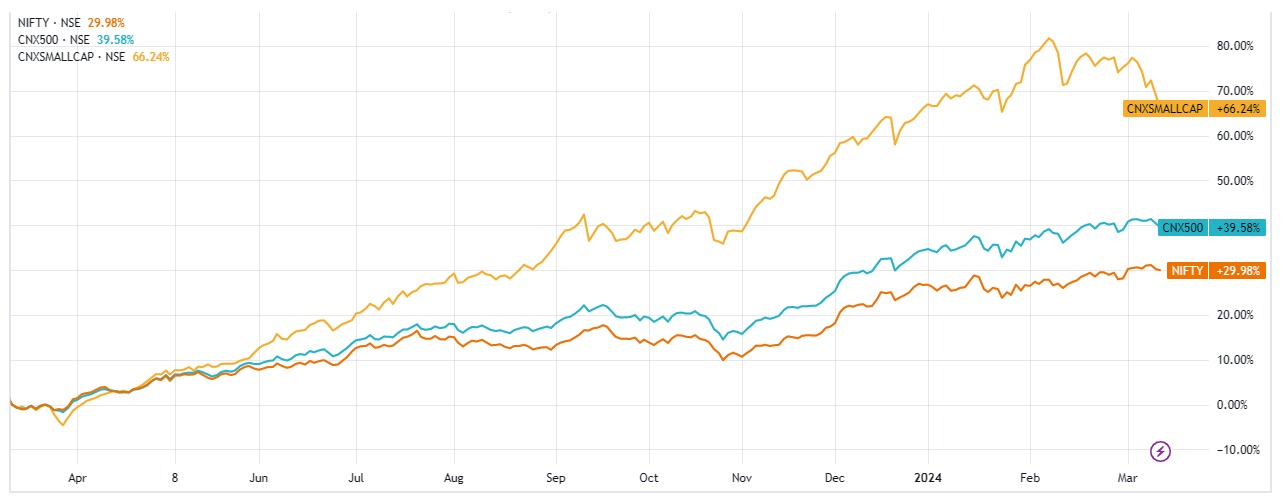

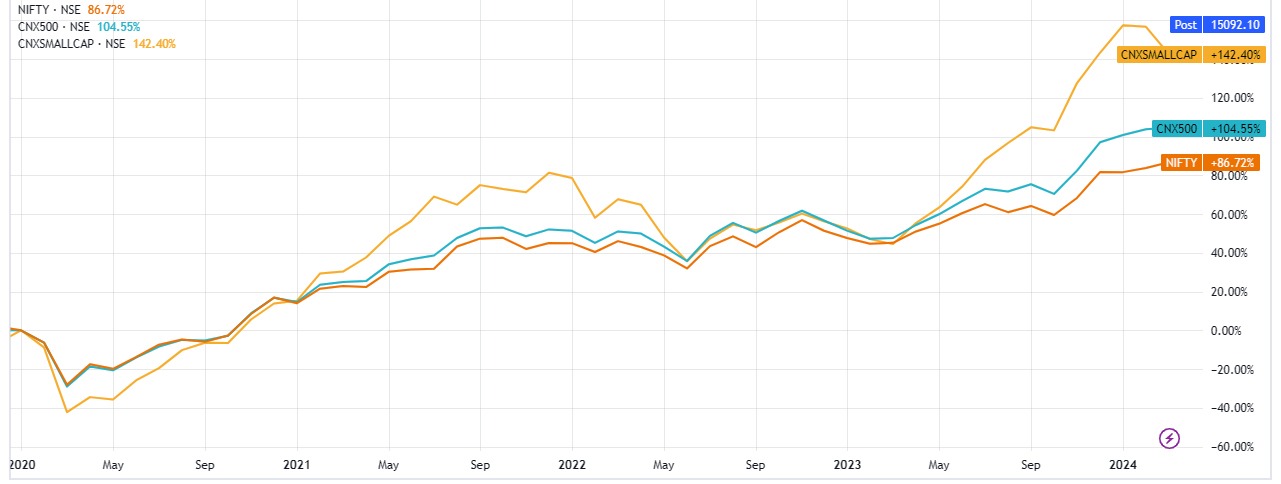

The past year has proven exceptionally lucrative for the majority of investors across various sectors. As illustrated in the chart below, the NIFTY Smallcap 100 Index has surged by approximately 66% in the past 12 months, while the Nifty 500 and NIFTY 50 have experienced growth rates of around 40% and 30%, respectively. This represents a remarkable outperformance compared to the historical performance of these indices. To provide further context, since March 1st, 2004, the Small Cap 100 Index has yielded a 20-year Compound Annual Growth Rate (CAGR) of approximately 15%, surpassing the rates of approximately 14% and 13% for the Nifty 500 and Nifty 50, respectively. The one-year performance reflects a significant deviation from long-term returns which has raised our curiosity.

Source: TradingView

Given such an impressive outperformance in the previous 12 months, investors may draw one of two conclusions: (a) the markets have experienced a surge and investors may face the risk of a correction to the mean rate of returns, or (b) there has been a fundamental shift in the nature of Indian businesses, suggesting that high growth is anticipated to persist. While the future remains inherently unknowable and uncertain, we strongly believe that the first scenario is significantly more likely to unfold. The second conclusion resembles the notion of "this time is different," a phrase that echoed through the markets prior to significant downturns such as the Global Financial Crisis of 2008, the Dotcom Bust of 2000, and the Great Depression, among other notable instances over the past century. On the whole, a thorough examination of market history reveals that this time is not different, and while history does not exactly repeat itself, it often follows similar patterns.

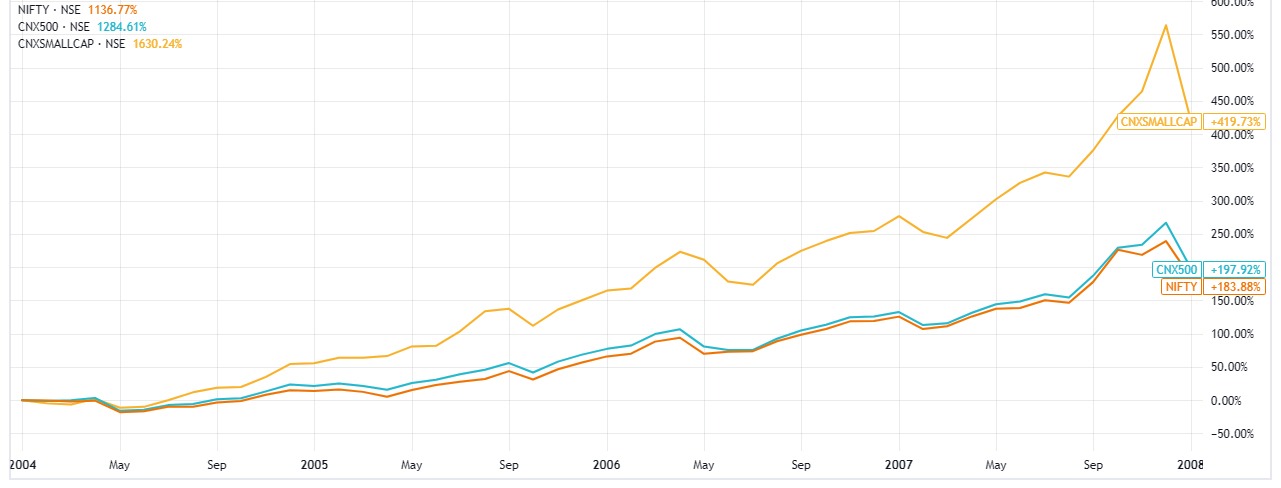

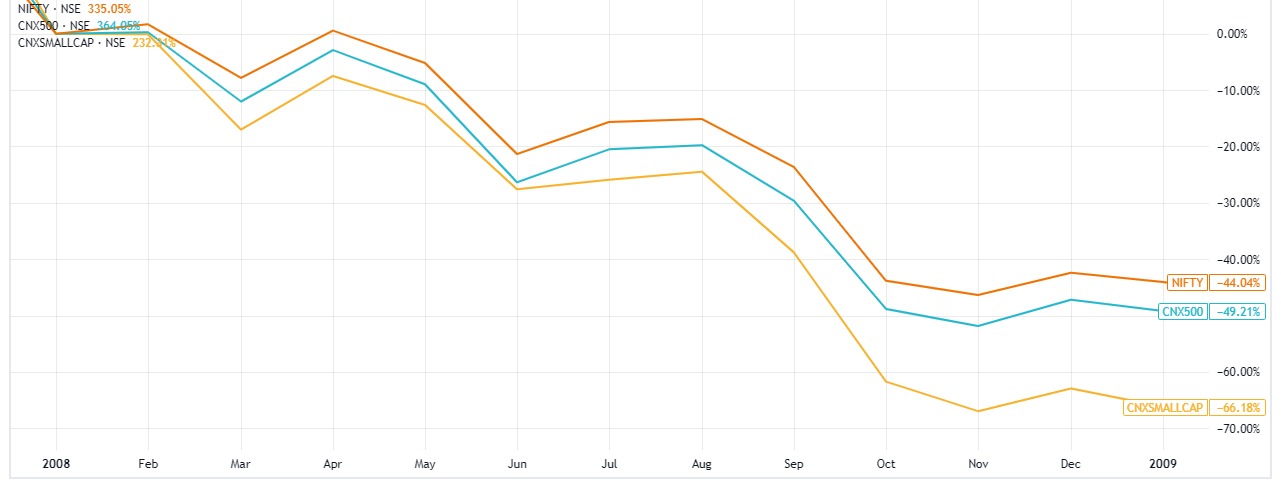

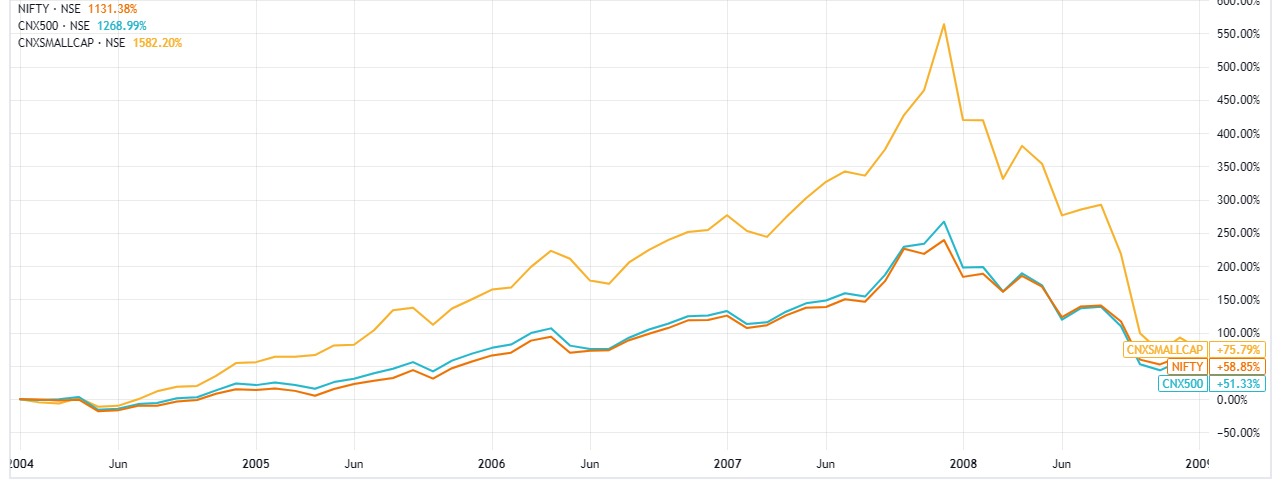

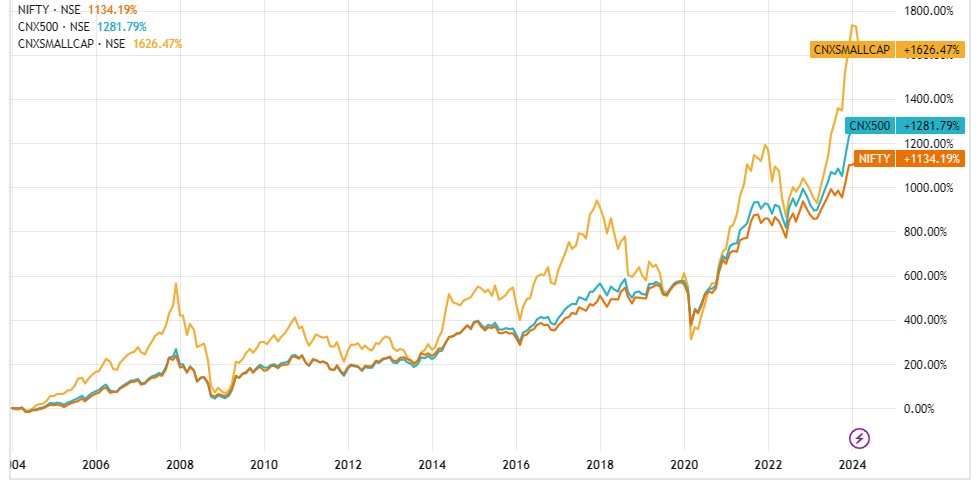

Let’s examine the history of these indices, starting in 2004. From January 1st, 2004, to January 1st, 2008, the Nifty Smallcap 100 Index surged by approximately 4.2 times, while the Nifty 500 and NIFTY saw increases of around 2 times and 1.8 times, respectively. However, by 2009, just a year later, the gap had significantly narrowed to less than 25%, with the Nifty Smallcap 100 Index still showing a return of approximately 75% over the 5-year period. This indicates that the Nifty Smallcap 100 Index dropped by approximately 66% in a year, while the Nifty 50 and Nifty 500 experienced declines of less than 50%. In essence, to achieve an additional return of approximately 25% over the 5-year period, representing a Compound Annual Growth Rate (CAGR) of around 4.6%, considerably higher volatility was required. While the returns were higher, they came at the expense of exceptionally high volatility.

Source: TradingView

Source: TradingView

Source: TradingView

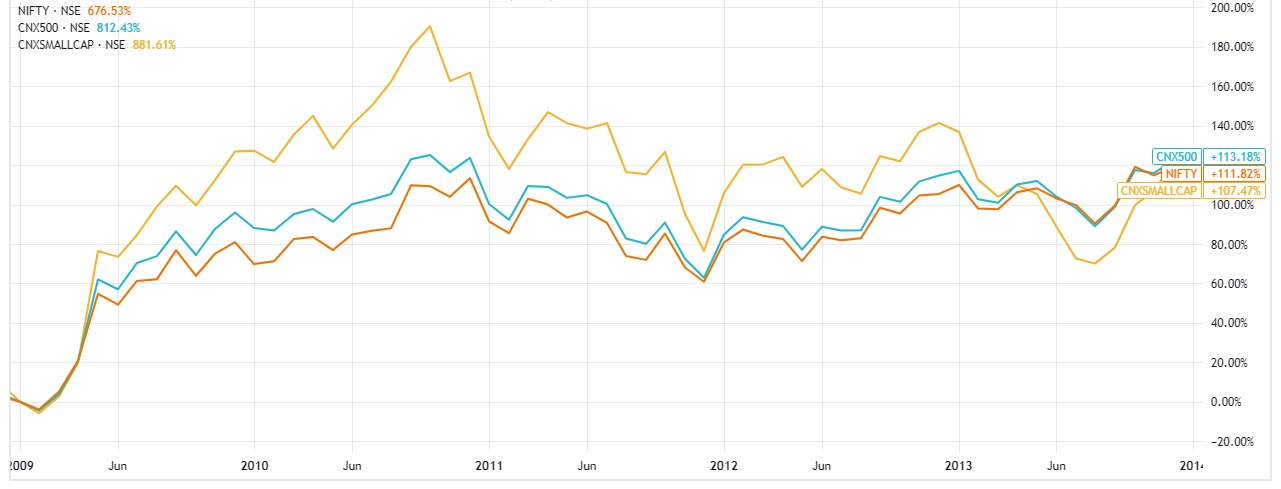

Let’s assume you're an investor who prioritizes returns over market volatility, perhaps even neglecting to monitor your portfolio for extended periods. Following the entire correction, you perceive small caps to be heavily discounted and believe they should constitute a substantial portion of your portfolio. Now, it's time to determine whether this time truly differs. The period from 2009 to 2020 unfolds an intriguing narrative of both outperformance and underperformance. Remarkably, until 2014, five years after hitting bottom, the Nifty Smallcap 100 index failed to surpass the NIFTY 500 and NIFTY 50 indices in terms of performance.

Source: TradingView

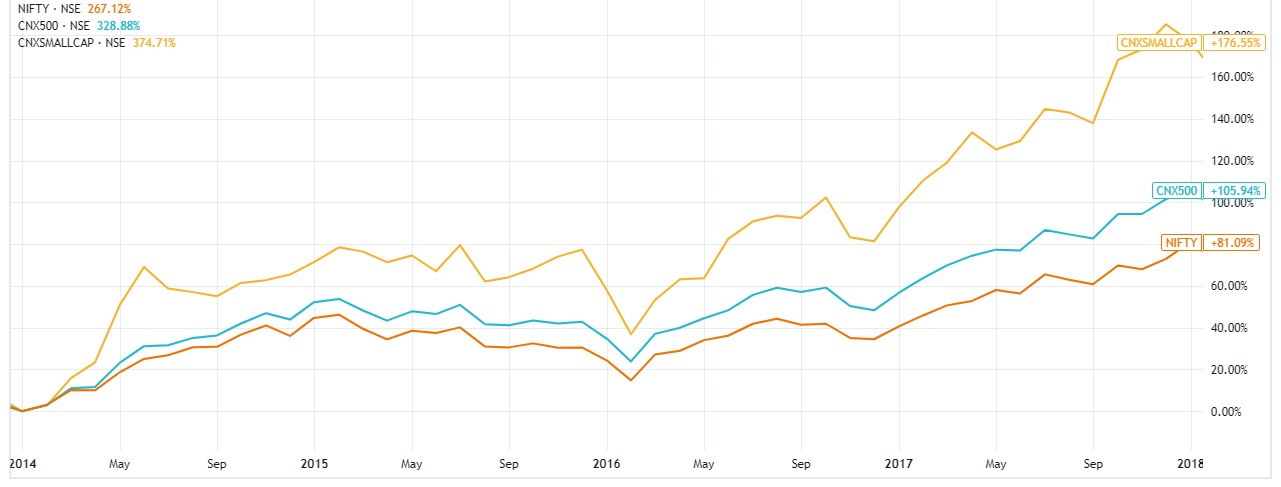

In the subsequent four years, the Nifty Smallcap 100 index exhibited a significant outperformance. From 2014 to 2018, the small-cap index surpassed the Nifty by approximately 95% and the Nifty 500 by around 70%. The overall Compound Annual Growth Rate (CAGR) during this period stood at approximately 28.89% for the Smallcap Index, approximately 19.6% for Nifty 500, and roughly 16% for Nifty 50.

Source: TradingView

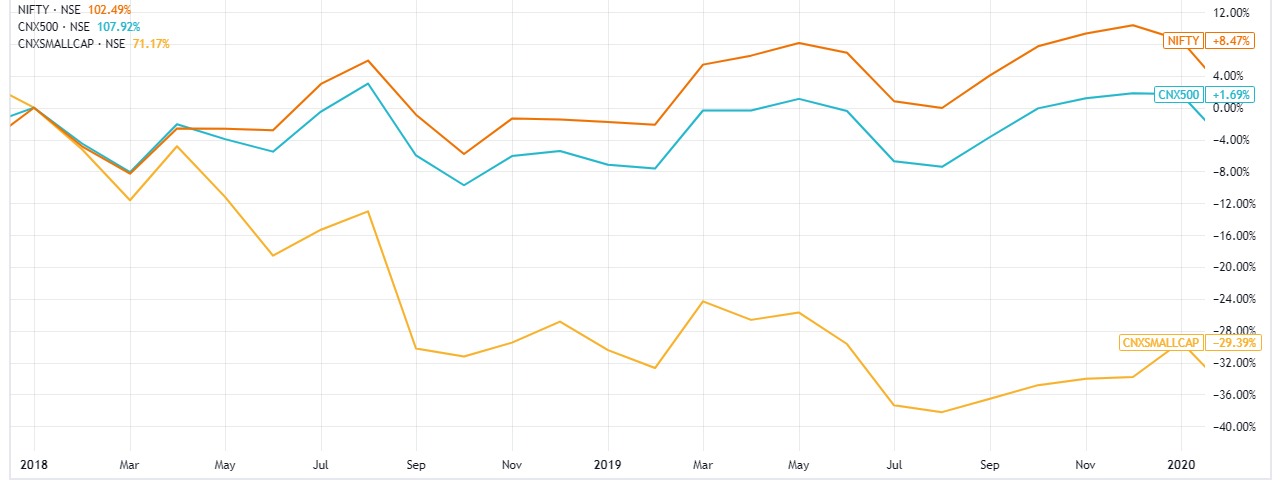

However, the outperformance proved to be short-lived. As anticipated, the Nifty Smallcap 100 index experienced underperformance over the following two years. Although the Nifty and Nifty 500 maintained positive trends, the Nifty Smallcap 100 index declined by approximately 29% over the subsequent two years. It's important to note that this decline is measured until January 1st, 2020, before the onset of the Covid-19 pandemic.

Source: TradingView

The markets underwent a correction due to the impact of Covid-19, with the Nifty Smallcap 100 index declining by an additional approximately 40%, while the Nifty 50 and Nifty 500 corrected by less than 30% between January and March. Until June 2022, there was no net outperformance as the Nifty Smallcap 100 index corrected by around 30% from its peak in January 2022. However, during the period from January 2020 to March 2024, despite the correction, the Nifty Smallcap 100 index outperformed the Nifty 50 and Nifty 500 by approximately 56% and 38%, respectively. The four-year Compound Annual Growth Rate (CAGR) for the Nifty Smallcap 100 index stands at approximately 26%, while the CAGR for the Nifty 50 and Nifty 500 is approximately 16% and 18%, respectively.

Source: TradingView

Now, let’s examine the complete picture. From January 2004 to June 2020, the cumulative outperformance of the Nifty Smallcap 100 index over the Nifty 50 and Nifty 500 has been negligible, if not zero. For approximately 16 years, the increased risks did not translate into higher rewards. Although the Nifty Smallcap 100 index did demonstrate significant outperformance at various intervals during this period, such gains were often offset by substantial corrections. However, at present, the Nifty Smallcap 100 index is indeed outperforming the Nifty 50 and NIFTY 500.

Source: TradingView

The recent outperformance raises an intriguing question: What might the future hold?

While we cannot know for certain, historical trends may suggest that current rewards are already priced in and that risks could be looming on the horizon. We refrain from making predictions about the market's direction, but we do believe in understanding how market cycles operate. According to the market cycle, the small-cap sector appears to be overheated, with considerable risk at current price levels.

Why are small caps more volatile?

There are several potential reasons:

- Liquidity: Smaller companies typically have lower liquidity compared to larger ones. Consequently, when smaller companies experience growth, there is greater competition for a limited number of shares, leading to sharply inflated prices. Conversely, during downturns, the imbalance between sellers and buyers is substantial, resulting in overreactions both during upswings and corrections.

- Growth: Smaller companies often have a vast growth runway, leading to higher short-term growth rates that may be extrapolated over longer periods. Conversely, low short-term growth may be mistakenly assumed to persist over the long term.

- Limited information: Many small-cap companies have limited public market history, leading to misjudgements regarding management quality, vulnerability to business cycles, and competition. This lack of information can cause price fluctuations in both directions.

What is the story missing?

- Data availability: Our analysis focuses on the Nifty Smallcap 100 due to data availability, but there are numerous small caps with lower market capitalizations. Consequently, returns for these companies may be even more volatile than the index suggests.

- Concentration: Individual investors typically hold far fewer than 100 shares, making portfolio returns potentially more volatile.

- Market cap-weighted index: The Nifty Smallcap 100 index is market cap-weighted, meaning returns are influenced more significantly by larger companies within the index.

What should an investor do?

While this narrative might suggest selling holdings and waiting for a correction, that's not necessarily the recommended approach.

- Be aware of the risks: Investing in small caps offers higher rewards but also comes with higher risks. While investors may currently be enjoying rewards, they should be mindful of potential drawdown risks. There are seldom any free rides in the market.

- Sell and wait: Exiting small caps that have reached peak valuations to seek undervalued opportunities within the sector or waiting for new opportunities may seem logical. However, this approach is not advisable due to market unpredictability, as opportunities may not arise immediately, and biases may hinder entry at low valuations.

- Rotate allocations: During periods of unusually high returns for small caps, investors may benefit by booking some profits and reallocating them to larger companies that align with their investment philosophy. We prefer this approach as time in the market tends to be more crucial than timing the market.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: