Stocks - Q : Quality | V : Valuation | PT : Price Trend

Funds - P : Performance | Q : Quality

Funds - P : Performance | Q : Quality

About the company:

CMS Info Systems is the largest ATM cash management company in India, as well as one of the largest ATM cash management companies worldwide based on number of ATM points. CMS manages cash logistics for 255,000 ATMs across India and manages close to 18,000 Brown Label ATMs. CMS has deployed its AIOT remote monitoring service at nearly 25,000 sites.

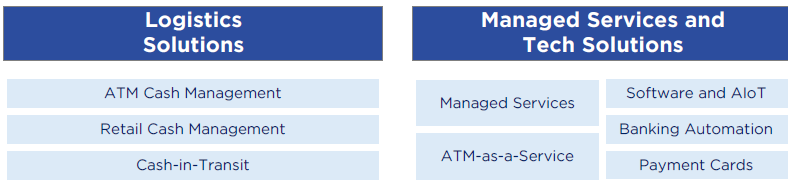

Business Segments:

Cash management services: Under this segment, CMS services banks by helping them replenish their respective ATMs with required cash when necessary. CMS offers Cash in Transit service to Banks, in which it helps banks transfer cash from one branch to another, even across cities along with servicing banks.

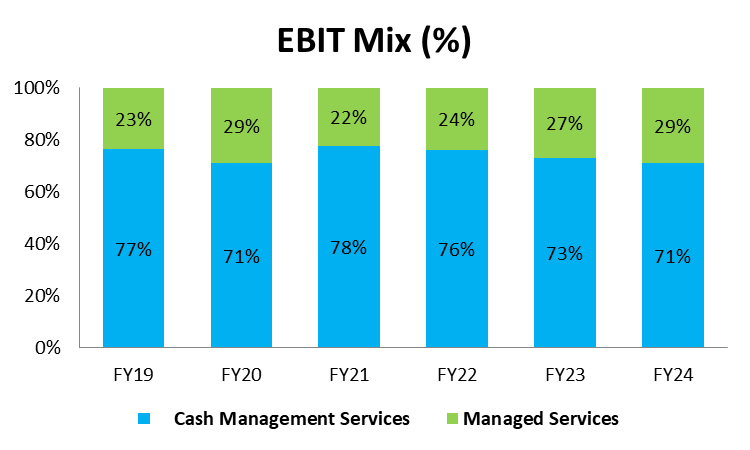

It also helps retail outlets like Petrol Pumps, retail stores, etc. in transferring their cash from the outlets to their respective bank accounts. CMS has innovated in this retail cash management by offering a solution called CashX, in which the cash is deposited in the respective bank accounts as soon as the cash is picked up by CMS, enabling the retail outlet to get access to their money in hours, rather than days. These three sub segments together form the Cash management segment of CMS and this segment contributed to 71% of the EBIT.

Managed Services: Banks outsource their ATM operations to players like CMS, under which it engages in the sale as well as maintenance of ATMs. For this, it has also set up an ATM manufacturing plant in Chennai which has been operational from May 2023. Under this segment, CMS offers a brown label ATM (also known as BLA) management service, in which it set up ATMs for a bank under the bank’s name. Under BLA model, the entire capital expenditure of finding locations and buying and setting up the ATMs are borne by CMS. In turn, it gets fixed revenue, along with a service charge per transaction.

CMS also develops software for ATMs and has deployed this software on ~25% of the ATMs in the country. It also undertakes the cards personalization outsourcing business of Banks but this contributes to a very small chunk of the revenue. CMS has also introduced a technology solutions business where it develops ATM software and also has launched the rapidly growing ALGO AIoT - Advanced Remote Monitoring Solution which replaces the need of having continuous physical round the clock security of an ATM.

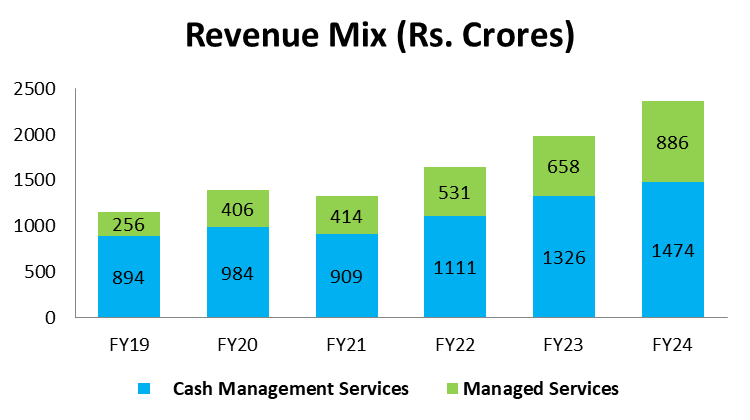

The Revenue Mix stands at ~60:40 in favour of Cash management, which was 70:30 a few years ago.

(Source: Moneyworks4me Research)

(Source: Moneyworks4me Research)

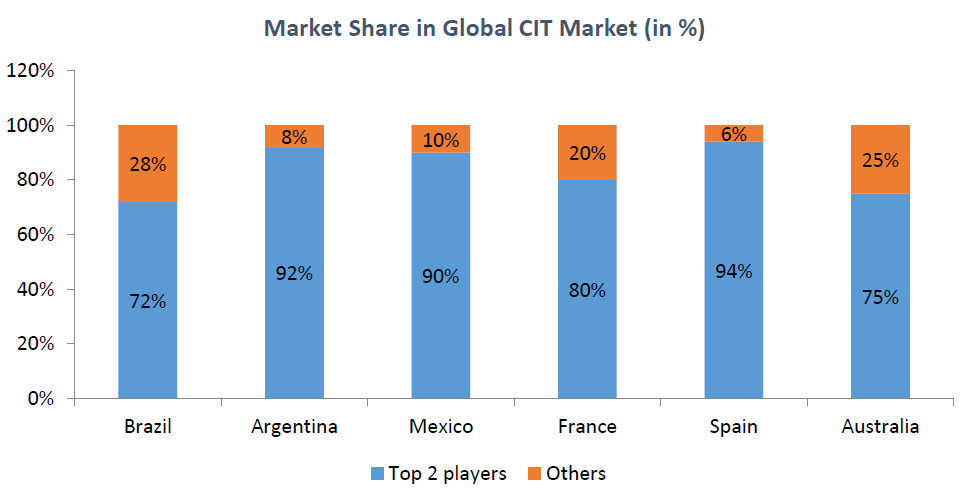

Competition: The main competitors to CMS are international players such Brinks, NCR and listed Indian companies like Radiant Cash Management & SIS Ltd. However, CMS is the largest in India in terms of market share in the cash management vertical with ~40% revenue share. Globally Cash Management is heavily dominated by top players. India, like other global markets, is set to become a duopoly with the top two players expected to have a combined market share of 90% by FY 2027.

Graph below sets out the market shares in the global CIT market in FY21:

(Source: DRHP)

Michael Porters 5 Forces Analysis for CMS:

With the below mentioned analysis we shall understand the business dynamics for CMS in each of its business segments. As we can see on majority of the fronts the negatives for CMS are low and that is the reason it has been able to deliver consistent operating Margins, ROCE and ROEs.

Particulars | RCM/ ATM Cash | Managed Service |

| Buyers bargaining Power | ATM Cash - High, RCM - Low | Low |

| Suppliers bargaining Power | Low | Medium |

| Threat from new entrants | Low | Low |

| Threat of Substitutes | High | Medium |

| Competitive intensity | Low | Low |

Growth Levers:

(A) Busting the Myth: CASH NO MORE KING

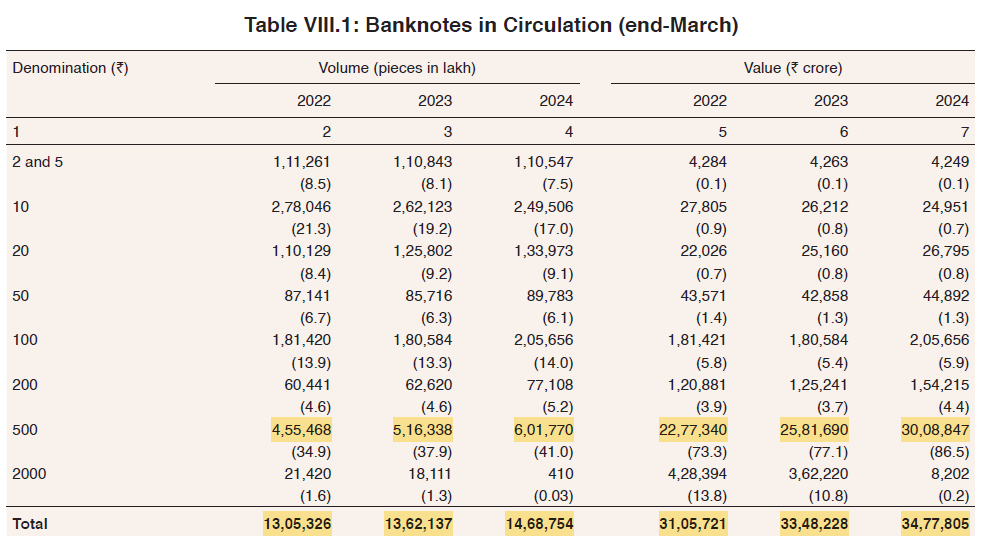

As against popular perception that with the advent of digital payments (incl. UPI), cash usage shall be reducing, currency in circulation (CIC) has been increasing in the past years. As per RBI Annual Report 2024, even after the withdrawal of 2,000 Rs notes, Bank notes in circulation have risen at the rate of 5.8% from the past 2 years.

(Source: RBI Annual Report 2024)

(B) Higher Outsourcing and Replacement led demand: India today has about 250,000 to 260,000 ATMs as an installed base. ATMs in India have an average life cycle of eight to ten years. So every year there will be about 25,000 to 30,000 ATMs come up for replacement. There is also a growth of about 1-2% in the overall network. India had a massive expansion of the ATM network in 2012 - 2014, many of those are now due for replacement, and hence we are seeing a refresh cycle currently.

Increasingly during the replacement, banks want to outsource the entire ATM network management, which significantly increases the addressable market for companies like CMS. It has a 25% win-rate of contracts as it is a relatively new entrant in the BLA sector with current market share which is in the mid-teens. Vertically integrated platform for CMS significantly improves uptimes and delivers a superior quality of service and helps in better cost efficiencies.

(C) Industry consolidation: RBI has set Standards for Outsourcing of Cash Management activities of the banks which include minimum net worth requirement of Rs. 100 Cr & fleet size of 300 vans of specific requirements. This along with other qualitative requirements makes the compliance cost to operate in the industry very high because of which many weak players exit the market.

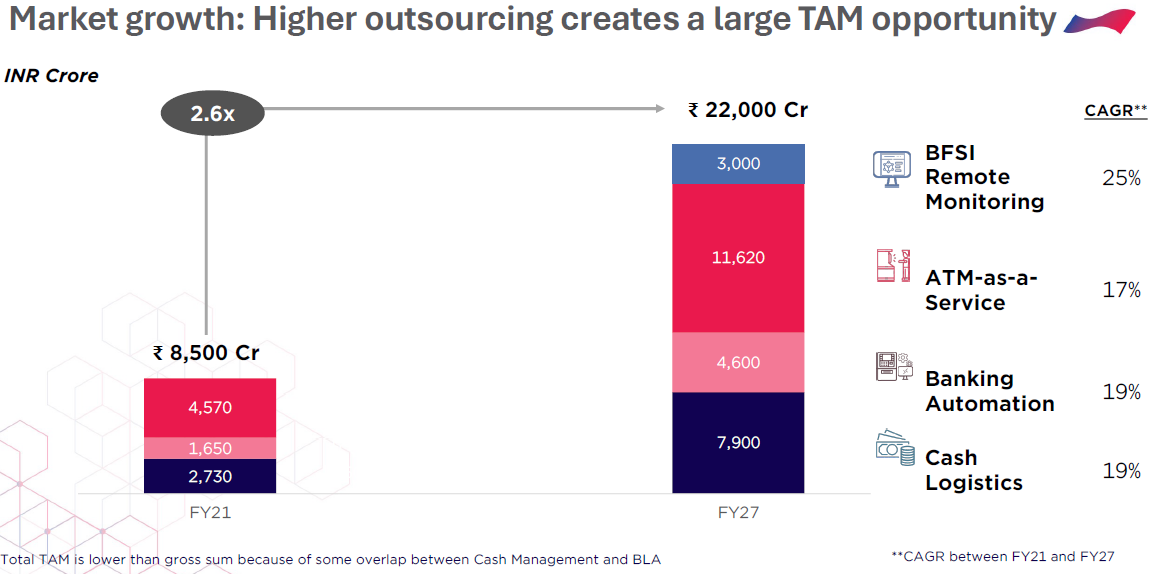

(D) TAM expansion: Company has successfully forayed in new businesses in the past and has ambitions for increasing the market share further with focus on ATM as a service, BFSI remote monitoring and banking automation segment. TAM in the domains is growing as shown below:

(Source: Company Reports)

(E) Strong Order Book

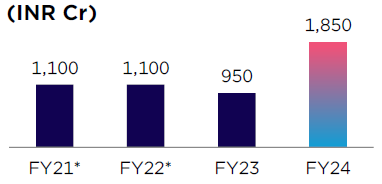

Under the managed services segment, company has received significant orders in the recent years. These orders get operational in 1 year timeframe and orders are for a period of 5-7 years. Cumulative Orders in the past 4 years amount to Rs. 5,000 Cr. Which is more than double of FY24 revenues. This provides us higher visibility in terms of revenue growth that we anticipate from the company.

Company plans to incur a capex of Rs. 150-200 Cr per year for the next 2-3 years for the growth in Managed service (mainly in BLAs). This will be funded through internal accruals.

Yearly Order wins:

(Source: Company Reports)

Positives:

Concerns:

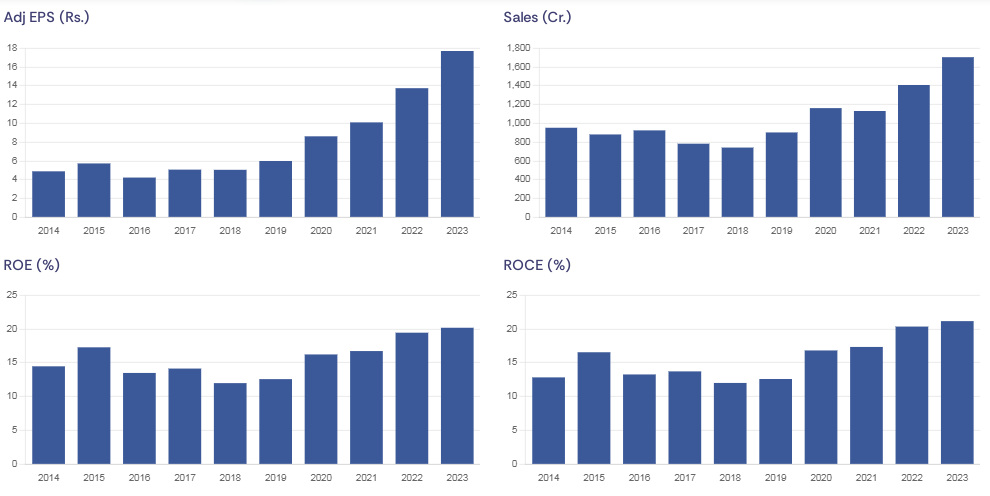

Financials: From 2018 till 2024, CMS Info Systems reported a 15% CAGR growth in net revenue with EBIT growing at 23% CAGR in the same period. The company’s PAT also grew at 28% CAGR from FY18 to FY24. The company has guided that it will achieve a revenue target of roughly Rs. 2500-2700 Cr in FY25 and it is on track to achieve this target.

To Checkout 10 Yr X-Ray Click here

Management Profile: Rajiv Kaul, Executive Vice Chairman, Whole Time Director and CEO: Rajiv has an illustrious career as he was previously the Managing director of Microsoft India and was later associated with Actis Capital LLP as a partner. He completed his BTech degree in Computer Science from BITS Pilani and did his Post Graduate Diploma from XLRI Jamshedpur.

Ownership history: The company’ current chairman Rajiv Kaul partnered with Blackstone and bought out CMS computers from Subhiksha in 2015. Blackstone later sold its stake in CMS to another PE firm Barings via its affiliate company Sion. Sion being a VC firm exited its stake in the company recently (Feb 2024). Rajiv Kaul currently holds a 6.19% stake in the company as of March 2024, marking a sharp increase from the 2.6% held in the previous quarter.