This is a story of two friends Ticker Ram and Chatur who decided to bet on stocks in 2005. Ticker Ram was a seasoned investor with a penchant for picking stocks quoting at low prices in the market; a strategy Chatur completely disagreed with. So, they took a bet to find out who was right. They decided to invest Rs. 1 Lakh in 2 stocks each, chosen by their respective strategies; the person with the best return at the end of a 5 year period would be declared the winner. The prize for the winner: Bragging rights for life!!

The stakes were high. Ticker Ram had to win the bet at any cost. He was of the belief that low priced stocks (say a stock worth less than Rs. 100) was a better investment than a high priced stock which was worth say Rs. 500. He was very confident that this strategy of buying low price stocks was definitely sound.

So, how did he go about selecting his stocks?

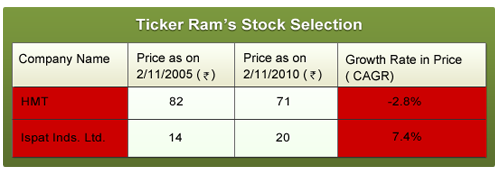

Ticker Ram's Stock Selection:

The principle Ticker Ram followed with more belief than anything else, when investing in stocks, was:

“Always invest in a low-priced stock because you get more number of shares and these shares being cheap (in terms of actual price) will rise faster than a costlier stock”

Out of all the “cheap” stocks, he narrowed down on 2. Both were quoting below Rs. 100. He invested Rs. 50,000 in each company. He was very happy because by investing in these low priced stocks, he had gotten a higher number of shares which he felt was more valuable. He felt that because these stocks were low priced the possibility of them growing and becoming multi-baggers was also larger. This combined with the higher number of shares he got would give him great returns by 2010 and thus he would definitely beat Chatur!! He bought the shares and laughed wickedly!!

But 5 years down the line, the laughter had turned into tears. He was devastated to see that he had barely made any profit on his investment. He couldn’t believe his eyes. He thought he had made two wonderful investments at cheap prices but something had gone wrong. One of the stocks he had invested in, Ispat Inds., had given him positive return but on a CAGR basis, the returns were lower than a fixed deposit. His other investment viz. HMT on the other hand, had actually decreased in value and had given negative returns.

He could only hope now that Chatur had done worse than him. Let’s see how Chatur selected his stocks for the bet.

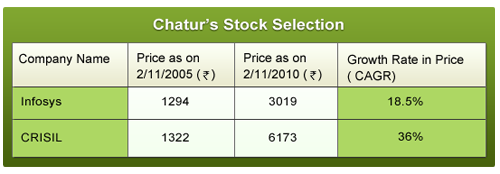

Chatur's Stock Selection strategy:

He was a person who did a thorough analysis before investing in stocks. His ideology was,

“Invest in fundamentally strong companies and only when they are available considerably below their actual worth”

Chatur invested in two of the most well known companies viz. Infosys and CRISIL. Both the stocks were quoting above Rs. 1000 and definitely did not fit the bill of cheap stocks according to Ticker Ram. However, he was very confident that these companies were fundamentally strong companies and were available at a price below their actual worth.

5 years later, he was happy to see that he had indeed been right. Infosys had given him a return of 18.5% year-on-year whereas CRISIL has done even better and given returns of 36%.

So, what was the difference in the 2 strategies?

Ticker Ram was used to picking “cheap” stocks and never looked at the fundamentals. If he had been more prudent he would have realized that HMT’s sales were declining before 2005 and it was also carrying heavy debts. Ispat Inds. Ltd. was a similar case and post 2005 it failed to register profits consistently burdened by the high debt.

Chatur was much more prudent while picking up his stocks and was not guided by any myth. Both his picks had performed robustly in the period leading up to 2005. Infact Chatur looked at the 10 year financial performance of both these companies, Infosys and CRISIL, and saw that they had performed remarkably well on the five key financial parameters (Net Sales, EPS, BVPS, ROIC and Debt to Net Profit). Both had good future prospects and were available at an attractive price. He didn’t have to think twice about investing in them.

So, what is the moral of the story?

Value is more important than the no. of stocks

There is an old adage which says “Quality is better than quantity”; the same holds true even for the stock market. Just because a stock’s price is low and hence you can buy more number of shares does not mean that it is a better deal. What is more important are the returns that you make which are calculated as a percentage of the total capital you have invested and not determined by the number of stocks you are holding.

Consider Ticker Ram's investment strategy. When he invested Rs. 50000 in Ispat at a price of Rs.7, he got more than 7000 shares. On the other hand, Chatur got just 38 shares by investing in Infosys at a price of Rs. 1294. Thus, irrespective of the number of shares, the investment was the same i.e. Rs. 50,000 and their final returns were calculated on this investment, not the number of shares. So, the key is to find stocks which offer more value irrespective of their price.

Does this mean that we should never invest in cheap stocks? No! Definitely not. Stocks like Havells India Ltd. & ITC have risen from Rs. 8 and Rs. 22 respectively in 2001 to Rs. 413 and Rs. 177 respectively in 2010, giving a return of 55% & 26 % CAGR respectively over the last 10 years. What is important is to find out whether the stocks are cheap in terms of their valuation with strong growth prospects.

So, what should you look at before going for a cheap stock?

Five Key Financial Parameters – The first and the most important step is to look at the past performance of the company as well as its future growth prospects. A company which has recorded consistent growth in its financials and has a sustainable competitive advantage is likely to give you great returns in the future.

P/E Metric – Once you find a fundamentally strong company, also check the P/E multiple to find out whether the stock is undervalued or overvalued with respect to its earnings. Know more on how to use the P/E multiple by clicking on P/E metric.

P/BV Ratio- Another metric you can look at is the P/BV ratio. To know how you can be thorough in using P/BV as a valuation metric click on P/BV.

Finally, also make sure that you know what is the MRP of the stock to understand the right value of a stock to minimize your risk.

Remember that if stock price was the only indication of whether a stock is cheap or not, nobody would be buying stocks like Infosys, Grasim etc,. The reality however, is actually opposite to this with the volumes traded in Infosys for e.g. around 50,000 shares every day on an average.

Have you invested in 'low price' stocks? Do share your experience.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: