It was not too long back that the crash of stock market in 2008-09 took us by storm. The world witnessed one of the worst financial crises since the Great Depression of 1929. India’s impressive GDP growth of over 8 % (average over 4 years before the crash) came down to 6.4% in 2008-09. The confidence of consumers, investors and companies took a huge hit.

However what was more remarkable than the crash was the recovery. Within a year or so the confidence of consumers & investors was restored. Companies started posting good numbers; India’s GDP growth rate was back on track. The stock market once again bounced back to close to the 20,000 level.

The question then is – How did this revival happen? Did it happen by itself or was there a catalyst which made it possible? Yes. There was a catalyst which led to the revival and it was the government spending.

So, what is Government spending?

Government spending is the sum total of the total expenditure that a government makes in a financial year. For e.g. India’s total Government Spending is 10.9% of its GDP. The Government is a separate entity which can act as

- A Consumer - The government consumption expenditure involves its expenses on goods and services for collective consumption, upkeep of its numerous departments and the purchases required for them.

- An investor - In the true sense, Government invests for the development of the country and the economy. It spends heavily on developing the infrastructure of the country which propels the current and future growth for the economy.

Government incurs expenditure on economic and social activities like agriculture, rural development, transport, education, health, water supply, welfare of backward of classes etc. In a developing economy like India which is marred by a wide gulf between haves and have-nots, it becomes the prerogative of the government to carry out social welfare projects like National Rural Employment Guarantee Scheme (NREGA). Such projects have helped create large scale rural employment which increases the disposable income and overall demand in the economy.

A large part of the government’s expenditure is incurred on repayment of interest on loans, providing subsidies to industries like petroleum, agriculture, fertilizer etc, defense payments and maintaining the law & order situation in the country. To summarise, there can be no substitute for government spending in a developing economy like India.

So, when does the Government Spending become indispensable?

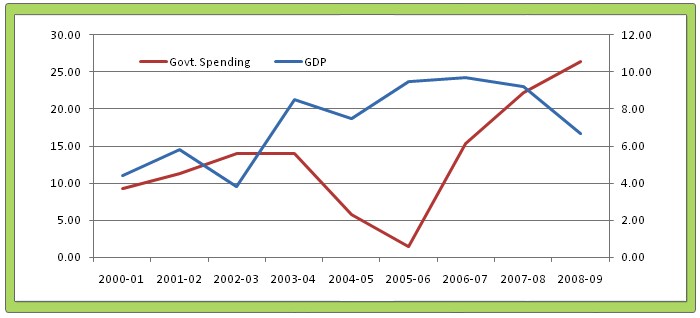

Before we get to the answer, have a look at the graph below.

The above chart shows the GDP growth rate and Government spending during the period 2000-2010. It is seen that during the year of 2008-09 the growth rate in GDP slowed down to 6.7%, prompting the government to increase its overall spending in the economy by 26.4%. A company or industry might be able to compete with rising prices, cut throat competition from domestic and international players but what it is unable to compete with is – Lack of Demand. During a crisis the government increases its spending to propel the demand in the economy and combat this exact situation.

Let’s see how

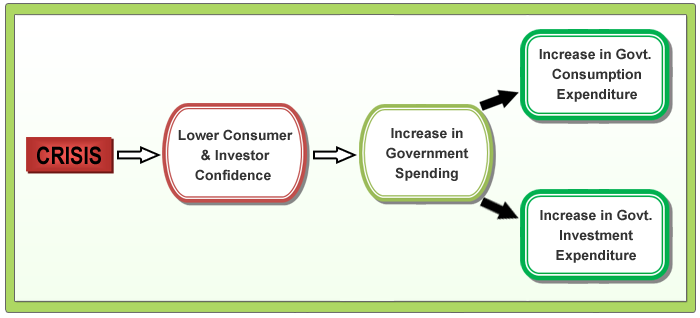

When the economy is going through a downturn, the first impact is on the consumer confidence which is beaten down. This in turn pulls down investor confidence too. The result is a fall in consumer demand and industrial production (Read more on Consumer Spending & IIP to find out its full impact).

To combat this, the government takes strong actions by increasing its spending on key sectors and also increasing its own consumption expenditure to revive the falling demand situation in the economy. This is exactly what happened in 2008-09; the government increased its expenditure on key sectors like agriculture, irrigation, transport, communication, energy etc. by approx 42% to Rs. 2,04,129 Cr. (much more than the average growth of 17.4% on key sectors during 2000-2007). It also increased subsidy expenditure by approx 82% to Rs. 1,29,243 Cr.

A crisis is a situation when the government spending takes precedence over normal business activity. But be it crisis or no crisis the importance of government spending cannot be overlooked.

But can the government continue to spending endlessly? Not really. The government also looks to promote private investment in the economy. As seen in the chart above, the growth in Government spending fell from 14.02% in 2003-04 to 1.5% in 2005-06. This was the time when the GDP was growing steadily and private investment was also on a high. During these times the government concentrates more on welfare activities.

Impact of Government Spending: Industry based Analysis

Now that we know the importance of Government spending, let’s understand how it impacts particular industries or sectors. The government propels the growth in an industry by either increasing it’s spending in it or supporting it in the forms of subsidies, lower interest rate for investments etc. Here is an analysis on some of the key industries of the economy.

Infrastructure- Infrastructure sector (accounts for 26.7% of India’s industrial output) is the backbone of any economy and is necessary for the successful functioning of a country. The government introduces projects for development of road, highways, railways, aviation etc. The government has set aside $ 475 billion in its 11th Five Year Plan (2007-2012) for investment in infrastructure. With the increasing presence of private players in this sector, companies like Reliance Infra, GMR Infra, Punj Lloyd etc stand to gain from this. The economy stands to gain from these projects irrespective of whether they are undertaken by govt. or given to the private sector because

a) Infrastructure development is essential for the growth of the country & economy

b) Industries like cement, steel, copper, coal etc stand to gain from it as the product of these industries would act as a raw material for infrastructure activitiesPower Sector - A growing economy and rising population has led to an exponential rise in demand for power in India. The power sector is largely dependent on the government plans & projects it undertakes. In the 11th Five Year Plan the target is to add 78,700 MW of power during 2007-2012. The impact of government spending has a spiral effect. Expenditure on Power Sector not only augments the growth of power companies like NTPC, Power Grid Corporation etc. but also gives impetus to heavy engineering industries like BHEL, L&T etc which provide inputs to companies from Power Sector. The chain does not stop here. The rise in demand for engineering industry increases the demand for industries providing raw materials to them in turn, and the wheel of development starts rolling.

Sectors dependent on subsidies: Oil is a key raw material for most of the industries. Government gives huge subsidies to Oil Marketing Companies like IOC, HPCL, and BPCL for selling petroleum products at a subsidized rate. This makes it almost impossible for private players to compete with these state-owned companies. That is the reason why Reliance had to close down all its petrol pumps in 2008. But the government cannot continue to provide subsidy forever. Infact, it has already started the deregulation process and petrol has been deregulated. In the short term the oil companies like IOC, HPCL, BPCL stand to gain from this move but in the long term they might face increased competition because private players would now be able to compete with them.

Similarly, fertilizer industry is also highly dependent on the government subsidies. Even today, more than 50% of population is dependent on the agricultural sector. Fertilizer being the key raw material for agricultural sector, the government has continued to increase its subsidy to the farmers. The total fertilizer subsidy has increased from Rs. 13800 cr. in 2000-01 to Rs. 75849 cr. in 2008-09.Other sectors like Automobile, logistics, textile etc also gain from government spending. Over the last 10 years the government’s expenditure on transportation has increased from Rs. 7740 cr. in 1999-00 to Rs. 31213 cr. in 2009-10. Due to large infrastructure requirements, it is expected that construction of roads, highways, airports, ports etc. will continue. Sectors like automobiles and logistics business stands to gain from this. Companies like Tata Motors, Ashok Leyland, Container Corporation of India etc. have benefited heavily from this and have shown good growth in the commercial vehicle segment over the years.

Similarly, the textile sector has also benefitted since the introduction of schemes like Technology Upgradation Fund (TUF) Scheme. The textile companies have availed the benefits and have started using advanced technology of production to increase their productivity.

By now it is quite evident that the government decision has a significant impact in the growth of the key sectors and the overall economy.

So, what should be your action point?

Look for investment in the sectors which would be direct beneficiaries of a favorable government policy.

Investment in Infrastructure companies could prove to be profitable in the short term as well as the long term because of the growing demand for it. But it is crucial that you invest in a fundamentally strong company when it is available at discount.

A developing economy like India and a growing population ensures the ever increasing demand for electricity. Investment in the power companies which are fundamentally strong and available at discount could be a good bet.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: