Recently, the stock market reached record highs, which is generally considered a positive development. However, some people became anxious about it. This unease led to the belief that the market was overvalued and that selling investments to hold cash was the best course of action. In the world of investing, optimism is often followed by pessimism. When the market goes up and reaches certain levels, there is anticipation of a correction, which can make the market more volatile. In such situations, people often face a dilemma: should they stay invested or should they take profits and wait for the market to become more reasonable or cheaper?

To address this question, let's first understand the difference between "timing the market" and "time in the market." These two approaches represent speculation and investing, respectively. The speculation involves making bets on where the market is headed in the future and adjusting your investments accordingly, essentially trying to predict market timing. On the other hand, investing focuses on the quality of assets and holding them for the long term, emphasizing the idea of being in the market over time.

When you try to time the market, you're essentially speculating on the ups and downs of the market. Whether this speculative strategy is successful or not is a subject for further exploration. In contrast, the concept of time in the market is more akin to long-term investing, where you rely on the quality of your assets and the benefits of compounding to work in your favor.

If we look at the Nifty 50 index and its earnings per share (EPS) over the long run, they tend to move together. This indicates that stock prices tend to follow earnings. As long as businesses continue to perform well and generate profits, EPS will grow, and stock prices are likely to follow this upward trajectory. Therefore, as long as businesses are thriving, the stock market is expected to continue rising.

Timing vs time

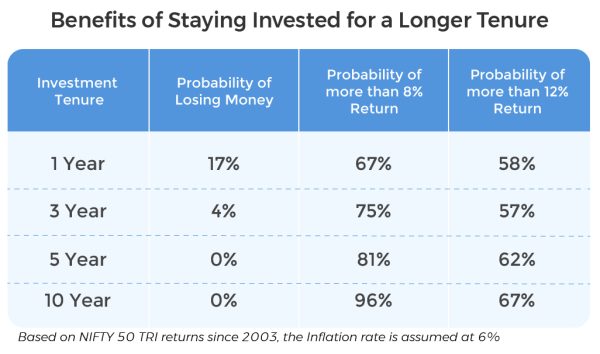

The illustration below demonstrates how staying invested gives better returns in the long term.

Example #1

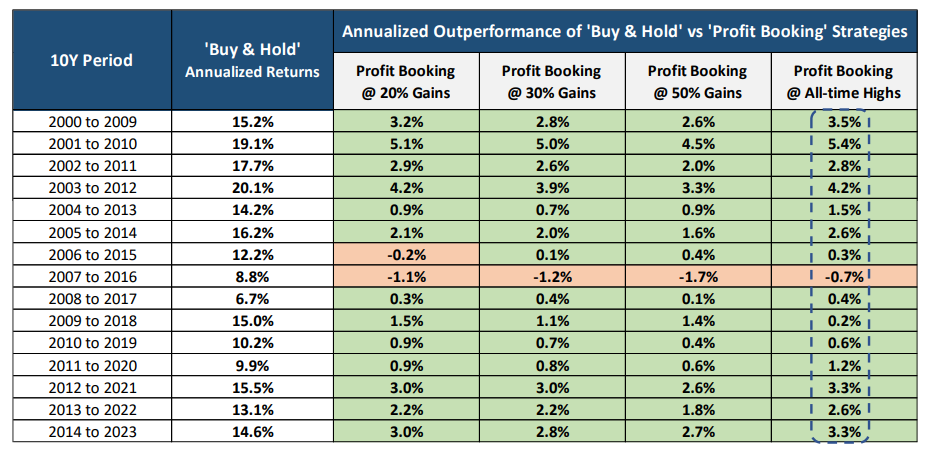

Staying invested outperforms profit booking (timing) in a longer-term horizon. Profit booking may look attractive when the market is at its peak, but it is not a wise move. It disrupts the process of compounding.

Source: FundsIndia Research, MFI

'Buy & Hold' Investor invests into equities and holds the same for the entire period; 'Profit Booking @ X% Gains' indicates portfolios of investors who deploy the profits made in equity into debt whenever the absolute gains reach 20%, 30% and 50% levels; 'Profit Booking @ All-time Highs' indicates the portfolio of an investor who deploys the profits made in equity into debt whenever the Nifty index touches an all-time high; Nifty 50 TRI is considered as the equity option and HDFC Money Market Fund is considered as the debt option; Taxation impact has not been factored for simplicity.

As the above table shows, barring one instance ‘Buy & Hold’ strategy have always outperformed ‘timing’ strategies.

Example #2

Source: ET

The table shows that the longer the investment period, the higher the potential returns and the lower the risk of loss. For example, if someone invested for 3 years, the chance of losing money is around 4%. However, investing for 5 or 10 years eliminates the possibility of loss.

Example #3

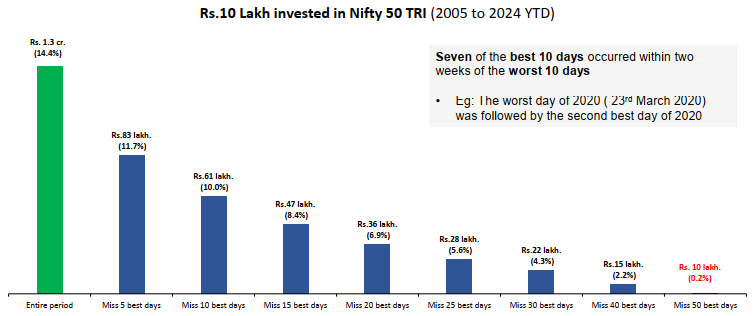

Source: MFI, FundsIndia Research. Period Considered: Jan-05 to Jan-24

Equities are non-linear performers and if you missed a few best days to invest in the market, your portfolio returns would reduce by significant value.

What’s clear from all the above illustrations is: The longer term you stay invested, the higher your returns tend to be. Even when selecting the worst days to invest, you would still earn a decent return. If you happened to get lucky about timing, your returns would have a significant positive impact. But the probability of successful timing is very low. You can read our blog (here) for more clarity on market timing.

Here's a crucial insight: 90% of people lose money in trading because they try to beat the market. However, as the late Mr. Rakesh Jhunjhunwala used to emphasize, the market is supreme, and trying to beat it is a futile endeavor. So, attempting to time the market is often a fool’s errand.

In essence, staying invested for the long term, even during market fluctuations, tends to yield better results than constantly trying to predict and time short-term market movements. There are a few reasons we’ve outlined to emphasize the same.

Media Influence: The media and analysts can hype up stocks, leading investors to make impulsive decisions. Long-term investing provides a more balanced perspective and reduces the impact of media-induced excitement.

Volatile Days: Market ups and downs can be extreme on certain days. Trying to time the market means risking missing out on big gains or buying during significant declines, which can harm your returns.

Valuation Perspective: A long-term approach allows you to invest when stock valuations are attractive and avoid overreacting to short-term fluctuations, providing a better overall perspective.

Transaction Costs: Frequent buying and selling come with fees like brokerage charges and taxes, eroding profits. Timing strategies can be costly due to these transaction expenses.

Bottom line:

There isn't a single perfect way to invest and different strategies work for different people. However, for most investors, a straightforward approach of staying in the market for the long term can be more effective than constantly trying to predict the best times to enter or exit. That’s why; we suggest to stay invested in the market irrespective of market highs and lows. Wealth creation is a steady and consistent process. It takes years to create a fortune.

We at moneyworks4me also follow the same simple but effective process which has a proven track record. We help you build a long-term sustainable portfolio. You can visit our website for more details or talk to our Investment counselor.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: