Momentum investing is an investing strategy which involves buying stocks that have gone up over the period of last few months or trading sessions with an intention to sell it at an even higher price and making a quick buck. This style of investing is thus different from the normally accepted investment logic which suggests that you should buy low and sell high. Momentum investors seek out stocks with the potential to double or triple within just a few months. They generally hold a stock for a few months and monitor their holdings daily. They tend to sell their stocks within a few months of acquiring it.

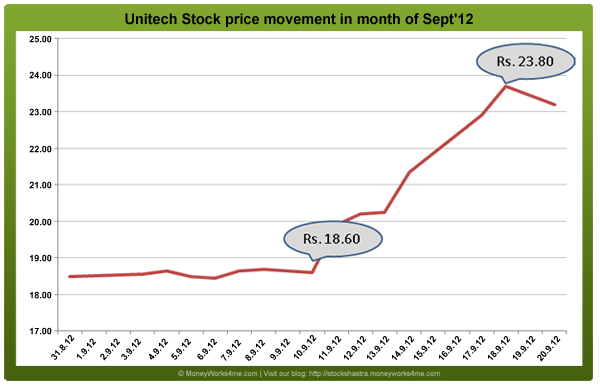

The graph below shows the stock price movement of Unitech Ltd, a famous momentum stock:

So, how do investors find out momentum stocks?

There are some variations in the way investor’s measure momentum like

The percentage change in stock price over a period – a week, a month or a quarter.

Increase / decrease in trading volume – stocks gone up with high volume are thought to be the best momentum stocks.

Some take a call based on earnings announcement.

Now, that we know what momentum investing is and how you can find momentum stocks, lets understand the basic assumptions behind momentum investing.

What are the assumptions underlying momentum investing?

Investors learn slowly - If investors are slow to assess the effects of new information on stock prices, you can see sustained up or down movements in stock prices after news comes out about the stock; up movements after good news and down movements after bad news.

Investors learn by watching other investors – Investors buy what they see others buying rather than analysing the fundamentals. This attracts new buyers to the stock.

Investors have recency bias – Investors give more importance to recent happenings over the fundamentals and old information. This may result in investors reacting more aggressively to recent information and hence stock prices may continue their upward/downward journey.

Thus you can understand from these assumptions that to make money from momentum investing you need to be proactive and act quickly or you may risk missing the bus.

Can momentum investing always yield outstanding returns?

Chasing momentum stocks might not always lead to outstanding returns because of the following limitations.

More an issue of right timing: Stock investing based on momentum is highly dependent on timing. If you buy a stock after the momentum wave has faded there is a great chance that you may end up losing money.

Momentum stocks are usually observed to be risky stocks: Momentum stocks seem to be riskier than the rest of the market and often are trading above their MRP. An investor building a portfolio out of momentum stocks might end up with a portfolio of risky and overvalued stocks.

High brokerage expense & lower returns: Momentum investing requires you to trade more frequently and this leads to an increase in the transaction costs (brokerage). Also, this type of investing is not suitable for a retail investor because you may not have sufficient time to keep tracking the stocks daily.

Failure to identify reversal in momentum: There has been historical evidence of stock price momentum in stock markets. The momentum however reverses itself and this reversal is impossible to predict. There is a great chance that an investor following such a strategy may buy into the stocks at a wrong price and wrong time and may end up losing money instead of making money.

So, should you go for momentum investing?

One of the golden rules of stock market investing is to invest in stocks with long term perspective. Most of the investors ignore this golden rule and end up making loses in the process. Human nature is to be impatient and that is the reason why most of us do not have patience to stay invested in a stock with long term perspective. But the momentum crowd doesn’t seem to get this lesson right; it keeps on chasing after the wrong stocks until it is too late.

With momentum investing, knowing when to sell is even more important than knowing when to buy. So, to succeed in momentum investing, you need to have a mechanism that will tell you when it is time to buy and when to sell. While a few investors might claim or boast that they have such a mechanism, it is more of an exception than a rule. The truth is that there is no full-proof method, which can tell you when to enter and when to get out of the momentum cycle with a reasonable degree of certainty.

Concluding, we can say that success in momentum investing requires a very high degree of skill combined with a higher level of fortune. The bottom line is that for retail investors like you and me the cons of momentum investing seem to outweigh the benefits and therefore it would be a good idea to stay away from any “hot” momentum stocks that you may come across in the market.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: