Cyient DLM Limited IPO Details:

Estimated Market Cap: 2,000 Cr

IPO Date: 27th June to 30th June

Total shares: 2.23 Cr

Price band: ? 250- ? 265 per share

IPO Issue Size: ~ ? 592 Cr

Lot Size: 56 shares and multiples thereof

Purpose of IPO: Fresh Issue for repayment of debt & working capital requirements.

About Cyient DLM Limited:

Cyient DLM is a leading integrated EMS (Electronic Manufacturing Services) and solutions provider with a strong focus on the entire life cycle of a product, including design, build, and maintain. With over two decades of experience, the company is a qualified supplier to global OEMs in the aerospace and defence, medical technology, and industrial sectors. It is one of the few EMS companies in India catering to highly regulated industries and the largest supplier of EMS services to the aerospace and defence industry by value in India.

The company has derived significant advantages and a strong competitive edge from the sector expertise of its Promoter Cyient Ltd. which was named in the ‘Leadership zone’ by the Information Services Group across aerospace, telecommunication, semiconductors, industrial, and medical devices verticals.

Cyient DLM is led by a diversified Board with an average of over seven years in the EMS industry, which is supplemented by its professional management team with an average of over 20 years of industry experience. The leadership team is supported by a workforce of 634 full-time employees and 387 contract workers and an NPI and engineering team of 68 persons and an enhanced in-house quality control system team, in addition to Cyient Limited’s design team.

About the industry

The India EMS is a sizeable industry, contributing to 2.2% (USD 20 billion) of the global EMS market in CY2022. India’s EMS industry is the fastest growing among all countries at a CAGR of 32.3% and is expected to contribute 7.0% (USD 80 billion) of the global EMS market in CY2026. The expansion of India's EMS industry is being fuelled by a variety of factors. Significant reasons driving the growth are raising labour costs in other parts of the world and a trend among large OEMs to outsource manufacturing rather than invest in their own infrastructure

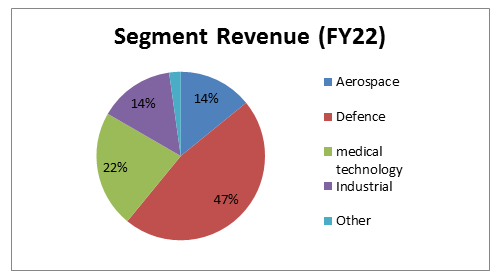

Portfolio of the company and Revenue breakup

The Company’s solutions primarily comprise: (i) printed circuit board (“PCB”) assembly (“PCBA”), (ii) cable harnesses, and (iii) box builds which are used in safety-critical systems such as cockpits, inflight systems, landing systems, and medical diagnostic equipment.

It provides services across the product life cycle for clients by acting as an integrated service provider who can support their manufacturing and after-market services needs, as well as their design needs by leveraging the Promoter’s design team. As a strategic partner to clients across highly regulated industries, company enjoys long-term relationships with high customer stickiness and a high proportion of repeat business, which allows it to have strong visibility on future revenue and a stable client base.

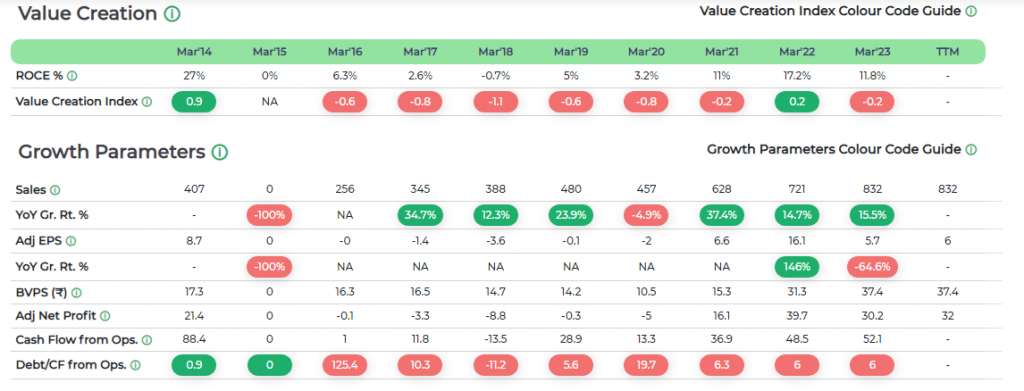

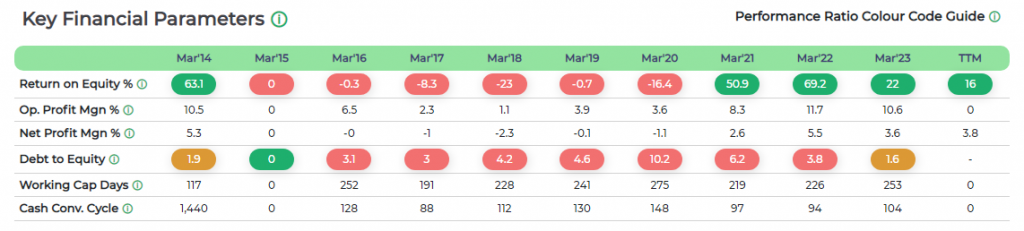

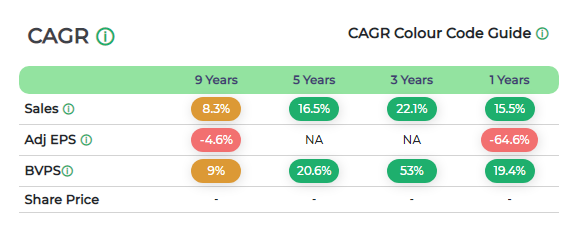

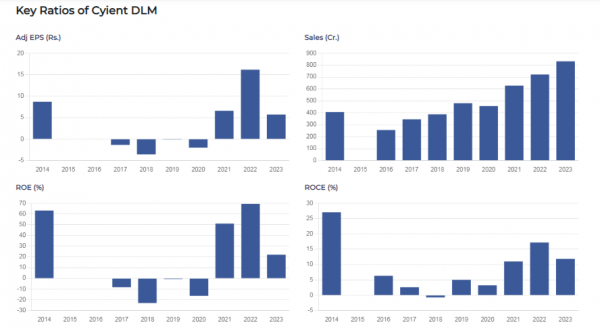

Financial:

Cyient DLM Ltd has shown consistent revenue growth over the years. The company’s revenue has grown at a CAGR of 16% over the last five years. The Company turned profitable in the year 2021. The gross margins have been volatile ranging from 3% to 12%. Interest is a significant component of its cost currently, however this shall reduce significantly post the issue. Management is keen on becoming net debt-free except for the promoter entity debt of about 200 Cr, this shall aid its net margins going forward.

[caption id="attachment_18885" align="aligncenter" width="770"] Source-MoneyWorks4Me, Company Data[/caption]

Source-MoneyWorks4Me, Company Data[/caption]

[caption id="attachment_18886" align="aligncenter" width="770"] Source-MoneyWorks4Me, Company Data[/caption]

Source-MoneyWorks4Me, Company Data[/caption]

Key Financial Ratios and Trends:

Management:

Rajendra Velagapudi is the Managing Director of the Company. He holds a bachelor’s degree in technology from Faculty of Engineering, Nagarjuna University, a master’s degree of engineering in automobile engineering from Anna University, Madras and degree of Master of science in design of rotating mechanics from School of Mechanical Engineering, Cranfield University. Prior to joining the Company, he worked with Ford Truck Manufacturing Division, Simpsons Co. Ltd., Bajaj Tempo Limited and Bharat Earth Movers Limited.

Ganesh Venkat Krishna Bodanapu is the Chairman, Non-Executive & Non-Independent Director of the Company. He holds a bachelor's degree of science in electrical engineering from Purdue University and a master's degree in business administration from the J.L Kellogg School of Management, Northwestern University. He has been associated with the Promoter Company (Cyient Ltd.) since 2003 and currently is the managing director and chief executive officer of the Promoter entity.

Competition:

The Indian EMS market comprises various tiers of companies including global EMS companies with operations in India and large and mid/small Indian EMS companies. Company faces competition from Indian EMS providers such as SFO Technologies Private Ltd, Bharat FIH Ltd, Avalon Technologies Ltd, Syrma SGS Technology Ltd and Elin Electronics Ltd, and international players such as Hon Hai Precision Industry Co. Ltd. (Foxconn), Pegatron Corp, Quanta Computer, Inc., Plexus Corp., Flex Ltd., Compal Electronics, Inc., Wistron Corp, Jabil, Inc

Positives:

- The company has the ability to provide integrated engineering solutions with strong capabilities across the product value chain.

- The Industry has high entry barriers for competitors due to the required technical expertise & capabilities in safety-critical electronics in highly regulated industries.

- Company has robust and industry leading order book with marquee customers, with whom they enjoy sustained and long-standing relationships as their preferred partners.

Risks:

- Cyient DLM’s business is dependent on the sale of its products to certain key customers. The loss of any of the key customers could have a material adverse effect on its business. Company is dependent on certain of its key customers, especially Honeywell International Inc., Thales Global Services S.A.S, ABB Inc., Bharat Electronics Limited and Molbio Diagnostics Private Limited.

- Company depends on third party suppliers for raw materials and components, which are on a purchase order basis. Such suppliers may not be able to perform their conditions in a timely manner, or at all and any delay, shortage, interruption, reduction in the supply of or volatility in the prices of raw materials on which company rely may have a material adverse effect on its business.

- There may be problems with the products company designs through the design team of the Promoter, manufacture or service that could result in liability claims against the company, reduced demand for its services and damage to its reputation.

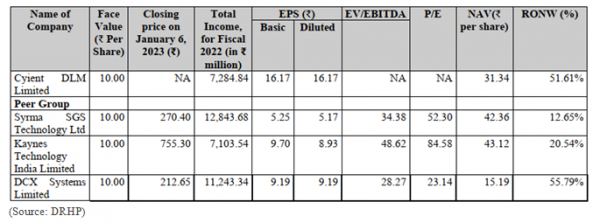

Valuation:

Based on the price band, the company is being listed at Rs 2,000 crore at the upper end of the price band. This implies an EV/EBITDA ratio of around 23x based on TTM earnings.

Relative valuation of the Indian Listed Competitors is as follows:

MoneyWorks4Me Opinion:

The company has created a niche place for itself in the EMS and solutions-providing segment. The manufacturing sector of India has the potential to grow multifolds in the coming period. India has started to look as an attractive hub for foreign investments in the manufacturing sector just like it already was for the Services sector. Several brands have set up or are looking to establish their manufacturing bases in the country. The cost of manufacturing in India is the edge that is going to stay, the key here is how fast can Indian players increase their technological capabilities so as to be able to compete with the global players.

At present 65-70% of Cyient DLM’s revenue is exports, going forward when some part of the manufacturing assemblies for Aerospace, Electronics, Semiconductors come to India, Cyient DLM can be a reliable & capable partner to cater to their EMS needs thus increasing the share of domestic revenue as well. With currently just 2% of the global EMS market, the opportunity this industry provides is huge. Cyient DLM is a great play on this EMS theme.

Recommendation: Investors should Apply

Cyient DLM is expected to do well over the next few years as it wins more clients & orders. As per our analysis the IPO looks to be fairly priced, we would recommend retail investors to apply for the issue.

Important points to consider:

- IPOs in a popular sector often gets oversubscribed and retail investor is fortunate if he receives even 1 odd lot (Rs 15,000) in IPO allotment. Since this investment amount is small for our average investor, we recommend SUBSCRIBE in good companies with favorable prospects over the medium term.

- However, do not consider large investments in IPO stocks post-listing as they get listed at even higher valuation; additionally, they may overpromise for IPO success but under-deliver in reality.

- Conservative investors who wish to own a portfolio of Core companies must avoid investing in expensive or mid-small cap IPO.

Note: We do not recommend buying just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on a business model and valuation.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: