You’ve heard about it a lot. Finally, you decide to experience it for yourself…

Yes. it’s investing we’re talking about.

As soon as you start your investment journey, you may come across several terms that simply seem to fly over your head. These stock market terms are used commonly by the investing and trading fraternity alike. Getting familiarised with these terms can greatly help you in your journey towards investment success.

We hope this mini stock market glossary, simplified by MoneyWorks4me, helps you stay informed and make rational decisions when it comes to investing in the Indian Stock Market.

1. Stock/Share:

The basic stock market term ‘stock’ or ‘share’ is used to indicate ownership of a company, representing a proportionate claim to the company's earnings and assets.

2. Bull Market:

A commonly used term in the share market, the bull market refers to a situation where stock prices are continuously rising for a sustained period from a few months to a few years. A bull market signals improving investor confidence in the economy or global GDP, increasing sales and profits, declining unemployment, etc.

3. Bear Market:

The bear market indicates a scenario where the stock prices are rapidly decreasing (a decline of at least 20% from previous highs over at least two months). A bear market signals loss of investor confidence triggered by a slowing economy, increasing unemployment and inflation, and in some cases possible recession.

4. Asset Allocation:

Asset allocation is the practice of distributing your investments among various asset classes like equity, debt, gold, etc. in an attempt to balance the risk and reward in the portfolio. Asset allocation takes into consideration an individual’s risk profile, financial goals, and investment horizon.

5. Equity:

Equity refers to the shared ownership of a company. This is the value of total stock/shares outstanding; the sum of money that a company’s shareholders will receive in return when all of the assets are liquidated, and the company’s debt is paid off. The accounting equation is;

Asset – Liabilities = Equity.

6. CMP:

This is a stock market abbreviation of Current Market Price referring to the price at which the shares are currently trading.

7. Market Capitalization:

Market Capitalization tells you the current market value of a company. Based on market cap, a company can be classified as large, mid, or small. It’s calculated by multiplying the company’s total outstanding shares and its current market price.

8. Large Cap Stocks/Funds:

Another important term related to the stock market you may have heard often is Large Cap Stocks or Funds. At present, companies with more than 20000 Cr market cap values are classified as large cap stocks. Mutual funds investing at least 65% of their corpus in such companies are classified as ‘Large Cap Funds’. Most of the large cap stocks are mature and stable companies, high dividend payers, and widely tracked by the investing community.

9. Small Cap Funds:

Companies with a market capitalization of less than Rs. 5000 crores are referred to as Small Cap Stocks or Funds. Mutual funds mandated to invest at least 65% of their corpus in small cap stocks are classified as small cap funds. Small cap companies have the potential to grow faster than large and mid-companies. However, they are also extremely risky investments as their survival rate is low and many can go bust in an economic downturn. Investors should think about investing in them only if the investment horizon is long, 7-10 years.

10. Dividends:

Dividend refers to the distribution of a part of the company’s profits earned during a particular quarter/financial year.

11. Index Fund:

Index fund refers to a portfolio of stocks or bonds designed to imitate the performance and composition of a particular index. Being a passively managed fund, it has lower expenditures and fees as compared to actively managed funds.

12. Fund Manager/Portfolio Manager:

A fund manager is a person or group of persons responsible for implementing the chosen investment strategy through buying and selling stocks in the portfolio. They usually charge a fee for their work, which is basically a percentage of the fund’s average AUM or assets under management.

13. Debt Fund:

A debt fund is a type of mutual fund that invests mainly in fixed-income investments like bonds, money market instruments, etc. Debt funds usually have lower management costs as compared to equity funds.

14. Price change:

Price change signifies a change in the value of a particular security, positive or negative. Though it can be calculated across any period of time, the most commonly reported is the daily price change. Daily price change captures the difference in the price of a security over the previous day’s closing price.

15. The 52-week high/low:

52 week high/low is the highest and lowest price that the stock has traded at in the past 52 weeks. It’s an important technical indicator used to determine future trends of stock prices.

16. Return on Equity (ROE):

ROE is an important measure of the company’s financial performance. It measures how effectively a company utilizes its assets to generate profits and is calculated as Net Income / Shareholders Equity; where Shareholders Equity = Assets - Liabilities

17. The price-earnings ratio:

The P/E ratio is a ratio of the company’s share price over its earnings per share. It indicates how much investors are willing to pay for every rupee of earnings. A PE ratio can be used to determine whether a company’s share price is relatively high or low as compared to its own past or as compared to its industry peers. Keep in mind that a high PE stock is not always overvalued, while a low PE stock is not always undervalued.

18. ?The price to book value (P/BV) ratio:

P/BV ratio measures the market value of a company relative to its book value. P/B ratio is used by value companies with negative earnings or asset-heavy companies like banks or manufacturing companies. Generally, P/B ratios of less than 1 are considered as low. Again, a high P/B ratio isn't always indicative of overvaluation, similarly, a low P/B isn’t indicative of undervaluation.

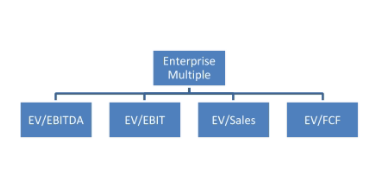

19. Enterprise multiples:

An enterprise value is a more accurate measure of the company’s worth as it values the firm with the perspective of a potential acquirer by including debt, the value of preferred shares, and minority interest, but minus cash. Therefore, EV multiples tend to be a better measure of valuation than their counterpart price multiples as they aren’t impacted by the changes in the company’s capital structure. The usage of enterprise multiples may differ based on the industry:

19.1 Enterprise Value (EV) / EBITDA: (Earnings Before Interest, Taxes, Depreciation, and Amortization): It’s the measure of a company’s total value ( or enterprise value) over its earnings/EBITDA. This ratio tells investors how many times EBITDA they have to pay, where they are to acquire the entire business.

19.2 EV/EBIT: The EV/EBIT ratio compares the total value of a company to its earnings before interest and taxes (EBIT). EV/EBIT is commonly used as a valuation metric to compare the relative value of different businesses. Though similar to the P/E ratio, it makes up for some shortcomings of the latter.

19.3 Enterprise value/sales: The EV/Sales ratio compares the total value of the company to its sales. It measures how much investors are willing to pay per unit of sales. It’s used to compare companies with substantial differences in accounting policies. It’s also useful in valuing companies with negative free cash flows or unprofitable companies.

19.4 EV/FCF: Enterprise Value to Free Cash Flow compares the total valuation of the company with its ability to generate cash flow. The lower the ratio, the faster a firm can generate cash to reinvest in its business or pay back the cost of its acquisitions.

20. Trading volume:

Trading volume is basically the number of shares being traded in any given period. A high trading volume indicates a high level of interest in that particular stock. It’s an important tool in technical analysis, where trading volume is used to determine the strength of the technical indicator.

21. Liquidity:

In the context of stocks, liquidity refers to how quickly and easily a stock can be bought or sold without affecting its price. Eg. a stock with consistently high trading volumes is considered to be liquid, as both buyers and sellers are present in large numbers

22. Volatility:

In simple terms, volatility means how much a stock's price moves around its mean price. Statistically, it’s a measure of the stock prices’ dispersion of returns. Usually, the higher the volatility, the riskier the stock. It’s measured as the standard deviation or variance between returns of the stock and the market index.

23. Moving Average:

The moving average (MA) is a commonly used technical analysis indicator. It smooths out price data by creating a constantly updated average price. The average is taken over a specific period of time, ranging from a few minutes to days and weeks. Moving averages are used to identify stock price direction and support/resistance levels. The two most popular types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

23.1 Simple Moving Average: It’s simply the average stock price over a specified period. Eg. a five-day SMA adds up the last five days' closing prices and divides it by five to create a new average each day.

23.2 Exponential Moving Average: EMA places more weightage on the most recent stock prices. The EMA reacts to price changes faster than the SMA, due to additional weightage on recent price data. However, it doesn’t necessarily mean that it’s a better indicator than the SMA.

24. Diversification:

Diversification is an effective risk management strategy that helps reduce the risk in your portfolio. It means allocating your investments across multiple asset classes (Equity, debt, gold, and real estate). Within equities, diversification ensures you make multiple investments across industries and stocks which saves you from a major loss if one of the stocks or industry is in a bad phase.

25. Mutual Funds:

A mutual fund is a pool of funds collected from multiple investors for the purpose of investing in stocks, bonds. Mutual funds are professionally managed by a fund manager. It can be open-ended or close-ended investments (schemes with lock-in periods, cannot be bought/sold in between).

Keep learning!

These 25 popular stock market terms are just the tip of the investment iceberg. However, this can give you a basic idea about the commonly used terms tossed about in trading platforms.

Take your first step into the world of stock market investments with expert advice from MoneyWorks4Me.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: