Sandeep Daga is the Managing Director and Chief Investment Officer of Nine Rivers Capital, a firm he founded in 2007. Before starting Nine Rivers Capital, Sandeep was a Partner at Frontline Ventures, a private equity firm focused on mid-market minority growth investments in India. His investing journey began in the late 1990s at ICICI Ventures, where he led B2B investments. Over his career, Sandeep has held board positions in several high-growth companies.

Nine Rivers Capital is one of India’s oldest Portfolio Management Services (PMS) focused on small-cap investments. Its Aurum Small Cap Opportunities fund has been in operation since December 2012. Sandeep's unique private equity approach to small-cap investing has been highly profitable, making the fund a standout performer in the small-cap universe. In his presentation to CFA Society India, called ‘Private Equity Approach to Small Cap Investing’, Sandeep Daga explains his firm’s philosophy that has generated substantial returns.

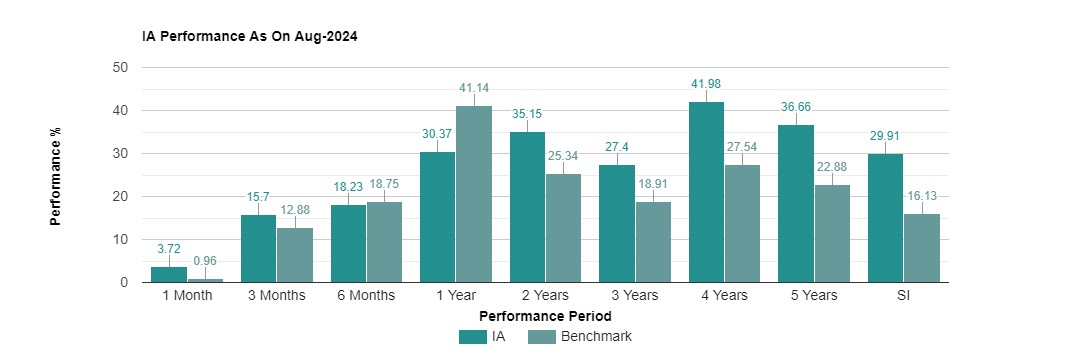

Source: APMI; SI- Since Inception

This article is divided into two parts. Part One discusses reasons for investing in small caps and an example of Nine Rivers’ private equity approach towards small cap investing. Part Two discusses the key tenets of the private equity approach, methods for generating investment ideas, corporate governance, red flags and behavioural biases, and his key lessons for investors.

Let’s dive into Part One!

Investing in Small Caps

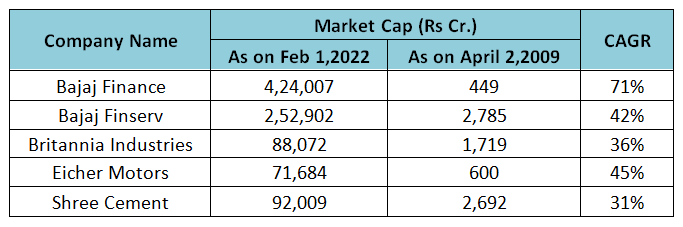

Investors often view small-cap stocks as inherently risky, but this perception isn't always accurate. Many small-cap companies have demonstrated their potential by growing into large-cap stocks, with some even joining the NIFTY 50 index. This transition from small to large caps can lead to significant wealth creation. In fact, over the past 15 years, five small-cap companies have successfully become part of the NIFTY 50.

Source: CFA Society India

Although not all small-cap companies will reach large-cap status, many will still generate wealth for shareholders by progressing to mid-cap status. Over the past decade, several small-cap companies have transitioned to mid-caps, delivering substantial returns in the process.

Source: CFA Society India

Despite the illiquidity and volatility often associated with small companies, the potential for such gains makes investing in small caps a rewarding opportunity.

The Private Equity Approach – Praj Industries

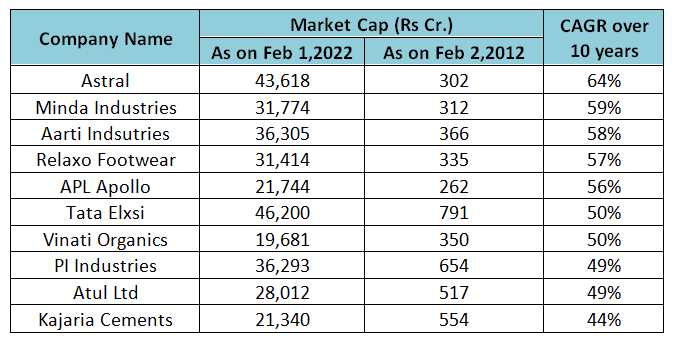

Historical data can often be misleading, as we tend to project past trends into the future—whether positively or negatively. For instance, a company that has experienced declining revenue, declining profits, and declining return on equity for five consecutive years, along with a financially stressed customer base, is likely to be dismissed by the investment community, causing its potential to be overlooked.

