Stocks - Q : Quality | V : Valuation | PT : Price Trend

Funds - P : Performance | Q : Quality

Funds - P : Performance | Q : Quality

About the company

Rossari Biotech (Rossari) is a specialty-chemicals manufacturer which was established in 2003 as a partnership, between Mr. Edward Menezes and Mr. Sunil Chari. Rossari has built a strong base of more than 1000 customers across segments with the likes of Hindustan Unilever (Love & Care, Cif, Rin, Vim), Reliance (Enzo), Arvind, Raymond, Gokul Poultry Industries. Currently, they are distributing more than 4,250 products and delivering their services through 435 distributors in 28 states and 8 Union territories in India. Rossari also exports its products to more than 33 countries.

Rossari operates 8 manufacturing facilities at Silvassa and Dahej in Gujarat, with a total production capacity of 354,100 MTPA. It has leveraged its 4 strategically placed R&D facilities, including a cutting-edge certified laboratory at the Mumbai IIT campus, to drive growth through smart chemistry and research. The company's R&D strength lies in its ability to swiftly deliver customized and cost-effective product solutions, encompassing synthesis, formulation, development, and technical services.

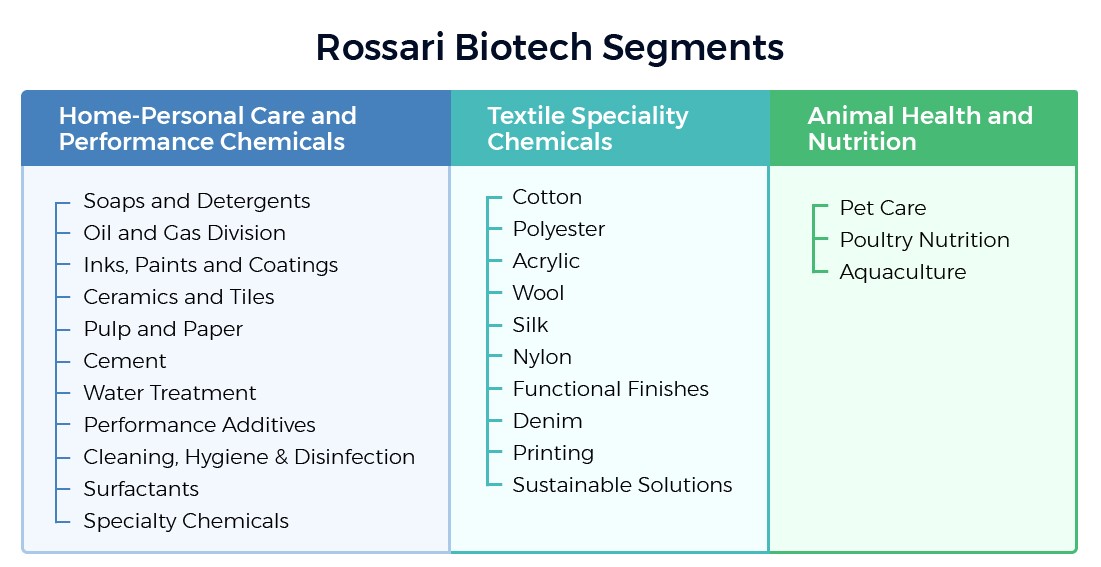

Rossari offers solutions in three main product categories:

Inorganic growth initiatives

Rossari Biotech successfully acquired and integrated three companies in last 2 years- Unitop Chemicals Pvt Ltd (33% FY23 revenue share), Tristar Intermediates Pvt Ltd (13% FY23 revenue share) and Romakk Chemicals Pvt Ltd (2% FY23 revenue share).The strategic acquisition of Unitop has helped Rossari diversify its product portfolio with its expansive product range in the agrochemicals, anti-foams, hand gels, viscosity modifiers, marine cleaners and Anti-Stats segments. Tristar has brought in significant synergy to Rossari in Pharmaceuticals, Textiles, Paints, Automotive and Agro-chemicals segments. The focus of the acquisitions will be on cross-selling products to existing customers and expanding into new areas of specialty chemicals.

In 2019, under the pet care segment, Rossari acquired a reputed Indian pet grooming brand - Lozalo International. The product range includes natural pet shampoos, powders, deodorants, sprays, creams, and floor washing liquid.

Competition

While competition is present across categories, Rossari has created a place for itself on back of a) partnering with customers for solutions, b) long standing relationships, c) expertise in select sub-segments.

Positives and triggers

Concern areas

Client concentration risk and short term contract: Reliance on a limited number of customers for the business may generally involve several risks. Notably, the company does not have any long term agreements with most of their customers, and the loss of one or more of them or a reduction in the demand for their products could adversely affect the business.

Raw Material Risk: Rossari’s largest expense is the cost of raw materials. Their primary raw materials are acrylic acid, surfactants and silicone oils which are subject to volatility due to factors beyond the company's control, such as market dynamics, economic conditions, and transportation and labor costs. The company does not have long-term agreements with suppliers, relying instead on purchaseorders, necessitating precise forecasting of supply and demand. Since product prices are typically fixed upon receiving a customer's purchase order, the company may not be able to fully transfer increased raw material costs to customers. But the same is done with some lag effect.

Financials

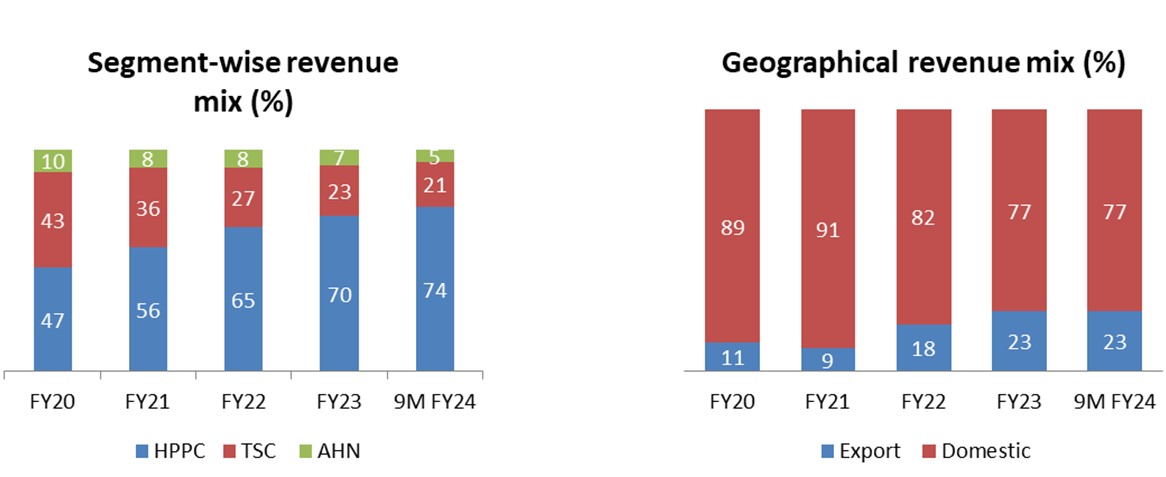

Revenues have more than tripled in the last 5 years from Rs.516 Cr. in FY19 to Rs.1656 Cr. in FY23 at a CAGR of 34%, majorly coming from the growth of HPPC segment. EBITDA has also shown consistent growth of 29% CAGR from FY19 to FY23. PAT has increased from Rs.46 Cr. in FY19 to Rs.107 Cr. in FY23 maintaining a moderate CAGR of 24% owing to increase in raw material costs. However, the raw material pressure has eased off over the last few quarters, which has led to an improvement in gross margins.

Management profile - Founders are technocrats with growth focus and clearly defined business roles.

Mr. Edward Menezes - He is the Executive Chairman and guides the company's technical, manufacturing, and marketing strategies. He has a B.Sc. in Textile Chemistry from University Department of Chemical Technology (UDCT) and master’s degree in marketing management from Prin. L. N. Welingkar Institute of Management Development and Research. His career spans over 34 years in textile processing.

Mr. Sunil Chari- He is the Managing Director and brings over three decades of expertise in textiles and related chemicals. He has a Bachelor's in Arts from Kakatiya University and a diploma in technical and applied chemistry from Victoria Jubilee Technical Institute. He is the cornerstone of Rossari's formidable sales and distribution network, driving market expansion and financial fortitude.

Moneyworks4me Opinion- Rossari has low debt to equity ratio, industry leading asset turnover, and an experienced management team with a great execution track record. It is also a proxy play on FMCG sector wherein branded companies are relatively expensive. Future outlook is strong on a) expansion coming into play, b) entering new industries and increasing target addressable market, c) stable raw material prices. Only short term hindrance looks like muted FMCG volume growth (esp. rural volumes). We value Rossari at Rs.700 (18x forward PE for FY26) and will wait for a better entry price given that current risk reward scenario is not lucrative.