Would you lend money to a person neck deep in debt? A person who has even mortgaged his house and personal belongings for debt?

Most likely the answer to this question will be ‘No’! Even if the person concerned is a relative or a friend, you will try to wriggle out of the situation by making excuses or atleast try to lower the loan amount; after all most likely you are not going to get your money back.

While investing, your first concern should always be preservation of your capital. As the first rule of investing says ‘Never Lose Money’. Now consider this situation: Promoters of a company have taken debt by keeping as collateral their controlling stake of the very company they own. Will you invest in such a company whose promoters have ‘pledged their shares’? No? Well, according to news reports many investors actually do invest in such companies. Infact, as per the latest numbers as many as 885 companies have pledged their shares amounting to a humongous Rs. 1,75,000 Cr and according to a report by one of the brokerage houses of 191 companies in the BSE 500 list are pledged.

So, let’s first understand what is Pledging of Shares?

Share pledging is the phenomenon when the promoters keep the shares of the company that they own as collateral for debt; this debt is taken either for personal needs or for funding the company’s business – be it for expanding the business or day-to-day activities. The shares are pledged with banks or non-banking finance institutions who offer the loan to promoters. NBFCs have been major lenders for these types of loans. The financial institutions generally lend 25-50% of the share value depending upon the liquidity in the market, promoter’s reputation and risk profile of the business and the stock. So, if a promoter wants a loan of Rs. 100 Cr., he has to pledge shares worth Rs. 200-Rs. 400 Cr. Doesn’t seem much of a problem, does it? Promoters want money, they take a loan against the shares that they own. What’s the problem in that?

The problems with pledging of shares…

Usually, the promoters will go for share pledging only after exploring and extinguishing the other sources to raise funds. Think of share pledging as a last resort – equivalent to a person mortgaging his house or even personal belongings for money. The company will usually have high debt on its books and will have already mortgaged its plants and inventory. Banks or NBFCs will be unwilling to lend and hence the promoters pledge their holding. This is a clear indication that the company is short of cash – not an ideal situation for any company.

The real problem starts when the company’s share price drops – due to bad performance or any other reason. Once the price drops, the value of the collateral decreases. So, shares which were initially worth say Rs. 400 Cr. are now worth only Rs. 300 Cr. The lender doesn’t like this. To protect his loan and limit his risk he needs more collateral and hence promoters get a call either to provide more money i.e. a margin call or pledge more shares. If they cannot do this, the lender has the right to sell pledged shares in the market and recover the money. It has been seen that the fear or even a rumour of margin calls also trigger large scale sale of some shares. The stock price then gets into a free fall and the drop is so quick that retail investors have no time to react.

So, why do promoters yet go for share pledging?

Share pledging can lead to promoters losing their stake in the company. Yet, as mentioned before as many as 885 companies have seen pledging of shares. Why do promoters then still go for this kind of funding? For one, as mentioned before, it is a last resort funding to secure cash for the business. The company will usually be heavily leveraged and getting more debt will prove difficult and more expensive. Promoters also go for share pledging because they do not have to liquidate their holdings to meet their cash requirements. During the period of pledge, promoters will continue to receive dividends, bonus etc. Thus, they still enjoy the benefits of holding the shares. Pledging is considered extremely risky if used for the promoter’s private funding needs.

Which Indian companies have gone for pledging of shares?

Promoters of many Indian companies have pledged shares to raise cash for working capital requirements, debt repayment, capacity expansion etc.

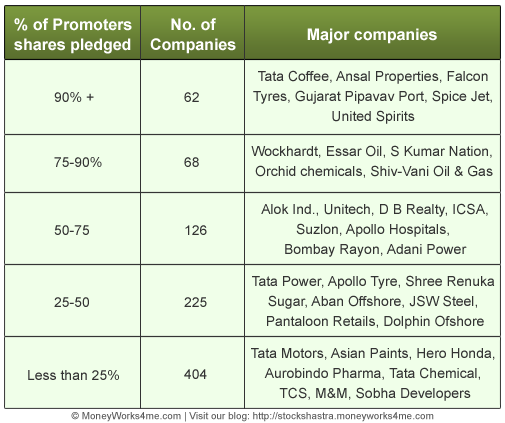

The table above gives the list of companies whose promoters have pledged their shares. Recently, shares of companies like GTL, S Kumar Nation and Orchid Chemicals have nosedived with the promoters pledging a large portion of their shares.

So, what should investors do?

While pledging of a company’s shares by promoters does not necessarily mean poor performance by the company, investors should be cautious when investing in such companies. Share pledging can be more crucial for small-cap companies. Further, companies which have very high debt on books and have seen an increasing trend of percentage of shares pledged should be avoided. But what about large companies like TCS, Hero Honda, Asian Paints etc which also figure in the table given above? Promoters of large companies, which are financially strong, can usually easily withstand margin calls and avoid loss of shareholding. Having said that, a bit of caution never hurts anyone. In fact investors who have a low appetite for risk should certainly stay away from such stocks. Remember the first rule of investing: “Never Lose Money!”

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: