Sandeep Daga is the Managing Director and Chief Investment Officer of Nine Rivers Capital, a firm he founded in 2007. Before starting Nine Rivers Capital, Sandeep was a Partner at Frontline Ventures, a private equity firm focused on mid-market minority growth investments in India. His investing journey began in the late 1990s at ICICI Ventures, where he led B2B investments. Over his career, Sandeep has held board positions in several high-growth companies.

Nine Rivers Capital is one of India’s oldest Portfolio Management Services (PMS) focused on small-cap investments. Its Aurum Small Cap Opportunities fund has been in operation since December 2012. Sandeep's unique private equity approach to small-cap investing has not only been innovative but also highly profitable, making the fund a standout performer in the small-cap universe. In his presentation to CFA Society India, called ‘Private Equity Approach to Small Cap Investing’, Sandeep Daga explains his firm’s philosophy that has generated substantial returns.

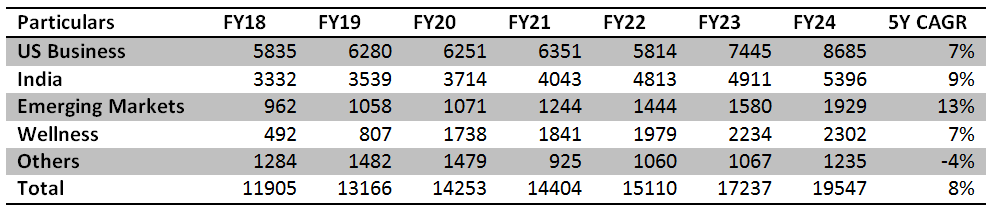

Source: APMI; SI- Since Inception

This article is divided into two parts. Part One discusses reasons for investing in small caps and an example of Nine Rivers’ contrarian approach in small-cap investing. Part Two discusses the key tenets of the private equity approach, methods for generating investment ideas, corporate governance, red flags and behavioural biases, and his key lessons for investors.

Let’s dive into Part Two!

Key Tenets of the Private Equity Approach

- Be Early: Identifying an investment thesis early allows investors to benefit from the discovery premium as more investors take notice over time. However, being early also requires patience, as it may take longer than expected for the thesis to materialize. Monitoring macroeconomic shifts—such as policy changes, digital transformation, and financial trends—can help identify potential opportunities for early investment.

- Build Nuanced Expertise in Industry Segments: Private equity investors need a deep, nuanced understanding of specific industries rather than just a surface-level overview. This expertise helps identify the most profitable parts of the value chain and allows for investing with conviction. While a detailed understanding doesn’t always guarantee idea generation, it is a critical element of the research process and improves the likelihood of successful investments.

- Invest for the Long Term: Long-term investments allow investors to fully capitalize on solid research. While short-term volatility can test patience, holding investments for an average of five years maximizes potential gains. Small variations in the holding period are understandable, but a long-term commitment is key to reaping rewards.

- Buy Growth at a Reasonable Valuation: In the small-cap market, a model portfolio framework is often not suitable. Small caps tend to be illiquid and volatile, so forced buying at unfavourable prices can result in poor returns. Investors should buy stocks at or below a certain price and be willing to wait for the right opportunity.

- Be Concentrated: The private equity approach favours a concentrated portfolio of well-researched, high-conviction investments. A focused portfolio of around 15 stocks allows investors to allocate significant capital to their best ideas. Small caps require intense tracking and oversight, and a large, diversified portfolio makes it difficult to effectively monitor each investment.

Portfolio allocation for each investment idea should range between 5-10% of the total portfolio size to maximize potential returns. Investors must also have the conviction to hold onto winning investments, even if they grow to represent a disproportionately large portion of the portfolio—up to 25%.

However, it's crucial to manage risk by controlling sector weightings. Sector exposure should be limited to 1 or 2 ideas, with a maximum of 30% of the portfolio allocated to any single sector at the time of purchase. This ensures diversification and reduces the risk of overconcentration in any particular industry. - Invest to Exit: This tenet mirrors the private equity model, where every investment is made with a clear exit strategy in mind. Once the investment thesis has played out, and investors have benefitted from earnings growth and valuation rerating, much of the value has already been captured, warranting an exit.

This may seem contrary to the idea of long term investing, as investors often profess their desire to hold companies for a decade or more, but the exit decision must consider the risk of long term investing as well. Volatility and illiquidity in small caps can lead to strong corrections of 30-60% even for good quality businesses, which can lead to underperformance for a small cap focused portfolio. Additionally, very few companies make the jump from small cap to mid-cap, and even fewer make the jump to large-cap, and extremely improbable to have such foresight. While companies that do jump across market capitalisation categorisations create a lot of wealth, betting on such low probabilities may become extremely risky.

The Top-Down Approach to Idea Generation

Industries or sub-segments that are poised for multi-year structural growth often benefit from strong macro tailwinds are ideal hunting grounds as they provide strong environments for revenue and earnings growth. These can and have included policy and regulatory shifts such as ethanol blending, RERA, the China +1 strategy, Production Linked Incentive (PLI) schemes, and the rise of green hydrogen. Demographic trends like the financialization of savings, under penetration of consumer goods and services, and the increasing need for senior living are tailwinds that the Indian economy will witness. Additionally, technology advancements such as cloud computing, SaaS, and AI/ML-driven analytics further enhance industry potential.

Another key factor is transformative management changes, such as the professionalization of leadership and the younger generation stepping into leadership roles. These changes often bring fresh perspectives and strategies, propelling companies forward.

Disruptive business models also shape investment decisions. For example, the rise of electric and autonomous vehicles, the gradual mainstreaming of plant-based proteins, and the sustainability efforts of large consumer companies (like Extended Producer Responsibility, or EPR) all serve as critical indicators of where to invest—and where to avoid investing.

The Bottom-Up Approach to Idea Generation

- Solid Business Franchise: Invest in businesses with a proven brand and strong execution capabilities that lead their niche markets, ideally with an innovative edge. These dominant businesses are best positioned to capitalize when industry tailwinds emerge, allowing them to benefit the most from favourable market conditions.

- Profitable Growth: Growth without profitability destroys value. It's better to invest in companies with moderate sales growth of 15-20%, where earnings either keep pace or grow faster, rather than in businesses with higher sales growth but lower quality earnings. Sustainable growth that prioritizes profitability is essential.

- Operating Leverage: Operating leverage enables a company to grow its earnings disproportionately relative to sales, thus increasing returns on capital. This can be achieved through improved efficiency in both hard assets, such as plants and machinery, and soft assets, like employees and sales infrastructure.

- Low Financial Leverage: Excessive debt can lead to severe problems during cyclical downturns, resulting in significant wealth destruction. Maintaining low levels of debt reduces the risk of permanent capital loss and helps ensure the company can weather downturns without catastrophic consequences.

- Healthy Return Ratios and Robust Free Cash Flows: Companies that generate strong return ratios and healthy free cash flows can reinvest profits to fuel future growth. If they don't have enough reinvestment opportunities, they can reward shareholders through dividends and buybacks. Conversely, companies that only produce strong free cash flows for short periods during a cycle can be traps to avoid.

On Governance

ESG attributes play a crucial role in investment decisions, with different sectors requiring emphasis on different attributes. In the chemical and pharmaceutical industries, strict compliance with environmental regulations is critical to avoid regulatory issues that could lead to costly plant closures. In industries like textiles and information technology, which are highly dependent on people, the focus shifts to inclusivity and workplace culture. A more inclusive and happy workforce often translates into higher efficiency and, ultimately, improved profitability.

Corporate Governance is a more complex attribute and cannot be evaluated with a one-size-fits-all approach. Investors can assess governance quality by examining past management decisions, the treatment of minority shareholders, and adherence to prudent accounting practices. Much of this information is publicly available, but deeper insights can also be gained through informal reference checks and industry networking. Understanding a company’s internal processes through scuttlebutt can also help assess its governance quality.

While it is rare for a company to excel in every aspect of corporate governance, as long as it meets a reasonable threshold, it may still be considered a sound investment. However, it is crucial that companies either maintain or improve their governance over time. Signs of declining governance standards can raise red flags, as poor corporate governance may lead to lower-quality returns and increased risks for investors.

Avoiding Red Flags

When investing, it’s important to steer clear of companies where decision-making is concentrated in the hands of a single individual, as this creates significant key person risk and indicates weak upper management. Similarly, avoid companies led by so-called ‘rockstar’ management teams, who often make grand promises during bull markets but fail to deliver, remaining disconnected from reality and downplaying the risks and challenges the company faces. Management teams that frequently shift focus or chase new opportunities prematurely can also be problematic, as this lack of direction increases investment risk. Additionally, avoid companies with accounting inconsistencies, related party transactions, or unnecessary share pledges, as these red flags often signal deeper issues with corporate governance.

Behavioural Pitfalls to Avoid

Investors must guard against several cognitive biases that can negatively impact decision-making. The Endowment Effect can cause investors to become overly attached to a stock, blinding them to its flaws or other better opportunities. It's crucial to remain objective and dispassionate. Heuristic Biases also pose a risk, as investors may extrapolate personal experiences or preferences to form opinions about an industry, overlooking the wide range of individual tastes. Data, rather than personal preferences, should guide decisions. Additionally, Chasing Momentum occurs when, after conducting thorough research, investors buy stocks at inflated prices due to a sudden run-up, often resulting in subpar returns. Decision Paralysis can lead to missed opportunities or diminished returns when investors hesitate too long before making a buy or sell decision. Lastly, Confirmation Bias can cause investors to ignore evidence that contradicts their views while favouring information that confirms their beliefs, often without proper scrutiny.

Key Lessons

Investing is a long-term game that requires patience. It’s common for an investment not to deliver immediate returns, even as the market trends upward, leading to frustration. However, it's essential to remain patient and allow the investment thesis to unfold, as it may take time for the market to recognize its value. A company’s leadership and management team serve as its greatest competitive advantage. While investors may base their thesis on industry tailwinds and growth opportunities, the real bet is on management’s ability to execute effectively. Additionally, humility is crucial—investors must remain open to learning and acknowledge that they don't know everything. Over time, knowledge compounds, and continued learning pays off.

Valuation should also be approached thoughtfully. Reasonable valuation is based on the quality of the business, not just an absolute price-to-earnings multiple—better companies deserve higher multiples. Furthermore, business fundamentals often outweigh macroeconomic or geopolitical developments. Strong companies tend to navigate adverse events better than their weaker peers and are well-positioned to seize macroeconomic opportunities. Lastly, an investor’s intuition can be invaluable. When something feels off, even if all the data looks fine, it's worth paying attention to that gut feeling to avoid potential mistakes.

The private equity approach to small-cap investing hinges on patience, deep industry knowledge, and disciplined execution. By looking beyond historical performance and focusing on the future potential of businesses, especially those with strong leadership and favourable industry tailwinds, investors can uncover hidden value. Managing risk through sector diversification, maintaining reasonable valuations, and staying committed to long-term strategies are crucial elements for success. Ultimately, the ability to navigate behavioural biases and exercise sound judgment ensures that investors can capitalize on opportunities while managing risks effectively.

Click here to dive into Part 1 and explore more of Sandeep Daga’s investing insights!

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: