Stocks - Q : Quality | V : Valuation | PT : Price Trend

Funds - P : Performance | Q : Quality

Funds - P : Performance | Q : Quality

What is the current position of the company, and its future outlook?

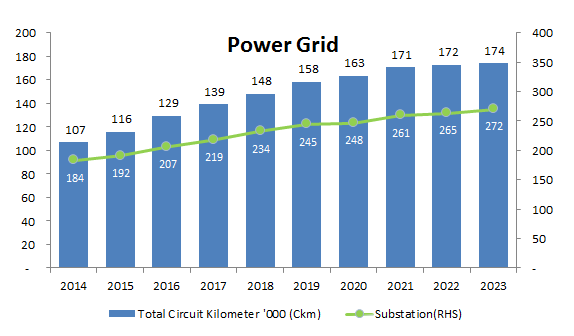

Power Grid Corporation of India Limited (PGCIL) is a Maharatna CPSU and India’s largest electric power transmission company. Government of India holds a 51.34% stake in the company as on March 31, 2023. PGCIL is principally engaged in planning, implementation, operation and maintenance of Inter-State Transmission System (ISTS), Telecom and consultancy services. Transmission plays a pivotal role within the power sector's value chain. The company holds a critical position in the advancement of India's power sector, with ownership of 85% of the interstate transmission network and the responsibility for transporting 45% of the total power generated in India.. India’s aim to expand renewable energy (RE) capacity to ~500 gigawatts by 2032 would require significant investment in transmission infrastructure. Thus, PGCIL has a large addressable market.

What is the company's current business model and how are current orders shaping up?

PGCIL’s revenue and profit are controlled through a regulated system that considers invested capital, a predetermined rate of return, and incentives, all within a transparent cost-plus model. In India, regulatory bodies like the Central Electricity Regulatory Commission (CERC) establish a defined rate of return on equity (ROE) on power transmission asset. The regulated tariff model (RTM) assures that PGCIL will consistently earn a predetermined fixed ROE.

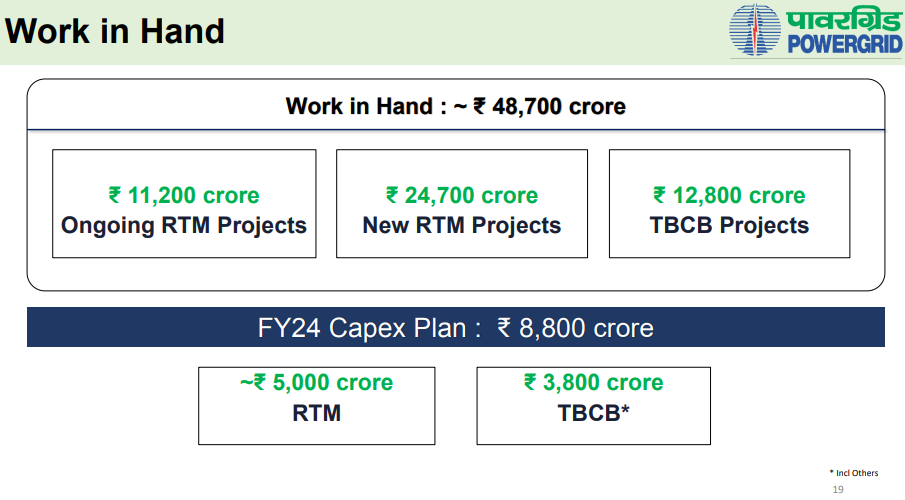

With an aim at facilitating competition in the transmission sector through wider participation in providing transmission services power ministry came up with tariff determination through the process of tariff-based bidding. The company is also exploring opportunities in the tariff-based competitive bidding (TBCB) framework for the company’s inter-state and intra-state transmission operations.

The significant backlog of ongoing projects valued at Rs. 48,700 crore, coupled with an extensive pipeline of transmission bids and a structured RoE model, establishes a solid foundation for anticipated earnings growth. There exists a potential for earnings to surpass our estimates, particularly if there is an accelerated increase in transmission capital expenditures. This highlights the company's promising earnings growth prospects and the potential for exceeding our current earnings projections.

What is the Capex plan ahead?

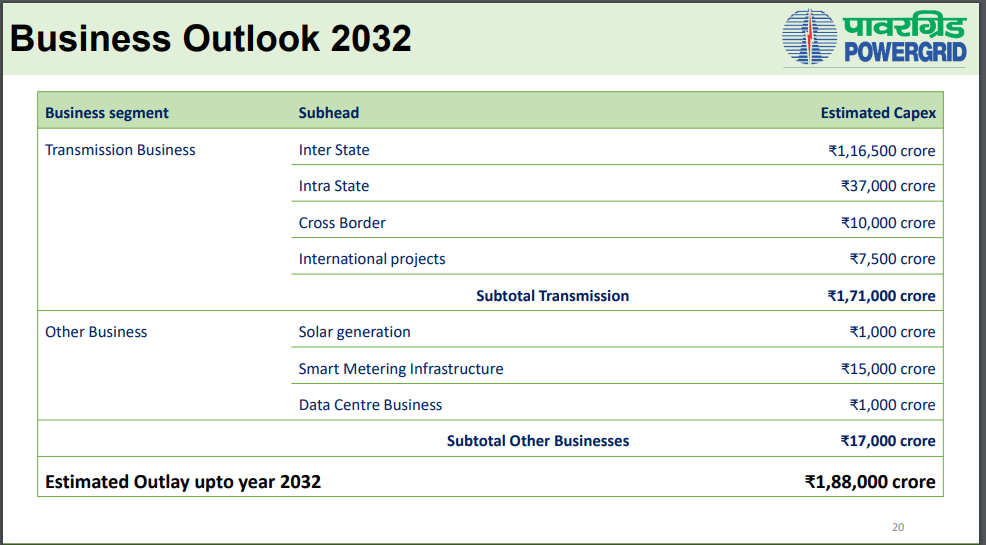

If we look at overall power sector growth opportunities, there is a significant push for renewable generation capacities and transmission plans for 500 GWs up to 2030. Substantial investments exceeding Rs. 4 lakh crores are anticipated in the transmission sector over the next 7 to 8 years.

Because of this PGCIL sees a large addressable market and estimates its transmission capex at Rs. 1.71 lakh crore up to 2032 and expects capex revival to Rs. 20,000- 25,000 crore starting from FY26.

Apart from transmission capex, Power Grid is actively diversifying its involvement across various segments of the power value chain, with a particular emphasis on energy management initiatives, such as the implementation of smart metering and Battery Energy Storage Systems (BESS). To facilitate these ventures, a subsidiary named PowerGrid Energy Services Limited has been established, focusing on exploring non-transmission business opportunities.

Smart metering has been gaining significant momentum, and Power Grid has earmarked a capital expenditure plan of Rs. 10,000 crore over the next five years and a cumulative capital expenditure target of Rs. 15,000 crore has been set for the period up to 2032. Company is planning to achieve a high-teen Return on Equity (RoE) in this segment. Apart from smart metering, Power Grid has capex plan of Rs. 1,000 crore each for solar generation and data centre business.

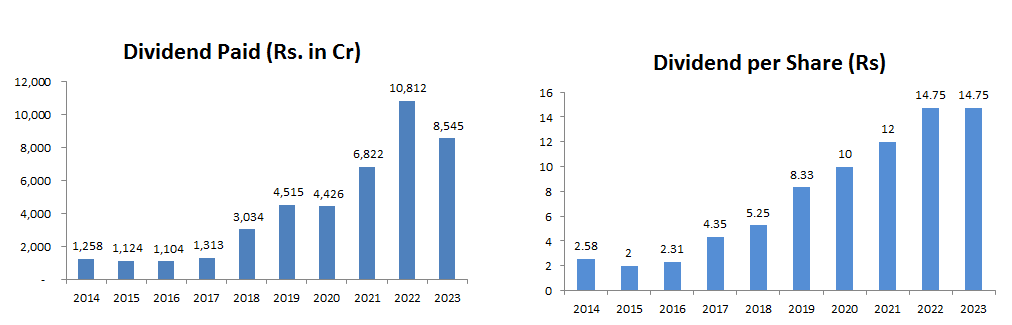

Does the company have a dividend payout policy?

The power grid has consistently paid dividends to its shareholders and is expected to continue in the future as well. The company considers the following factors while determining dividend payout:

a) Capital expenditure requirements considering expansion and opportunities

b) Borrowing levels and capacity to borrow

What are the concern areas?

The delayed capitalization of projects, coupled with challenges in securing new projects through the tariff-based competitive bidding route could be a concern. These factors can contribute to slower-than-anticipated project implementation timeline and a more constrained project acquisition outlook.