Return on Invested Capital (ROIC) is more than just any other profitability metric; it's a window into the effectiveness of a company's capital allocation strategy and its long-term value creation potential. As an Investor, ROIC serves as a powerful lens through which the quality of a business, its competitive positioning, and management’s strategic decisions can be evaluated. Let’s delve into what makes ROIC so essential and how to use it to make inform investment decisions.

What Drives ROIC?

ROIC measures the return a company generates on the capital it employs in its business operations. The formula is:

ROIC = Net Operating Profit after Tax (NOPAT) / Invested Capital

NOPAT is a more accurate measure of a company’s profitability, excluding the influence of leverage and non-operating items, focusing purely on the core business operations.

Invested Capital includes equity and debt but excludes excess cash and non-operating assets, providing a cleaner view of the capital actually utilized in the business.

To earn a higher ROIC, a company needs a competitive advantage that enables it to charge a price premium or produce its products more efficiently (at lower cost, lower capital per unit, or both). A company’s competitive advantage depends on its chosen strategy and the industry in which it operates.

ROIC's Role in Identifying Quality Businesses

As an Investor, ROIC is a crucial indicator of a company’s ability to generate value above and beyond the cost of the capital it deploys. A company that consistently reports an ROIC higher than its cost of capital (typically measured by weighted average cost of capital (WACC)) is creating economic value, not just accounting for profits.

Key Insights:

- Competitive Advantage and Moat: A high and sustained ROIC often signifies a durable competitive advantage. Industries with high barriers to entry, strong brand power, or unique intellectual property tend to exhibit higher ROICs. For example, companies with strong pricing power, low capital requirements, and scalable business models typically outperform their peers on this metric. As an Investor, focusing on companies with sustainable ROIC advantages can help identify potential compounders—stocks that can deliver outsized returns over time.

- Management's Capital Allocation: ROIC offers a clear view of how efficiently management is deploying capital. High ROIC can result from prudent capital allocation strategies, such as disciplined reinvestment in high-return projects, strategic acquisitions, or effective cost management. Conversely, a declining ROIC can signal capital misallocation—perhaps the company is over-investing in low-return projects, making expensive acquisitions, or facing operational inefficiencies.

How to Interpret ROIC

Interpreting ROIC requires context. An absolute number has little meaning. ROIC should be compared with industry, the company’s historical performance, and its cost of capital.

ROIC vs. Industry Average: As an Investor, we should compare a company’s ROIC to industry peers. For example, in capital-intensive industries like utilities or manufacturing, a good ROIC may be around ~13% lower than that in asset-light sectors like software (~40%) or consumer goods (~25%). Identifying companies that maintain higher ROICs relative to their industry peers can signifies a competitive advantage.

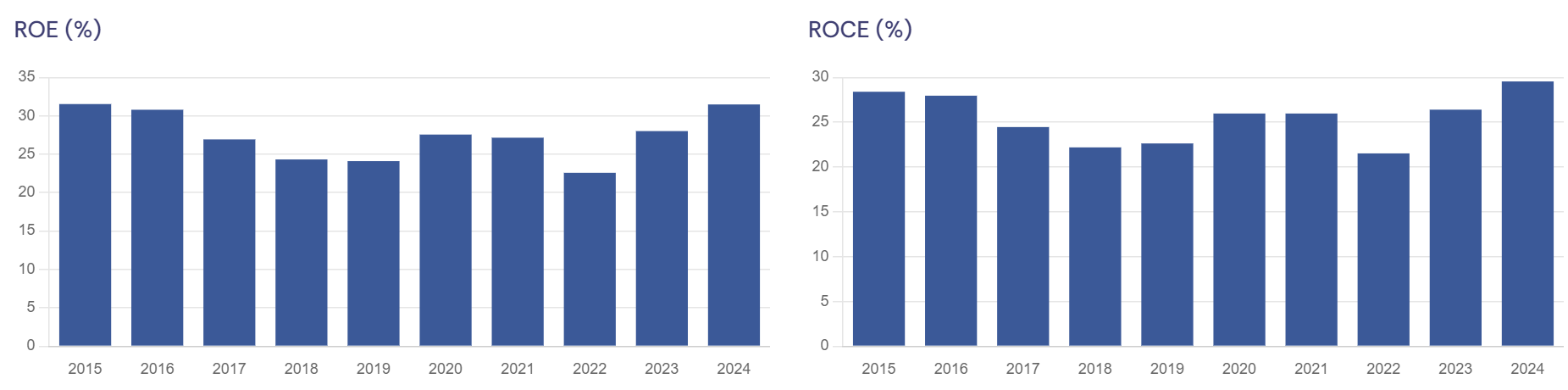

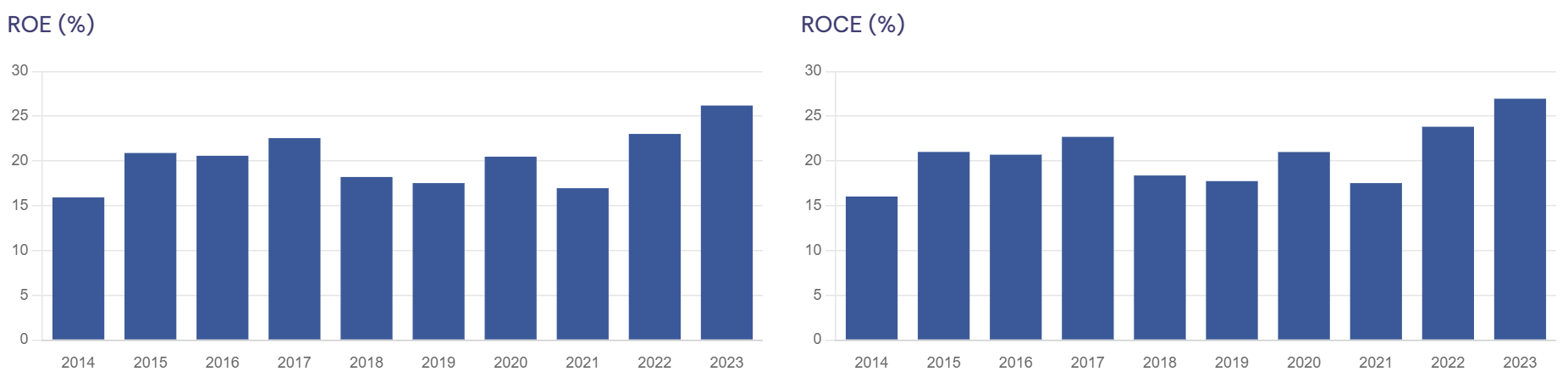

ROIC Trend Analysis: A rising ROIC over time often indicates improving operational efficiency, successful strategic initiatives, or strengthening competitive positioning. However, if ROIC is declining, it may indicate deteriorating margins, increased competition, or overinvestment in projects with diminishing returns. Analysing the trend can provide insight into the company’s future profitability and its ability to maintain a competitive moat.

ROIC and Growth: High ROIC combined with high reinvestment rates is a recipe for sustainable growth. As an Investor we should look for companies that not only have a high ROIC but also have opportunities to reinvest capital at similar rates of return. Such companies can compound their intrinsic value over time, driving long-term shareholder wealth.

Why ROIC Matters in Valuation

In equity analysis, the valuation of a company hinges on its ability to generate future cash flows. ROIC is instrumental in forecasting these cash flows accurately:

DCF Analysis and ROIC: In a Discounted Cash Flow (DCF) model, ROIC directly influences free cash flow projections. Companies with higher ROICs can generate more cash from each dollar of invested capital, supporting higher valuation multiples. Moreover, the sustainability of ROIC affects the terminal value in DCF models—if a company can maintain high ROICs, it justifies a higher terminal growth rate.

Link to Earnings Quality: High ROIC companies tend to have high-quality earnings, characterized by strong cash generation, less reliance on debt, and lower risk of earnings manipulation. These companies are generally in a better position to weather economic downturns, invest in future growth, and return capital to shareholders through dividends or buybacks.

Assessing Value Creation: ROIC above the cost of capital (WACC) indicates that the company is creating value. As an Investor, we should examine whether the company can sustain this value creation. Factors like the competitive landscape, potential industry disruptors, regulatory changes, and the company's reinvestment strategy all impact future ROIC and, therefore, its valuation.

ROIC in Action: A Case Example

Consider Asian Paints and Akzo Nobel two paint manufacturing company. Asian paint has an Average ROIC of ~35%, while Akzo Nobel India has an ROIC of ~25%. Both companies have a WACC of ~12%.

Asian Paints: ROIC (35%) > WACC (12%) – Asian Paints is creating value, generating 23% more return than the cost of its capital. As an Investor, We would dig deeper into how Asian paints achieve this—does it have a cost advantage, brand strength, or superior management?

Asian Paint's success belong to its strong brand, its true moat is its logistics network. Serval decades ago, Asian Paints began removing intermediaries – distributors and wholesalers- from its supply chain directly tapping into the point of sale that are paint dealers. The network of more than 70,000 dealers that they have built is a significant competitive advantage over other players in the industry.

Akzo Nobel: ROIC (28%) > WACC (16%) – Akzo Noble is also creating value, earning 12% more than its cost of capital. As an Investor, we should investigate whether this is a temporary issue or a structural problem. Akzo Nobel may be facing competitive pressures, regulatory hurdles, or suboptimal capital allocation decisions, which are impacting its value creation. Specifically, its lower value creation is linked to its higher exposure to the industrial paint segment, where it has limited bargaining power. This reduces the company's ability to command premium pricing or pass on costs to customers, negatively affecting its profitability and overall returns.

Conclusion

As an Investor ROIC is not just a metric but a fundamental concept that embodies the essence of a company's ability to create value. A thorough analysis of ROIC provides insights into a company's competitive positioning, operational efficiency, management's strategic acumen, and long-term growth prospects. By integrating ROIC analysis investment thesis, Investors can make more informed and nuanced decisions, distinguishing between value creators and value destroyers in the market.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: