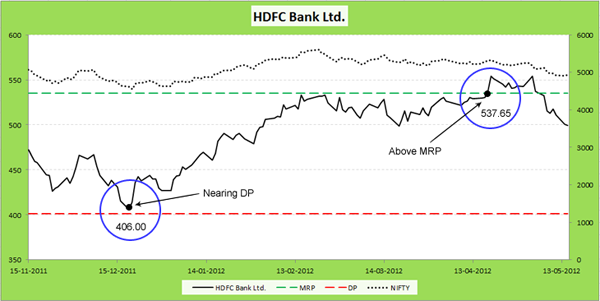

Another such example is that of HDFC Bank.

HDFC Bank is one of India's leading private sector banks. It has been one of the most reliable and consistent performer’s in the banking space. Due to the general pessimism prevailing in the markets in the month of Nov-Dec, the Nifty index was in a free-fall. In keeping with the general market trend, the stock price touched Rs. 406 (close to the MoneyWorks4me Discount Price) in December, 2011 creating a good buy opportunity for investors.

From this point, as the markets recovered, the stock price of the company too moved upwards to Rs. 537.65 (above its MRP), in a time-period of 4 months.

These are just few examples of Nifty 50 stocks. There are a good handful of stocks in the Nifty 50 which have proved to be gold mines for investors. The truth is that when such safe large-cap stocks fall below their fair price, especially during a market fall they offer amazing investing opportunities!

To see more proof on how Nifty 50 stocks can prove to be gold mines Click here.

But are all Nifty 50 companies worth investing?

No, not all Nifty 50 companies are worth investing into. Some of them may have not done so well in the past and are still facing problems currently. Many investors have often lost money by investing in such companies.

So, to help you find out the best and the safest stocks from the Nifty 50 index, MoneyWorks4me has launched a new offering -the Nifty 50 Superstars. This offers you an exclusive space where every Nifty 50 stock comes with a COLOUR CODE (financial strength) and an MRP (real worth) so you instantly know which companies are available at the Right Price and the Right Timing.

So, do check out the Nifty 50 Superstars and earn great returns!

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: