Stocks - Q : Quality | V : Valuation | PT : Price Trend

Funds - P : Performance | Q : Quality

Funds - P : Performance | Q : Quality

Allcargo Logistics is a engaged in providing integrated logistics solutions. It is one of the world’s largest LCL (Less than container load) consolidator based in India having around a 15% market share. LCL consolidations is where the logistics player books container berths with the shipping companies and then sub leases that space to different customer wanting to ship their goods. This is a win-win situation for all the parties involved, as the customer doesn’t have to pay for an entire container, while players like Allcargo can charge favourable rates. Allcargo also provides FCL (Full container Load) services.

Allcargo also operates Contract logistics and Express logistics under its listed subsidiary Allcargo Gati, thus providing an end to end supply chain solution to businesses.

Has the company undertaken any corporate actions in the past?

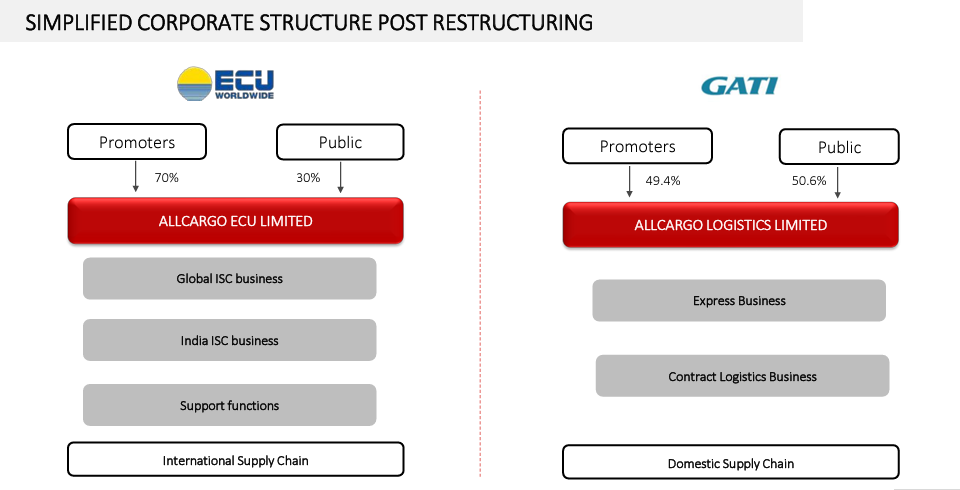

Phase (I complete) - During CY23, Allcargo had completed the demerger into 3 units, namely Allcargo Logistics, under which the International supply chain, express logistics and contract logistics are housed, Allcargo Terminals, operating the CFS/ICD (Container Freight Stations/ Inland Container Depot) business and TransIndia Realty, which operates logistics parks and crane rentals.

Phase II (by January 2025) - Further to this, Allcargo also has demerged its International supply chain business, under the name of Allcargo ECU Ltd. Allcargo’s contract logistics and express logistics business, which are housed under a complex structure of step-down subsidiaries, will be merged under a single subsidiary, named Allcargo Gati, which will then be merged into the main company, Allcargo Logistics after the demerger of the International Supply chain. This will conclude the ~ 4 year transformation journey, which has been done with an aim of making businesses strategically independent, providing financial flexibility, making the corporate structures simple and identifying core businesses for transformation and growth, whilst exiting non-core businesses.

Allcargo Gati is the holding entity of both the contract logistics and express logistics business post demerger.

What is the overall Industry Overview?

The Indian logistics sector is poised to grow in the range of 10%-12%, to USD 380 Billion by FY25. India’s logistics cost is around 12%-14% of the overall GDP, which the government has targeted to bring down to less than 10% of the GDP. These initiatives are in the areas of boosting infrastructure, effective policymaking, among others

What is the financial Performance of its various business segments?

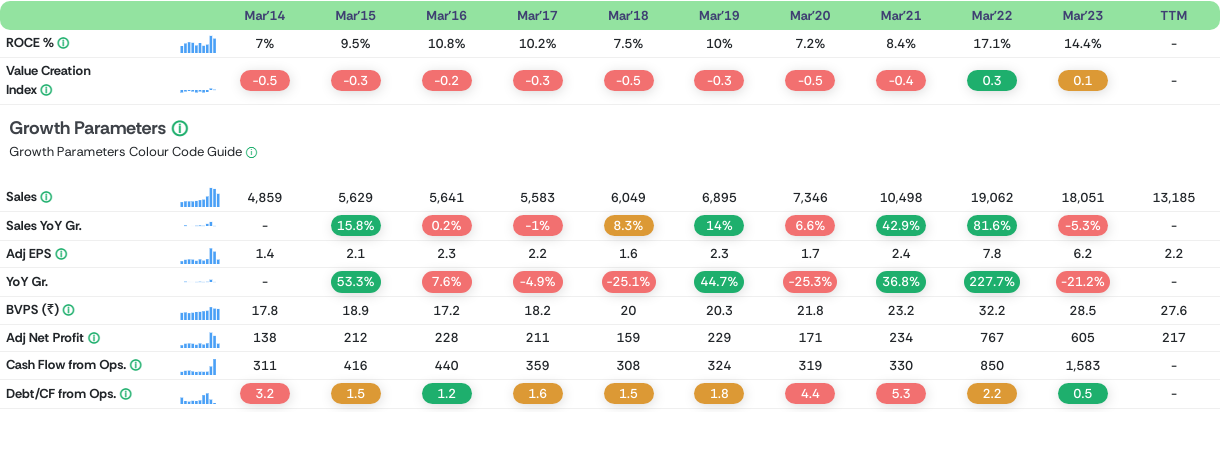

What has the historical performance of the overall business?

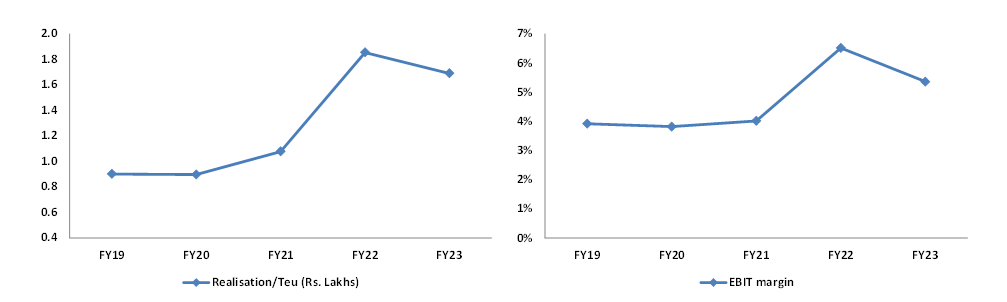

Allcargo experienced accelerated growth in FY21 and FY22, primarily driven by better realisation per TEU (Twenty Foot Equivalent) during covid. The growth of the LCL segment is mainly driven by growing e-commerce and trade around the globe. Given its inherent nature, LCL as a business is more profitable than FCL consolidation, given that any freight rate increase can be passed to the customers, thus protecting the margins, while in FCL, the margins are dependent on the freight rates.

What are the Capex plans of the company?

The business operates on an Asset Light Model, and hence does not incur significant capex, apart from routine refurbishment of their premises, IT capabilities and the maintenance capex of Rs.250 crores. In FY23, the company had transferred roughly about Rs.727 crores of assets to subsidiaries, on account of the demerger of its units.

What are the growth and margin prospects of the company?

Allcargo’s near term outlook is negative, given the stagnating volumes, which the management expects to come back in the second half of CY24. In the long term however, Allcargo will grow at a higher rate, given the governmental impetus on the logistics and manufacturing sectors of the country. The domestic logistics business should also do well, given the rising trade in ecommerce and increased demand for end to end outsourcing of logistics operations in the country. This, combined with the shift from unorganized players to organized players in this sector bode well for companies like Allcargo.

The margins of the company are heavily dependent on the volume mix of LCL and FCL and LCL is more profitable than FCL. The business of FCL is dependent on freight rates, which have normalised post Covid. Generally, when freight demand shoot up, companies like Allcargo stand to have a better margin, given the increased use of 40 ft containers and higher utilization in general, as can be reflected in the EBIT margins seen in the charts below. We expect the EBIT margin to stabilise in next few years.