Stocks - Q : Quality | V : Valuation | PT : Price Trend

Funds - P : Performance | Q : Quality

Funds - P : Performance | Q : Quality

About IGL

Indraprastha Gas Limited (IGL) is in the business of city gas distribution (CGD) in Delhi. IGL also supplies the gas to the nearby regions of Noida, Greater Noida, Ghaziabad, Hapur, Gurugram, Meerut, Shamli, Kanpur, Muzaffarnagar, Karnal and Rewari, Hamirpur, Fatehpur, Ajmer, Pali, Rajasmand.

IGL is formed as a JV promoted by GAIL (India) Limited and Bharat Petroleum Corporation (BPCL), each owning 22.5% equity. Also, Government of NCT of Delhi is holding 5% equity.

What are its Product Segment?

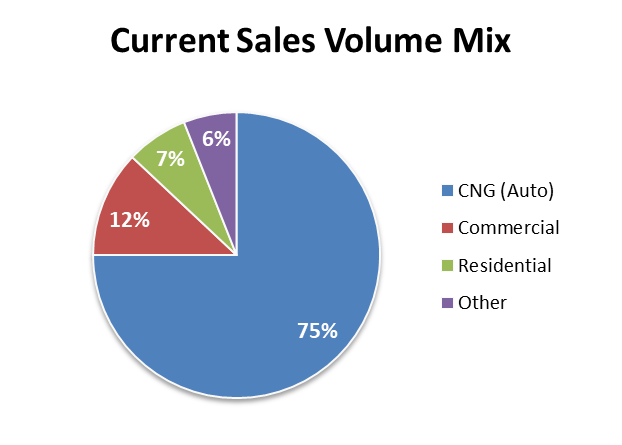

CGD sector has two segments - Compressed Natural Gas (CNG) predominantly used as auto-fuel, and Piped Natural Gas (PNG) used in in domestic, commercial and Industrial segments

Currently IGL derives 75% of its volume from CNG segment and remaining 25% from PNG segment.

What was historical Growth Rate?

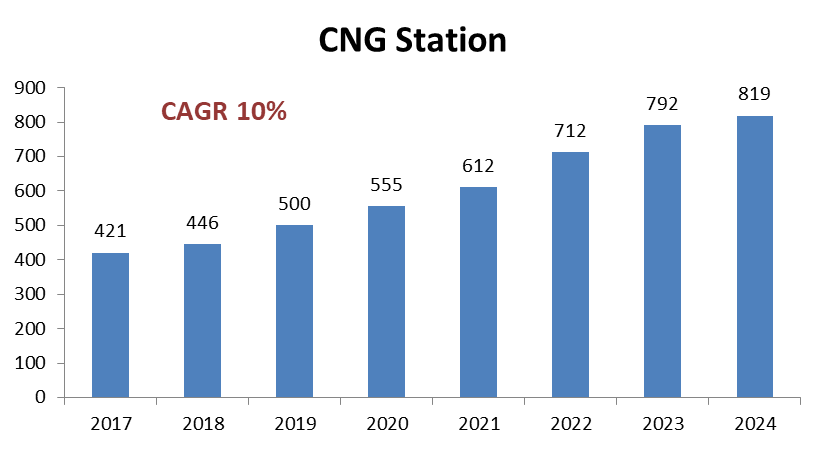

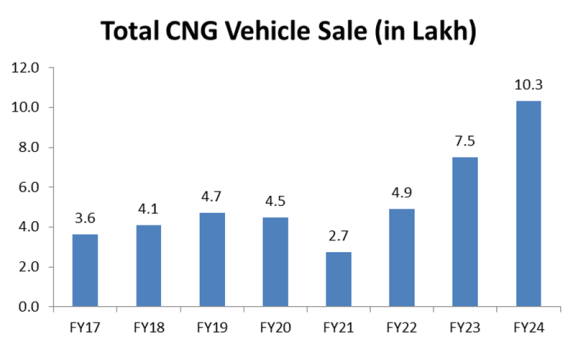

Over the last seven years, IGL has achieved a compound annual growth rate of 9% in the CNG segment's volume and 10% in the PNG segment's volume. During the same period IGL has increased its CNG infrastructure by 10%.

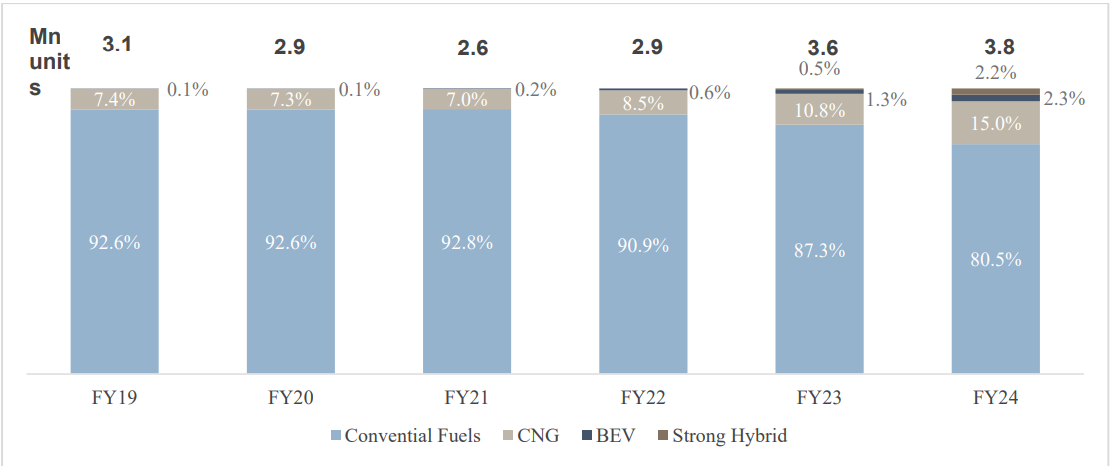

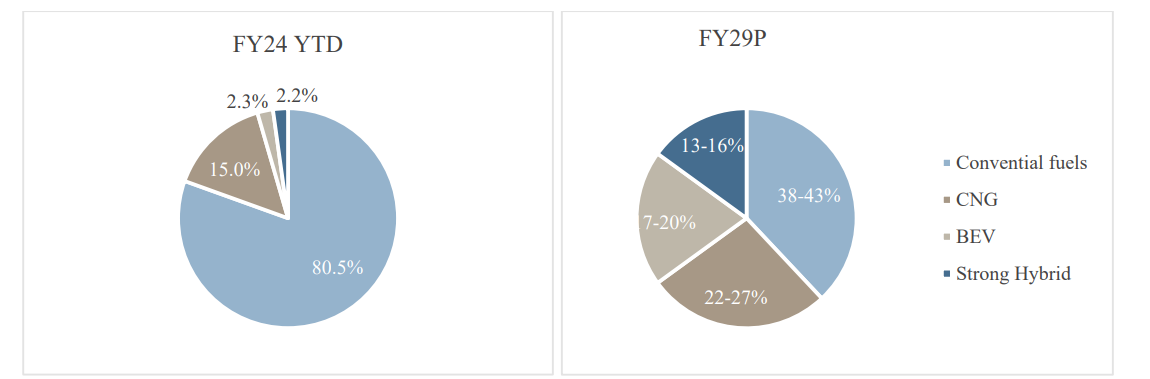

The share of CNG variants in passenger vehicle expanded from 7.4% in FY19 to 15% by FY24.

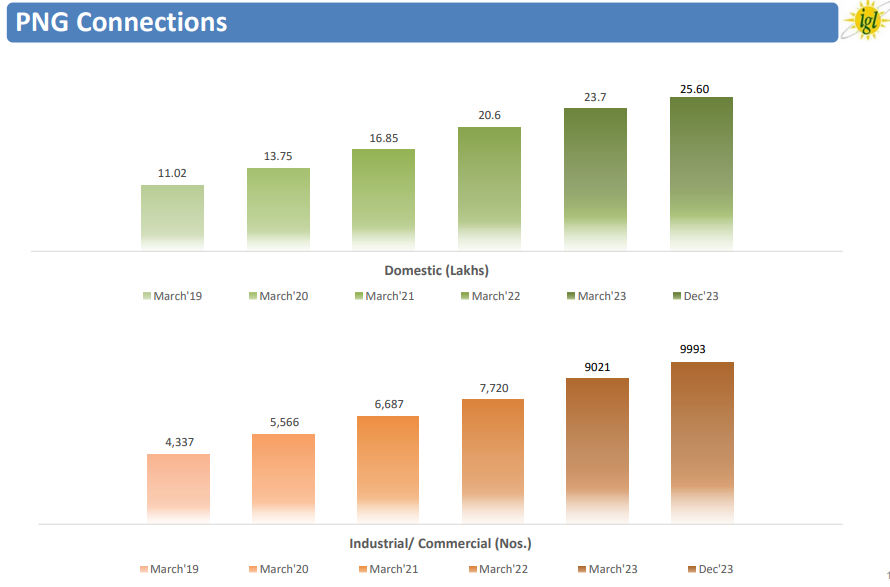

Since March 2019 IGL has expanded its PNG connection network significantly, growing from approximately 11 lakh to around 26 lakh domestic connections and from 4,337 to 9,993 industrial/commercial connections.

What is Future growth rate?

India has embarked on an ambitious trajectory to amplify its existing 6% share of natural gas in the energy basket to 15% by 2030. CGD will play pivotal role in the same. Healthy growth in CNG station infrastructure will drive the growth of CNG vehicle share. According CRISIL MI&A, by FY29 share of passenger vehicle CNG variants is estimated to rise to 22-27% from the 15% share clocked in FY24.

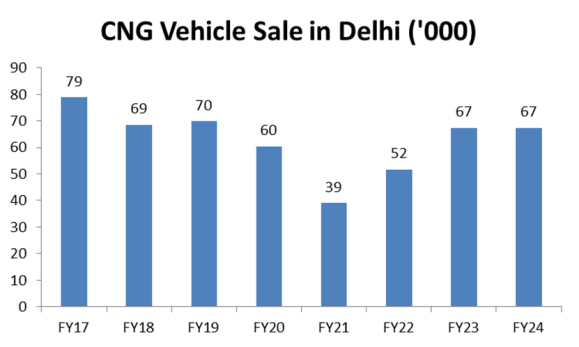

Delhi being early adopter of CNG infrastructure saw significant CNG vehicle penetration during 2017-18 period due to ban on diesel vehicles. Sales peaked at 79,000 units in FY17 and have since stabilized around 67,000 units in FY24. This trend indicates that while Delhi's market for CNG vehicles is reaching saturation, the overall CNG fleet continues to grow at a moderate pace. Future growth opportunities for CNG vehicle sales are expected to come from less penetrated regions, particularly in Uttar Pradesh, where CNG infrastructure is still developing.

What is the future Capex Plan?

IGL has envisaged annual capex of around Rs. 1,200 crore from FY24 to FY26. This capex will be for development of CGD network in the newly awarded GAs (Geographical Areas) and expansion of CGD network in its already authorised / operational areas. The said capex plans of IGL are envisaged to be funded through internal accruals. As of March 2024 IGL has Rs. 2,149 Cr cash and bank balance.

What are the other Investments?

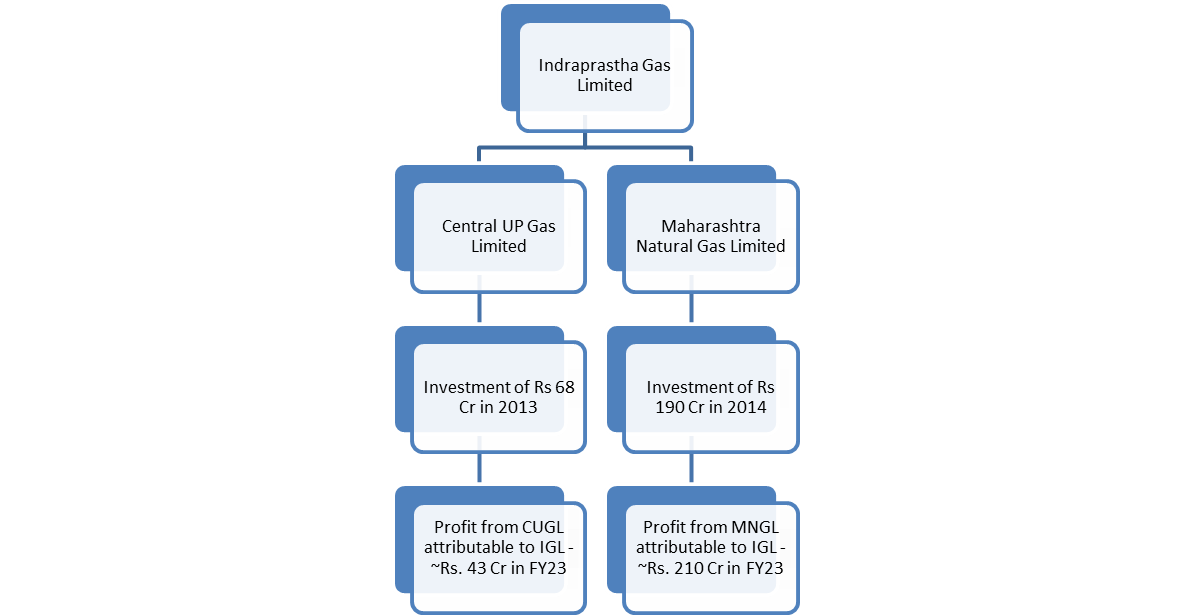

IGL has acquired 50% stake in the two CGD companies

What are the concern areas?