For most investors, the 'Right Stock’ remains an elusive mystery. We hear about it once in a while but are almost always unable to find it! What truly constitutes a ‘Right Stock’ and how do we find one amongst the thousands available in the Stock Market? Starting this week, we will be focusing on a series; the first being ‘How to Identify a Right Stock’.

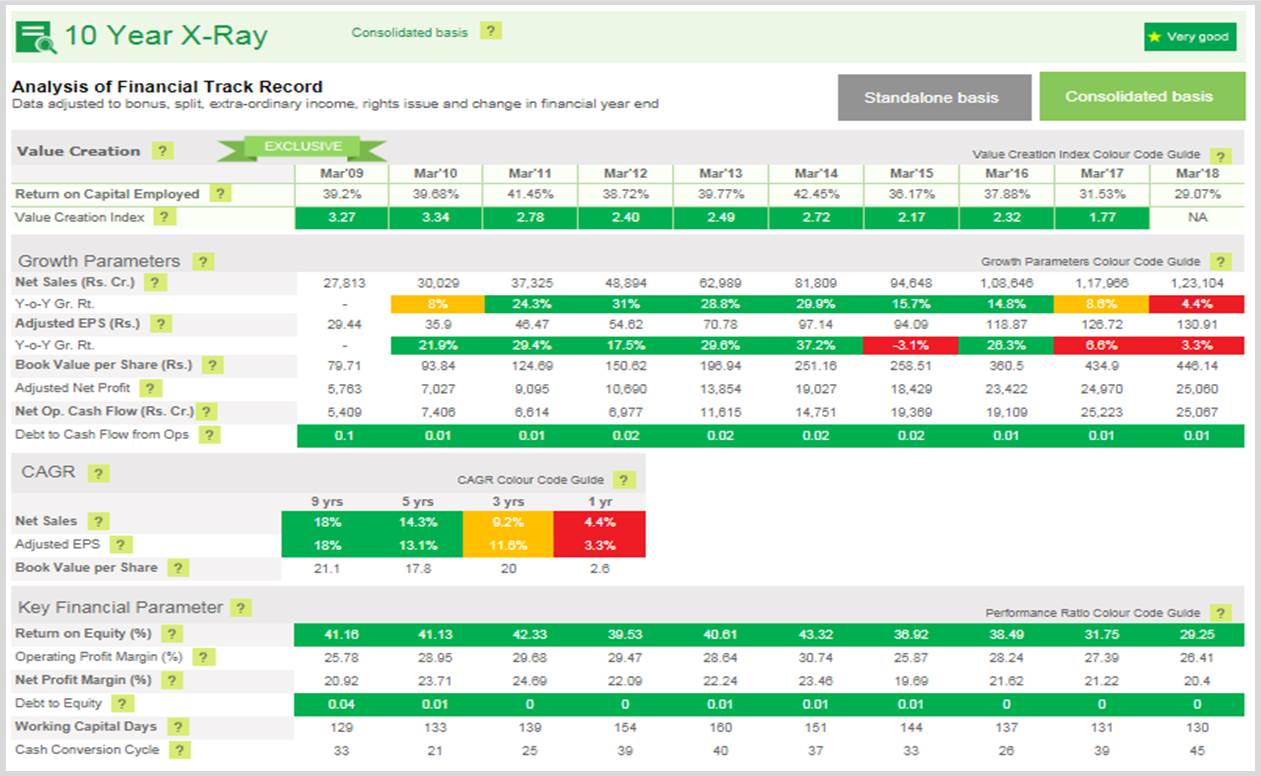

Value Creation:

The first and foremost question to ask of a company you’re looking to invest in is - does it create value for me?

From the investor’s perspective, ‘Value’ is created when the returns generated on the capital employed are higher than the cost of capital itself. After all, that’s what you want your investment to do. You want the returns from it to be higher than the costs you have incurred in investing in it. Likewise, you want the company, you invest in, to be generating returns higher than the cost incurred, on the capital employed.

Formally put, ‘Value Creation’ can be calculated using the following formula.

Return on Capital Employed-Weighted Average Cost of Capital)/Weighted Average Cost of Capital.

Explanation of the Formula:

Why do we take these factors into account? Let’s examine the formula in more detail and how it benefits you as an investor.

Weighted Average Cost of Capital (WACC)

The capital that the company raises is not free; there is a cost attached to it.

This cost, primarily, comprises of two factors:

1.Cost of Equity, which is further calculated using:

- Risk free rate of investment

- Risk associated with investing in stock markets

- Risk associated with investing in a particular company (measured by the Beta of the company)

2. Cost of Debt

These factors are proportionally weighted and we then, arrive at the Weighted Average Cost of Capital (WACC). From a value creation’s standpoint, the lower the company’s WACC, the better it is.

Return on Capital Employed (ROCE)

Now that we have a view on what the cost of capital is, let’s move on to the returns that can be generated on the capital employed. As mentioned previously, a ‘Value Creating’ company is one which generates a Return on Capital Employed (ROCE) that is higher than the Weighted Average Cost of Capital (WACC).

ROCE basically compares the earnings of the company against the capital employed. To put it simply, it tells how many Rupees are being generated by the company per Rupee of Capital that the company has employed. This measure gives a sense of how well a company is using its money to generate returns.

Comparing the ROCE and the WACC:

To know exactly how much value is being created by a company, it is essential to compare these two numbers using the formula given above. We will term the output of this formula as Value Creation Index (VCI).

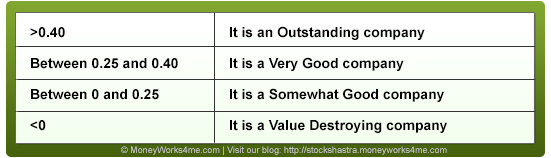

If the VCI is consistently:

Value Creation Index, thus, can act as first filter for identifying fundamentally strong stocks in the market. As mentioned previously, while looking at the VCI, it is important to check the consistency with which the company generates a positive return.

Apart from the value creation, revenue growth and margins should also be focused. When they both go hand in hand, only then company delivers sustained value for customers.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: