Stocks - Q : Quality | V : Valuation | PT : Price Trend

Funds - P : Performance | Q : Quality

Funds - P : Performance | Q : Quality

About

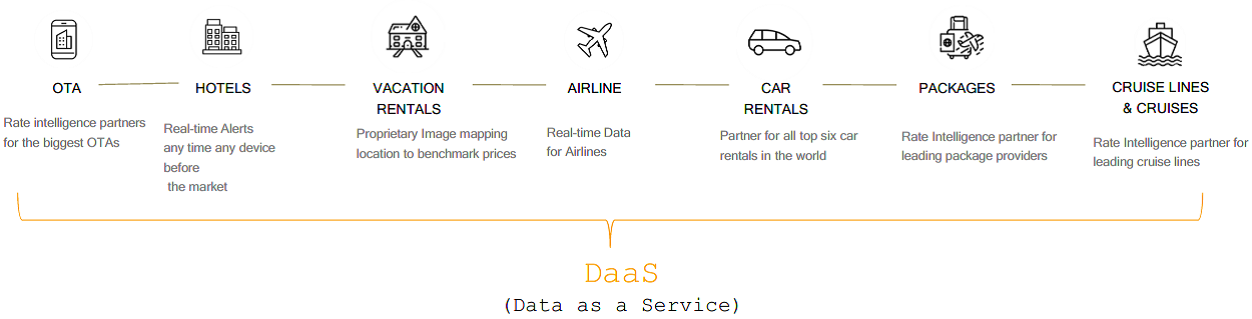

RateGain is a leading Software as a Service (SaaS) company specializing in the hospitality and travel industry. Established in 2004, the company initially offered a competitive intelligence price comparison product for hotels, simply put it gave data like - what is the average price charged in that particular area? And in which month prices have increased last year?

Over the past 20 years, it has significantly expanded its product portfolio, integrating advanced artificial intelligence and machine learning capabilities to deliver various solutions.

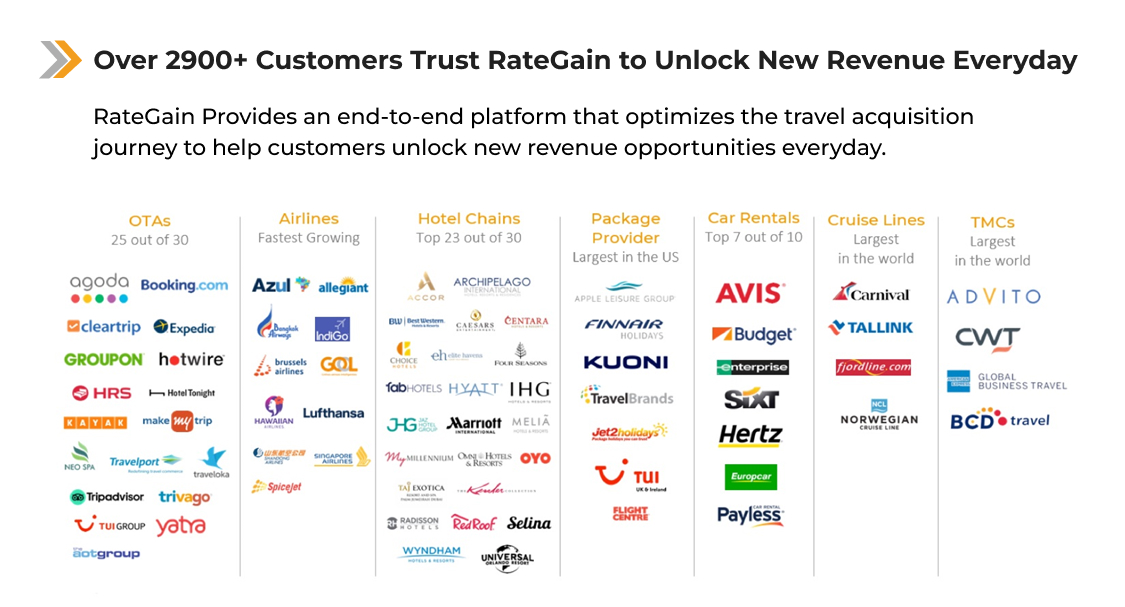

RateGain’s suite of products cater to clients across all verticals, including hotels, airlines, online travel agents (OTAs), meta-search companies, vacation rentals, car rentals, rail, travel management companies, cruises, and ferries. It has clients in more than 100 countries with key markets being across North America (55% of revenues) followed by Europe (31% of revenues) and Asia Pacific region (12% of revenues). Their solutions help businesses find the right guests, set optimal prices, distribute these prices through preferred channels, and ensure an exceptional guest experience, ultimately maximizing revenue.

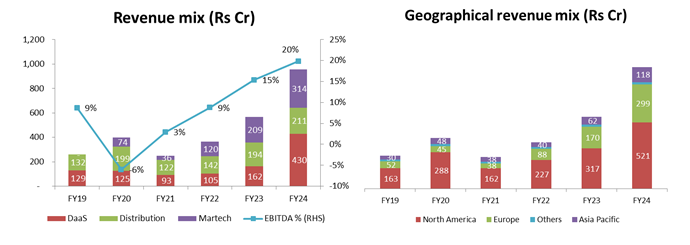

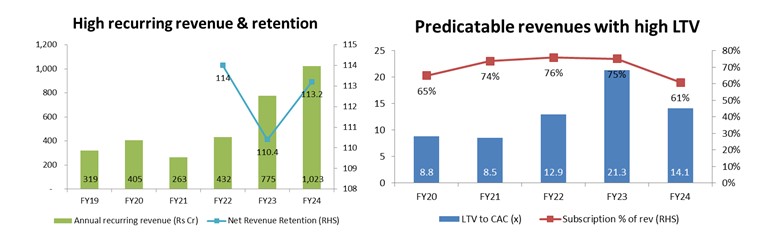

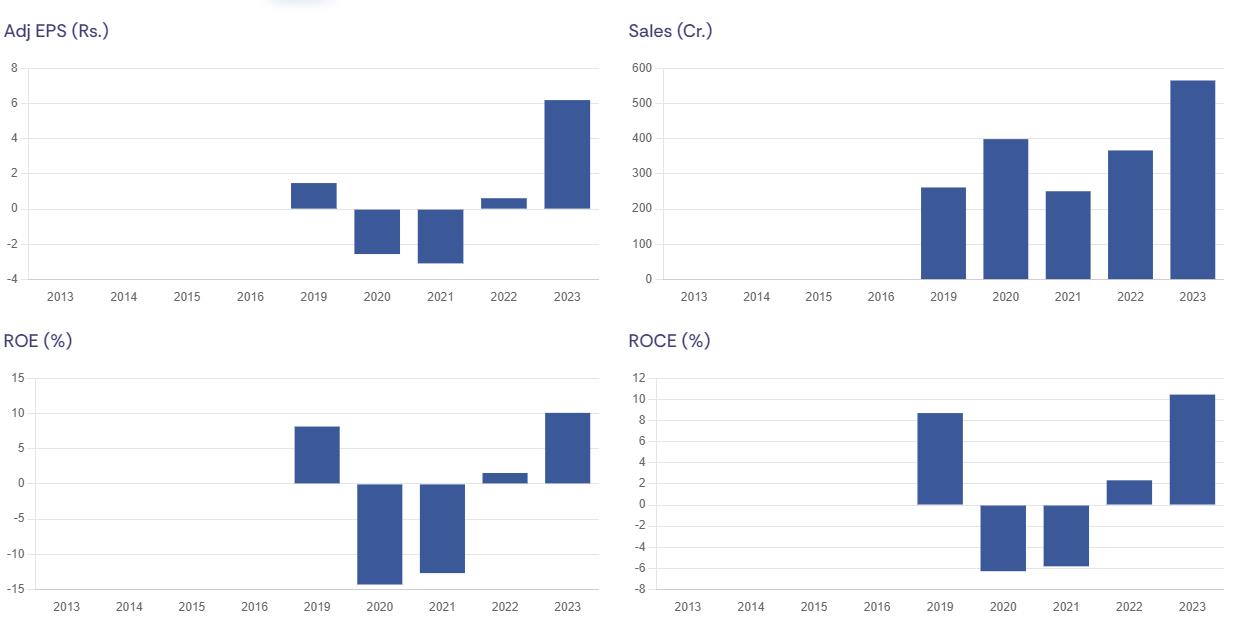

It has grown its revenue at 30% CAGR over FY19-24 supported by scale up of acquisitions. It also has strong annual recurring revenue of Rs. 1,023 Cr (current revenue Rs. 955 Cr) with high 14.1x Lifetime value (LTV) to CAC (Customer acquisition cost) ratio. EBITDA margins have expanded given inherent nature of business with high operating leverage as well as strong growth in high margin business segment (Daas), with room to grow further.

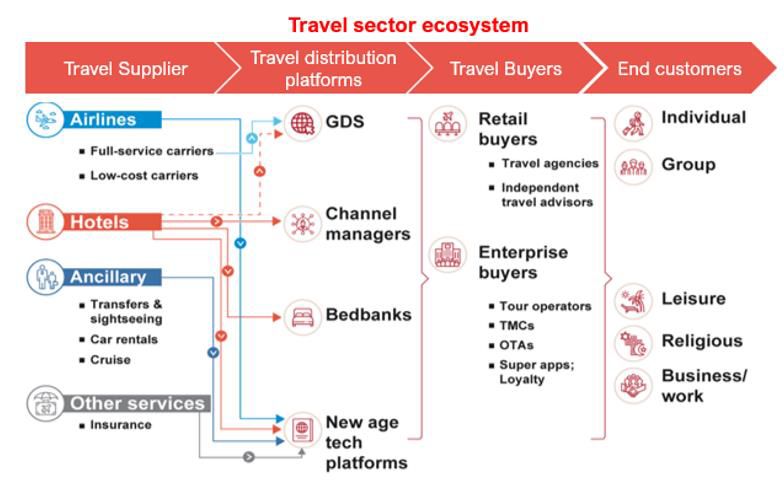

To understand RateGain and its place in the industry first let’s look at global travel industry landscape.

Industry

The global travel and tourism market, valued at US$ 1.7 trillion in 2017, has demonstrated significant recovery and growth, reaching US$ 1.9 trillion in 2023 and is projected to grow to US$ 2.6 trillion by 2027 (+8.2% CAGR). The ecosystem consists of–

A global distribution system (GDS) is a computerized network system owned or operated by a company that enables transactions between travel suppliers and travel buyers. (Examples-Sabre, Galileo, Amadeus, and Worldspan). Online Travel Agencies (OTAs) are likes of Easy Trip Planners, Yatra online, Ixigo, Make my trip.

Large addressable market and growth potential

The company serves a large total addressable market (TAM), which is estimated to grow at CAGR of 18% to US$ 11.47 bn by 2025. In the third party travel and hospitality technology space, the serviceable addressable market (SAM) of enterprise applications focused on guest acquisition, distribution, revenue maximization and wallet share expansion is also expected to grow at CAGR of ~18% to US$ 8.45 bn in 2025. Within the global value chain RateGain is well placed as compared to OTAs as they don’t have to keep on advertising to maintain market share, the hotels have to suffer high operating deleverage and have constrains to grow. The management targets to grow revenue to Rs.2,000 crores in the next 3 years, aiming for 26% CAGR (~20% organic). For the next year management has guided 20% growth with 100 to 200 basis improvement in EBITDA margin.

Business segments

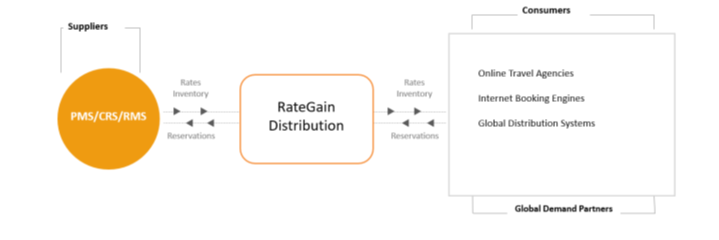

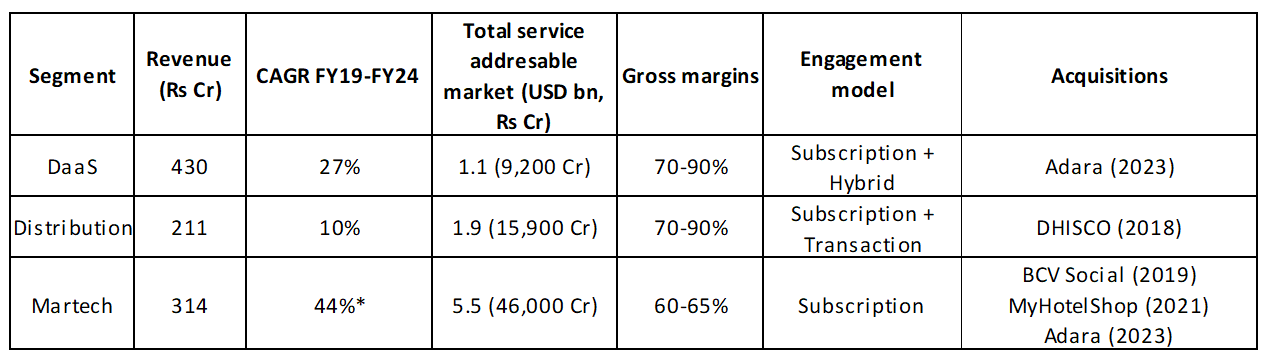

RateGain generates revenue primarily from the sale of its SaaS products, which include DaaS, Distribution, and Marketing Technology (Martech) products offered through its platforms.

*Revenue declined in FY21 on account of Covid

*PMS- Property management systems, CRS- Central reservation system, RMS- Revenue management system

Segment wise detailing-

*Martech (Marketing technology) started in FY21 with acquisition of BCV social, CAGR is from FY21-24

Data Lake (supply) and how it leverages it?

Pricing data is generated by: travel agents powered by GDS (Global Distribution Systems), hotel websites, OTAs, and meta-search sites like Trivago and Kayak.

The company sources its data from three primary sources:

The company also integrates data from various products to enhance others. For example, data from their DaaS products, such as rate shopping and switch products, are used to inform their AI products, improving future predictions. Similarly, extensive business intelligence data enhances the efficiency of their MarTech vertical.

Positives -

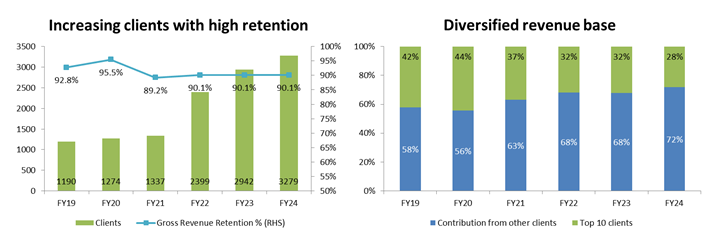

The company maintains a global and diverse customer base with long-standing relationships across various sectors, including travel suppliers and intermediaries such as airlines, hotels, online travel agents (OTAs). The company's AI-enabled platform and technology-focused offerings have contributed to long standing sticky customer base, as evidenced by strong Gross Revenue Retention rates.

*Subscription revenue % was lower in FY24 on full year impact of Adara’s acquisition (fast growing as well as nature of business), LTV to CAC- life time value to customer acquisition cost

Annual recurring revenue (ARR) is calculated based on the last quarter run-rate for resp. fiscal, which are contractually recurring and not one-off. Net Revenue Retention (NRR) – denotes percentage of incremental revenue from same clients compared to previous fiscal. Stable NRR means that company’s clients are growing which is either by wallet share expansion or increase in volumes.

RateGain has built a reliable and scalable revenue stream through its three primary business divisions: DaaS, Distribution, and MarTech. Each division employs a mix of SaaS-based annual subscription fees, hybrid fee models, and transactional models. Majority of these revenues are subscription based leading to predictable revenues. It also is reflected in high LTV to CAC ratio meaning customer acquisition cost is low but life time value is high. The company has Rs. 486 Cr of contracts in pipeline (~50% of FY24 revenues).

Company focuses on acquisition to enter new segments, enter new geographies and then cross sell products. At the same time these acquisitions contribute towards data lake. RateGain has adopted a three-step approach to acquisitions:

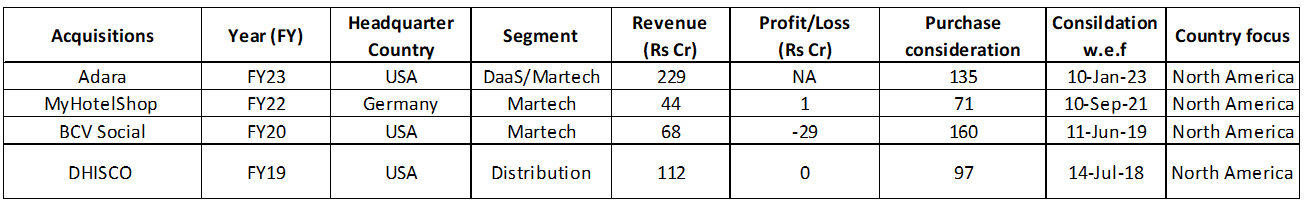

Acquisitions history: Pay low and scale up

Valuation discipline - Management maintains a frugal approach toward acquisition valuations, aiming for a 20% internal rate of return (IRR) and a payout period of 5-7 years for acquisitions. The company continues to scout for targets but remains unwilling to pay inflated valuations, usually paying (1.5-2x revenue). Currently, there are 2-3 advanced stage conversations, with potential deals expected to be consummated in the next 1-2 quarters. The targets are in the DaaS and distribution segments, with a couple of companies having revenues in the US$5-10 million range and others around US$20 million. The company has Rs 1,082 Cr net cash & equivalents to fund these acquisitions.

RateGain uses AI and machine learning to process vast amounts of data, providing real-time insights and recommendations. The company employs AI to optimize pricing strategies, enhance customer experiences, and improve operational efficiency. For instance, RateGain's AI-driven solutions help revenue managers predict market conditions accurately, making better and faster decisions. The company's AI-powered platforms, like Demand.AI and Content.AI, use real-time data from various sources to forecast demand and manage content, respectively.

Presence across all verticals compared to competition

The company's competitors are primarily headquartered in North America, Europe, and Australia. The principal competitive factors in the industry include product functionality and scope, performance, scalability and reliability of services and technology capabilities. The company is well-positioned to compete effectively based on these factors. RateGain offers a full product suite compared to competitors and makes it preferred partner. Also, company is able to save up on costs compared to global peers as it is based in India (lower data center/other costs).

Financials-

*Revenue declined in FY21 on account of Covid