However, upon closer inspection, an investor may discover that this company is a global leader in its field, with proven technological expertise and a presence worldwide. It stands to gain from favourable local and international policies, with its largest competitor being less than half its size. Furthermore, the company has diversified into new business segments that are showing promising growth in large, addressable markets. It has also hired skilled professionals to help steer its future, and despite recent challenges, the company remains cash-positive.

Source: CFA Society India

The tension between historical performance and future potential lies at the heart of the private equity approach. When investors steer clear of companies with poor past results, their valuations can become depressed, creating attractive opportunities. In these cases, financial metrics alone may not tell the full story, and an investor must rely on deep, ground-level insights. Gaining an understanding of the company’s true earning potential through industry channel checks is the cornerstone of the private equity strategy. This approach gives investors a distinct analytical advantage over the broader market.

A good example is Praj Industries, a company that had long underperformed but eventually transformed into a strong performer as favourable conditions emerged.

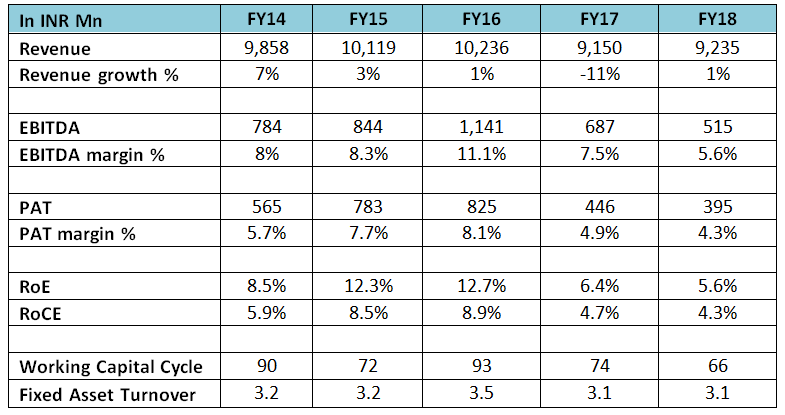

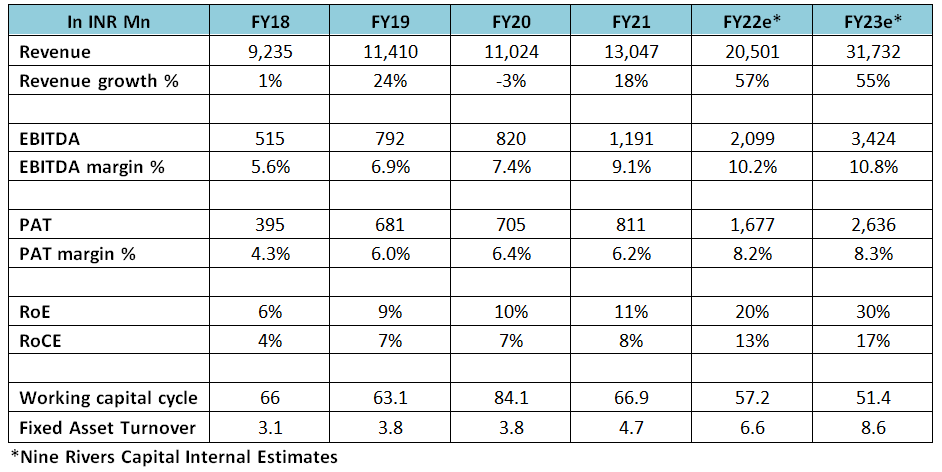

Source: CFA Society India

Since 2018, when the fund invested in the company, the company’s profits have multiplied, delivering multibagger returns. The company greatly benefited from India’s commitment to the Paris Climate Accords and the government's goal to reduce crude oil imports by increasing ethanol blending from 5% to 20%. This policy shift was transformative for the struggling Indian sugar industry. Ethanol blending helped sugar producers by lowering their working capital requirements, as surplus sugar could be converted into ethanol instead of being stored for future consumption, which led to the company’s improved performance.

In conclusion, the private equity approach encourages investors to look beyond historical performance and focus on the future potential of a company, particularly when supported by favourable industry or sector trends.

To continue exploring this topic and dive deeper into our insights, don’t miss out on Part 2 of our blog series which discusses frameworks, cycles, and behavioural insights. Click here to access it now!

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: